Investor sentiment towards emerging markets finally reversed after the surprise delay in QE tapering by the Fed. These markets are now showing clear signs of recovery and investors are trying to reap returns from their current depressed share prices.

One such market that has shown a sharp recovery is India, thanks to a slew of measures taken by the new RBI Governor, strengthening rupee and foreign capital inflows.

Inside the Recent Surge

The Asia’s third largest economy is trying to liberalize its financial markets in an effort to attract more foreign investors. In addition, India is in talks to enter into the emerging markets’ bond indices.

The Indian currency has shown a surprising comeback with double-digit gains after hitting a record low of around 69 per dollar during the month of August. In fact, the rupee was the best performing currency in September, outshining other major global currencies.

This strength was buoyed by RBI measures that allow banks to swap dollars received in foreign currency deposits for rupees and double the money that banks can raise through overseas bonds, which can also be swapped for rupees.

Improving fundamentals and a solid currency rebound have been well received in the markets and Indian stocks have given impressive performances over the past month. In fact, India ETFs have been the best performer among all the emerging Asia Pacific funds over the trailing one month.

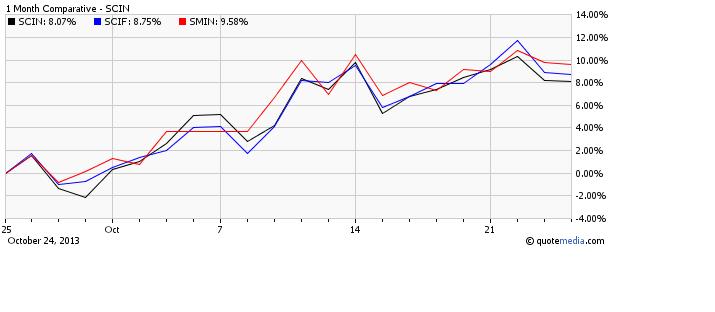

While this is true for all cap securities, small caps surged higher than their large cap counterparts. Below, we take look at the three ETFs, which track the Indian small cap market.

All of these funds offer exposure to pint-sized securities in the nation and while they will likely see more volatility, they could see better returns should the current trend continue as we move ahead toward the end of the year.

EGShares Indxx India Small Cap Fund (SCIN)

This fund tracks the Indxx India Small Cap Index, and is unpopular and illiquid with just $18.2 million in AUM. It has an expense ratio of 0.85%. With a holding of 76 securities, the product is heavy on financials with one-fourth share, while consumer goods, industrials and healthcare also get double-digit allocation in the basket.

Apollo Hospitals, Mahindra & Mahindra and Aditya Birla Nuvo are the top three elements in the basket with a combined 14.86% of assets, suggesting decent exposure in terms of individual holdings.

The fund gained nearly 8% over the trailing one month but is down 28.7% in the year-to-date period.

Market Vectors India Small-Cap Fund (SCIF)

This fund tracks the Market Vectors India Small-Cap Index, holding 95 securities in its basket. The ETF has amassed $94.8 million in its asset base and charges a high fee of 91 bps a year from investors.

Though the product has a slight tilt toward the top firm - MindTree – at 5.13% of SCIF, it is pretty spread across other securities. None of the securities hold more than 3.8% share. From a sector look, consumer discretionary and financials take the top two spots with 22% share each while information technology (17.1%) and industrials (15.9%) make up for the next two spots.

While the ETF delivered a negative return of 38%, it added 8.75% over the past month on recent optimism in the nation.

iShares MSCI India Small Cap Index Fund (SMIN)

This product follows the MSCI India Small Cap Index and holds 158 securities in its basket. The ETF has accumulated $2.8 million in total assets and charges 74 bps in fees per year.

The product is well diversified across individuals as each security holds less than 3.2% of total assets. Here again, consumer discretionary is the top sector with 19.35%, followed by financials (18.95%), industrials (17.10%) and materials (13.67%).

The fund is down 25% year-to-date while gained over 9.5% over the trailing one month.

Bottom Line

Though the short term looks promising on various stimulus measures, the long-term outlook might be gloomy given high current account deficit and stubborn inflation. However, growth in India is still the highest in the world thanks to the country’s rising middle class, a younger population and growing spending power that is boosting domestic consumption.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

India Small Cap ETFs Back On Track?

Published 11/03/2013, 01:18 AM

Updated 10/23/2024, 11:45 AM

India Small Cap ETFs Back On Track?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.