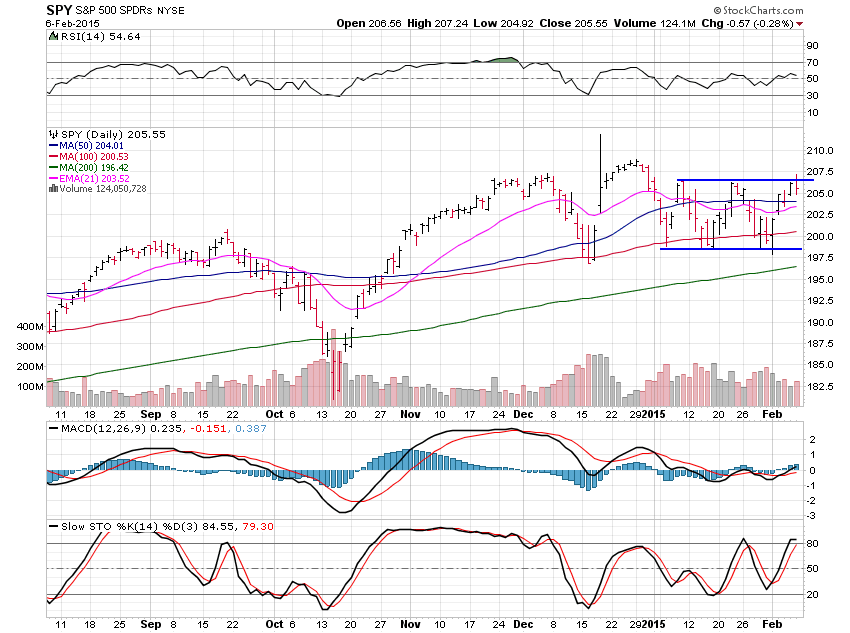

These are my thoughts on the SPY ETF“It’s not whether you get knocked down, it’s whether you get up.” —Vince Lombardi

Markets ran into resistance where they should have Friday and if my trading wasn’t a bit off. I’d have taken a short over the weekend in anticipation of a move lower this week but I didn’t.

I only tried two day-trades Friday and one was a nice winner while one was a small loser and I also tried some CELG but it wasn’t ready so I took about a dollar per share loss on that one and that is just the cost of trying a trade. I’ll lose a dollar anytime when something has the potential to return tens of dollars.

SPY looks ready to roll over here after a failed breakout Friday.

We’ve got to watch how SPY acts at the 200 day average but it hasn’t really posed much trouble lately so it shouldn't now.

If we don’t roll over right away here and hug the upper end of this range then we may see a true breakout higher later on in the week but we will see that coming if it develops.