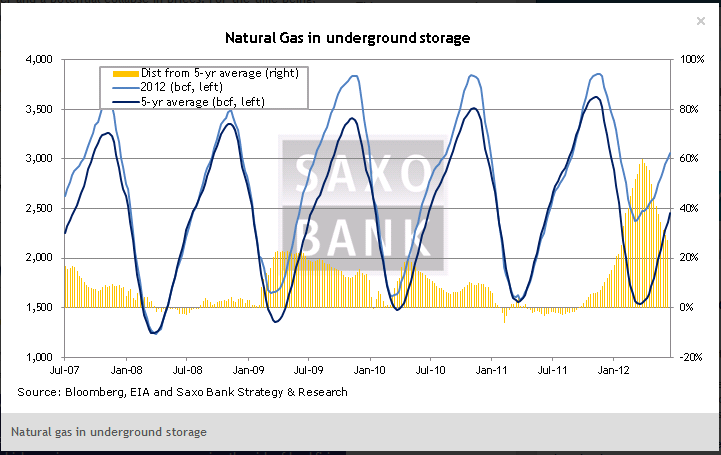

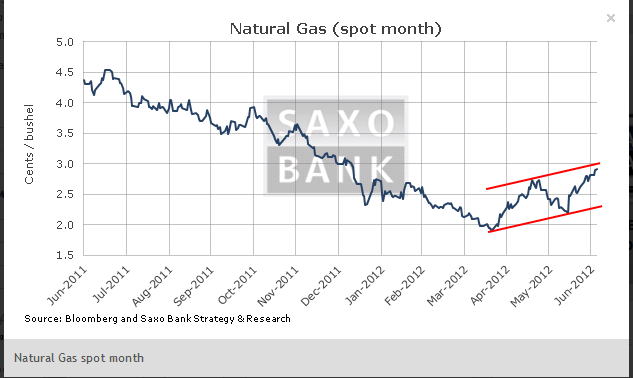

Natural gas went against the trend of falling prices during June as hot and dry weather across the US saw increased demand from power plants due to people turning on their cooling devices. Natural gas futures have risen by a half since dropping to a multi-year low in April. The increased consumption by power plants and increased use of natural gas at the expense of coal has helped drive down the supply surplus which reached a six-year high at the end of March.

This has also helped alleviate some of the fears from earlier this year that the continued increase in the supply surplus could eventually lead to storage congestion in October and a potential collapse in prices. For the time being, weather developments and coal-to-gas switching hold the key to price performance over the US summer period. The hurricane season adds some additional focus, although the risk of these often devastating natural occurances hurting production has diminished over the last few years due to the offshore-onshore shift. (A great degree of natural gas production has moved from inland due to increased shale gas production.)

The recent rally however has increasingly put the switch from coal at risk as gas becomes less competitive to coal and thereby removes the economic advantage. A prolonged period of high electricity demand over the peak summer months of July and August with higher prices as a consequence carries the risk of backfiring once temperatures drop and demand slows. Speculative traders are currently holding 4 billion dollars worth of net long positions in Henry Hub natural gas futures and swaps and they will be keeping a close eye on the weather as support from switching will reduce as the price rises. The weekly storage data, normally released on Thursdays at 14:30 GMT will also be watched very closely in order to see whether the annual surplus continues to shrink. Due to US July 4 celebrations this weeks number will be delayed until Friday.

Technically near-term resistance at USD 3 on the August contract could slow down any further progress.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Increased Cooling Demand Supports Natural Gas; Resistance Looming

Published 07/05/2012, 05:31 AM

Increased Cooling Demand Supports Natural Gas; Resistance Looming

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.