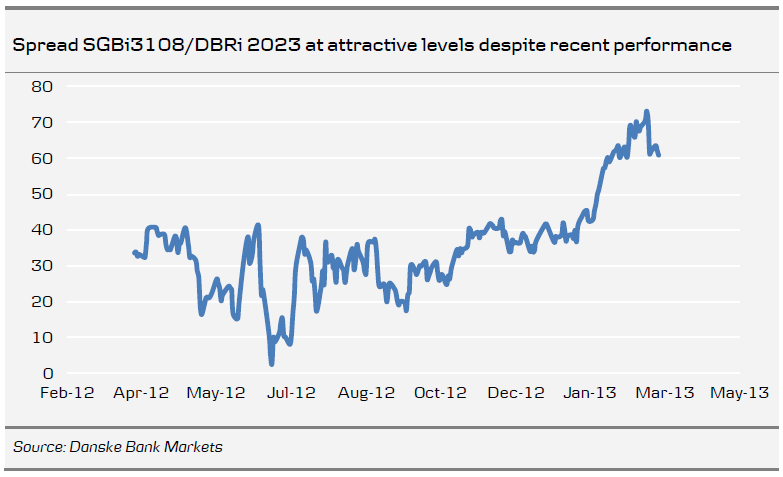

The Debt Office will tap the 10Y real rate bond SGBi3108 at tomorrow's auction. This will be the first auction with the larger volume of SEK1bn. We don't see any problem selling the bonds in the auction, at least not judging from the bid volumes at previous auctions. We see good demand from foreign investors as the real rate spread, similar to the nominal 10y spread, widened in the early part of the year. However, the spread has rebounded somewhat from the highs of previous trading sessions.

The February CPI for Sweden came in at +0.45 % m/m/ -0.17 % y/y – quite close to our call. However, only rounding saved it from being a tenth higher (at one decimal level). Looking forward, our forecast suggests we have now seen the bottom in the inflation cycle. CPI inflation is, however, likely to remain slightly negative for a couple of months, before becoming decidedly higher in H2 13. The strengthening SEK is, in our view, only a small downside risk unless there is a more pronounced appreciation of the currency.

Swedish real yields in the bond market are, in our view, inconsistent with long-term inflation expectations expressed in forward BEI rates. The low real rates in the market imply GDP data will be well below potential GDP over the next few years (we estimate potential GDP to be 1.5%), whereas the forward break-even inflation rates imply the GDP is well above the potential GDP. This is based on a very simple and rough estimate based on the historical (and intuitive) relationship between GDP and real rates as well as inflation (see charts) over the past 20 years. The two long-term rates observable in the market, i.e. the real and BEI rates, imply completely different developments in the Swedish economy for the coming decade. The long-term real rates imply that GDP will be well below the potential, and the forward BEI rates imply a GDP above the potential. We admit that this is a rough estimation, but the inconsistency is significant. We do not really see any Japan scenario in the Swedish economy, and in such a case (implied by the low real rates) it would be unlikely that inflation rate would top 2% as suggested by the forward BEIs.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Index-Linked Report: Sweden - Tap Auction In SGBi3108

Published 03/14/2013, 06:42 AM

Updated 05/14/2017, 06:45 AM

Index-Linked Report: Sweden - Tap Auction In SGBi3108

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.