We have been mentioning the energy sector for quite some time, looking at prices from both an equity and a forex perspective.

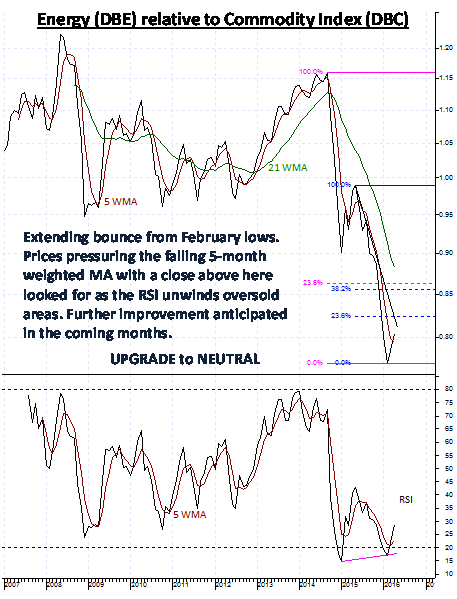

Our updated monthly publication, Commodity Sectors Relative to Commodity Index, looks at the energy sector from within the commodities space, and it would seem the narrative remains consistent.

There is a very well defined USD asset flow unfolding as commodity traders move out of precious metals, base metals and agriculture, and increase allocations in the energy sector.

This is expected to provide a further boost to the bullish energy story, as investors, hedgefunds and portfolio managers move towards a buy-into-weakness strategy.

We at XATS remain bullish energy, and expect to see this reflected in the fx space as forextraders maintain a bullish stance in both CAD and NOK, equity traders maintain overweight positions in energy related stocks, and commodity traders increase exposure in oil and natural gas.