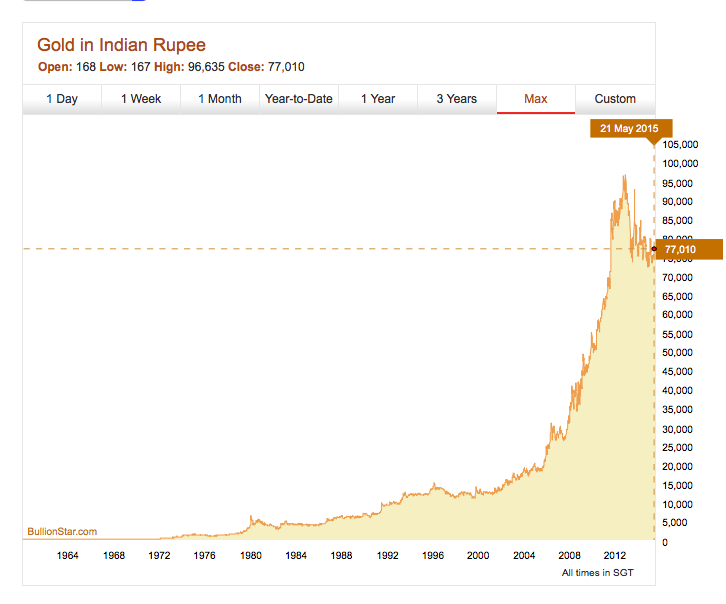

Indian citizens have long recognized the value of owning and saving in gold...and for good reason. As the Reserve Bank of India has aggressively devalued the rupee over the past 5 decades, the value of gold in rupees has skyrocketed! See for yourself:

By some estimates, private holdings of gold in India exceed 20,000 metric tonnes. Though a sensible person would see this as a long-term positive for India, the Keynesian brain trust of the RBI see this as short-term negative, instead. Why? Because the Indian central planners would prefer that regular Indian citizens save in rupees, not gold, thus increasing demand for rupees and driving up, or at least stabilizing, its value. Keep in mind, when an Indian citizen buys gold, he/she is selling rupee to do it. Therefore, more gold imports equals downward pressure on the rupee.

So, in the hopes of decreasing gold import demand, the disingenuous larcenists at the RBI have cooked up the scheme outlined in the document below. Please scroll through it in order to see for yourself what the intent of this program is.