After exhibiting weakness for a while, both US and India gold futures may be gaining strength for a mild rebound path but not sufficient enough to push it to a higher level. The examination of both Comex December futures contract over a longer period shows gold attained a peak close to $1800 levels in September on QE impact and this couldn’t be sustained and it fell further.

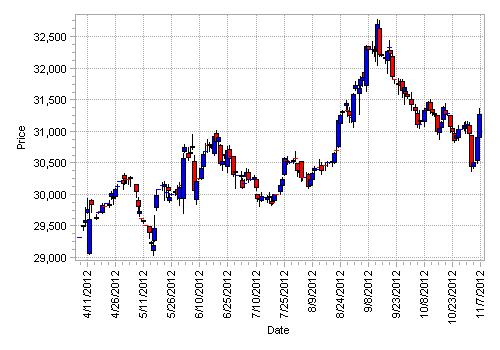

At India’s Multi-Commodity Exchange (MCX), Gold December contract also witnessed a peak during August, September months due to a combination of factors: such as festival demand, rise in global prices and sharp decline in Rupee value. MCX Gold futures charts from April show a weak trend until August-September as a doubling of import duty on gold to 4% in India Budget for 2012-13 caused huge drop in gold imports and reduced demand for jewellery purposes.

According to World Gold Council, investment and jewellery demand in India in second quarter of 2012 (April to June) fell to 181.3t, down from 294.5t in Q2 2011. At 56.5t, investment demand was less than half the level in Q2 2011. Indian jewellery demand also experienced a noticeable drop to 124.8t, down 30% year-on-year from 179.5t.

These marked declines were partly a reflection of the strength of demand in Q2 2011 and also driven by Indian investors taking advantage of the weak rupee against the US dollar. The fluctuations in the exchange rate and the rise in the gold price to records of around Rp30,000/10g in June were compounded by domestic inflation and concerns over a weak monsoon season.

On a seasonal basis, November heralds the peak festival demand for precious metals in India but weakness in Rupee continues to impact demand although in recent days demand seems to have picked up in bullion markets as traders buy anticipating Diwali festival (festival of lights) demand and certain days are considered auspicious this month for gold buying.

For the near term, solid support for gold is seen at INR 30,800, 30,400 per 10 gms at MCX while resistance is seen at 31,400, 31600 levels and exhibiting a sideways trend. Sustained rise above INR 31600 above levels may be required for confirming a bullish trend. As seen in the MCX December chart below, gold looks set for a milder bounce but not hard enough to touch previous highs.

For Comex Gold December, immediate support is seen at $1700 per ounce and further to $1675 and resistance is seen at $1750 levels although news of Obama’s re-election might help sustain a positive trend for the near-term. A milder bounce can also be expected with Comex December gold as can be seen from the chart below: A double top pattern has emerged signaling a trend reversal, but it has taken some time to emerge, but capable of repeating itself.

By Sreekumar Raghavan

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

India Gold, US Gold Futures May Be On A Mild Rebound Path

Published 11/08/2012, 01:47 AM

India Gold, US Gold Futures May Be On A Mild Rebound Path

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.