Risk Aversion Hurts Dollar Bulls

Despite Fed members' hawkish comments, such as William Dudley’s optimism regarding a liftoff this year, the market is pricing out an October rate hike amid lackluster data. We do not expect this week’s NFPs to modify the market’s view, as this is not the right environment to take more risk. Markets are focused on concerns surrounding emerging market high volatility and global stock markets sell-off. As a result, the entire US treasury curve shifted lower, the US 10-year is back below the 2.10% threshold, down 25bps from its September peak; the 5-year dropped 23bps to 1.3865%, while the highly Fed sensitive 2-year fell almost 16bps to 0.6525%.

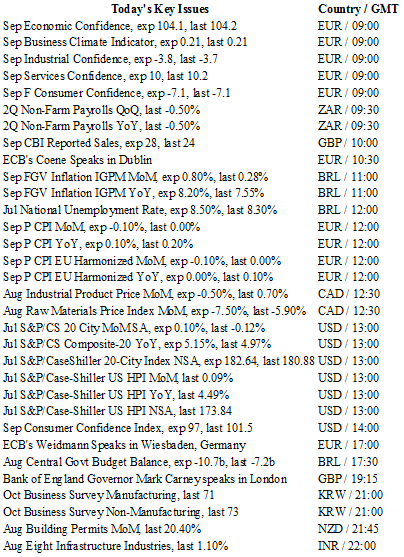

Today another batch of economic data from the US is due. Consumer confidence is expected to have fallen to 97 in September from 101.5 a month earlier. Finally, the S&P/CaseSchiller Index is expected to have improved 5.15% y/y in July from 4.97% a month ago. We don’t think that this week’s NFPs will be a game changer, however, a strong read could definitely secure a December move by the Federal Reserves and awaken dollar bulls.

RBI Surprises Market With A Rate Cut

In an unexpected move, India’s Central Bank (RBI) cut benchmark rates by 50bp to 6.75% (lowest level since May 2011), against an expected 25bp cut. Following the surprise move, the accompanying statement was also dovish, as the commodity driven disinflationary trends endure. Subdued oil and food prices have sent major inflation indices into a tailspin. India’s WPI fell to -4.95% for August, while headline CPI eased to 5.88% (combined CPI 3.66%), which is currently within the central bank’s target band. Yet the downward trajectory is concerning.

In addition, Governor Raghuram Rajan indicated that “weakening of global activity,” suggests that “monetary policy has to be accommodative to the extent possible.” Given the RBI’s dovish view on inflation outlook we now anticipate the central bank’s easing cycle to extend past 2015. However, part of the logic for the larger rate cut was mounting political pressure. Prime Minister Modi’s government has lobbied for lower rates to support slowing growth and to reduce high borrowing costs.

In spite of the negative connotations of today’s decision, the Indian outlook remains secure. GDP grew at a solid 7.0% y/y in Q2 2015 (outpacing China), and economic indicators point to further acceleration. Consumer consumption is on the rise and public spending is supporting weakness in foreign investment. Finally, government commitment to reforms, coupled with lower oil prices have improved India’s current account and fiscal balances, which should support increasing investor confidence. Despite the active easing bias, we remain positive on the INR. The solid growth outlook should outweigh the lower carry, while the overall sense that policy makers are conducting the correct strategy will improve India’s short and long-term outlooks.

Tsipras Spoke At The United Nations

A week has passed since Syriza won the new elections, allowing the new Government to vote the reforms which have been agreed to the European Union under the bailout plan. This election, seen more than anything as a reminder of the failure of the European negotiations, will only result in more austerity policies, which sounds ironic for a leftist government. It is now clear that the Greek people were definitely not resentful about the U-turn that Prime Minister Alexis Tsipras made after the “OXI” vote (no vote) in July when he decided to agree on a worse deal agreement. There is a huge contradictory issue here. The Greeks understand the hefty price that comes with staying in the eurozone but there is also this widespread belief that a Grexit could have had even worse repercussions.

Alexis Tsipras speech on Sunday at the United Nations Summit addressed the necessity for debt restructuring. Indeed we believe that the current bailout plan only serves to gain time. Greece was not able to reimburse its debt three years ago; it certainly cannot do so now with even more interest to pay. Furthermore, the required growth to manage this debt is impossible to reach for Greece. Tsipras is fully aware of this, adding that debt is a challenge “at the centre of our global financial system.” We concur, but what is the alternative, for countries to remain largely indebted forever? The future does not seem so bright for Greece.

USD/JPY - Treading Water Around 120.00

The Risk Today

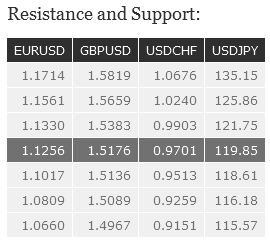

EUR/USD is increasing. Hourly resistance can be found at 1.1330 (21/09/2015 high). Hourly support lies at 1.1087 (03/09/2015 low). Stronger support lies at 1.1017 (18/08/2015 low). In the longer term, the symmetrical triangle from 2010-2014 favored further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). We remain in a downside momentum.

GBP/USD is declining toward hourly support at 1.5136 (25/09/2015 low). Stronger support can be found at 1.4960 (23/04/2015 low). Hourly resistance can be found at 1.5659 (27/08/2015 high). In the longer term, the technical structure looks like a recovery. Strong support is given by the long-term rising trendline. A key support can be found at 1.4566 (13/04/2015 low).

USD/JPY is moving sideways. The pair is still moving around the 200-day moving average. Hourly support is given at 118.61 (04/09/2015 low). Stronger support can be found at 116.18 (24/08/2015 low). Hourly resistance can be found at 121.75 (28/08/2015 high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF is still holding below resistance at 0.9844 (25/09/2015 low). The technical structure still shows an upside momentum. We remain bullish in the medium-term. In the long-term, the pair has broken resistance at 0.9448 suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).