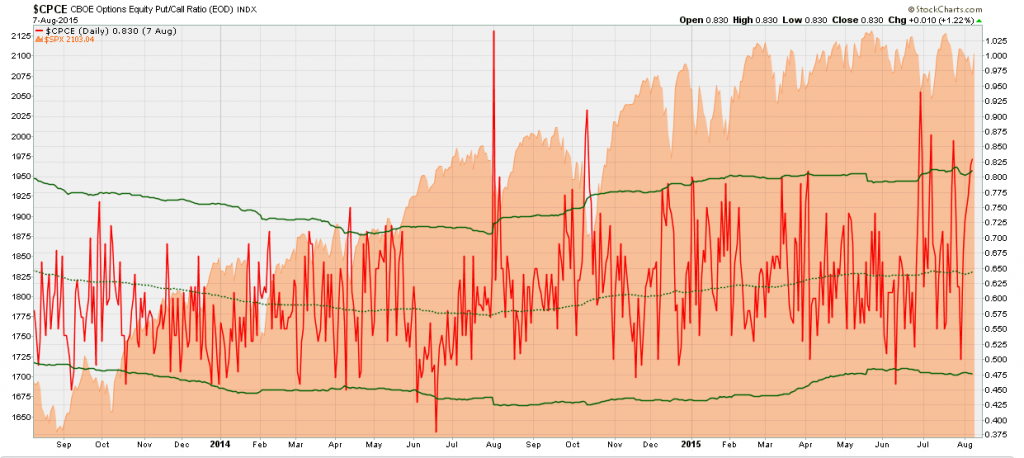

Going into today’s trade, stats were leaning negative but sentiment was well oversold as the S&P 500 futures (ESU15:CME) were trading at the lower end of the summer range. Particularly showing oversold sentiment was the $CPCE, which is the CBOE’s equity put/call ratio charted in image above having on Friday hit it’s second deviation band from it’s 200 day moving average.

On Friday’s recap we noted that entering this new week with a light calendar and potentially lower volume there was an increased likely hood that the trade would be a “thin-to-win” grind higher and that the DJIA cash index (^DJI:DJI) couldn’t sustain much more before a break to the upside. What occurred today was a market that just got over 1 million volume as the bulls delivered a run up in the overnight with buyers supporting the globex move as traders pushed the the ESU5 up about 40 handles from Friday afternoon to Monday afternoon. Participating in today’s buying were last weeks laggard such as crude oil (CLU5), shares of Apple (NASDAQ:AAPL) and the media sector that saw huge liquidation a week ago. As Danny Riley says: “it takes days and weeks to take the S&P down and a single day to bring them back up”.

In play again is that 2100.00 pivot on the S&P 500 futures. Since that level was first crossed on February 20th there have been 121 trading days, 46 of those days touched 2100, while 97 of the days since the first touch traded within 20 handles either side of 2100, now 20 of the last 26 weeks have seen a touch of 2100.00. As of late this level has been a bull killer providing resistance as rallies have failed to maintain higher having been unable to close more than 8 consecutive sessions above that important pivot.

Tomorrow’s calendar is again light but Tuesday has been very unfavorable to buyers this year and turn around Tuesday has been particularly relevant with it’s close in the opposite direction of Monday’s close 9 of the last 11 weeks, also given the 40 handle rally from Friday’s low and the trouble with 2100, it would be realistic to see at least minimal weakness.

Tomorrow’s Notable Earnings: Red Robin Gourmet Burgers Inc (NASDAQ:RRGB), Silver Wheaton Corp (NYSE:SLW)

Tomorrow’s Economic Calendar:

NFIB Small Business Optimism Index 6:00 AM ET

Productivity and Costs 8:30 AM ET

Redbook 8:55 AM ET

Wholesale Trade 10:00 AM ET

4-Week Bill Auction 11:30 AM ET

3-Yr Note Auction 1:00 PM ET

- Open: 2086.25

- High 2100.75

- Low: 2086.00

- Close: 2099.75

- Volume: 1,100,000 total

- MOC: 504 Million to Buy

by FairValue Trader