Despite the 10-year Treasury yield rising seven basis points (bps) from 1.50% to 1.57% for the Refinitiv Lipper fund-flows week ended June 16, 2021, investors continued to inject net new money into taxable and tax-exempt bond funds for the week.

During the fund-flows week, Federal Reserve Chair Jerome Powell delivered a slightly hawkish policy update which, while keeping its easy monetary policy unchanged, raised the Fed’s inflation forecast and signaled it expects to hike interest rates twice in 2023. Seven of the 18 policymakers indicated in their dot plots they were in favor of an at least 25-bps hike in 2022.

And while board members began talking about beginning discussions of tapering the Fed’s balance sheet purchases, Powell said, “it is not time to reach hard conclusions” and any tapering is “still a ways off,” remaining data dependent. Nonetheless, in its most recent policy-setting meeting, the Fed began laying the groundwork for future policy changes.

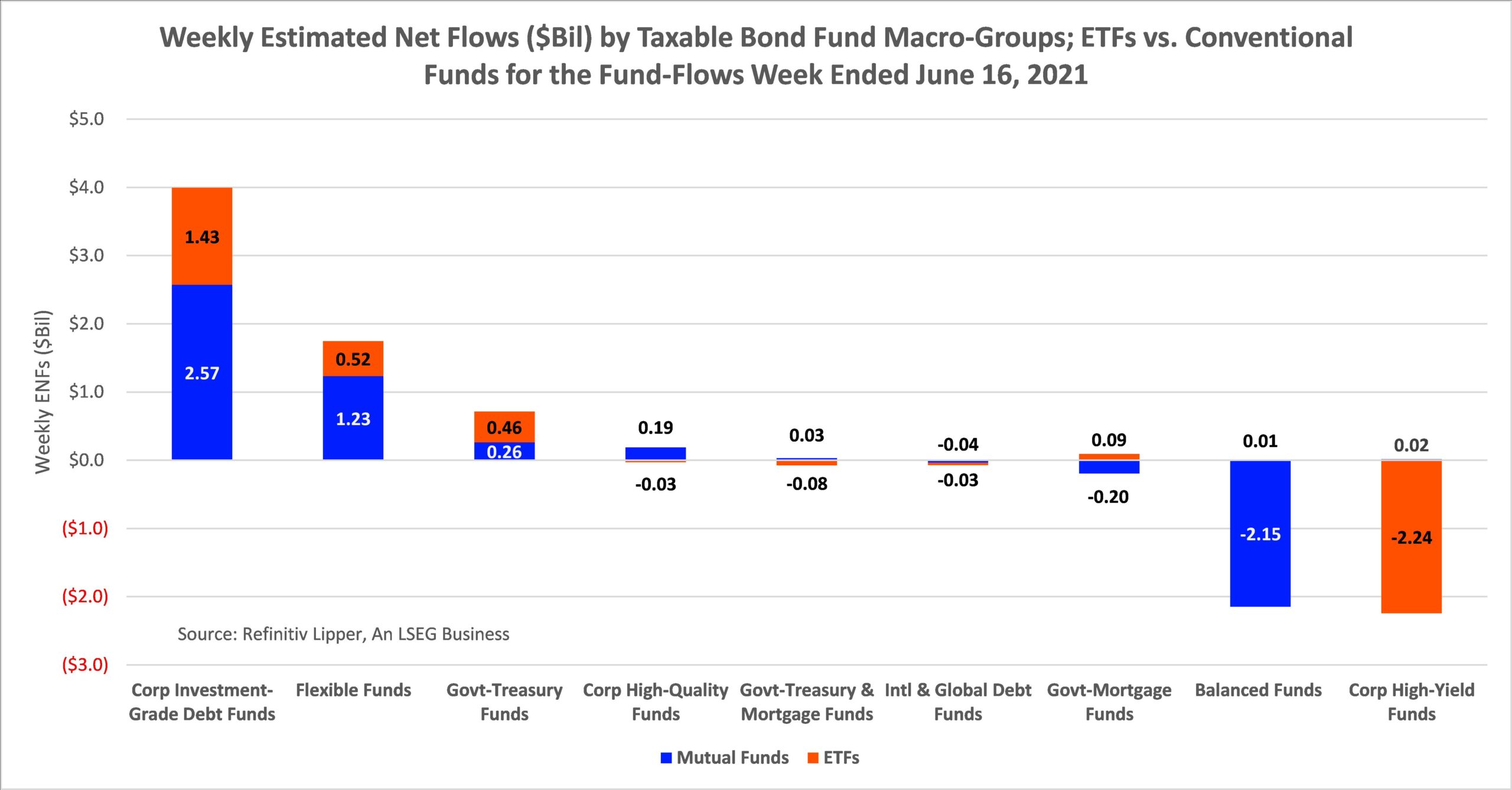

During the fund flows week, investors continued their search for yield, injecting a net $2.0 billion and $1.9 billion into taxable bond funds (including ETFs) and municipal bond funds, respectively. Conventional taxable bond funds took in a net $1.9 billion for the week, while their ETF counterparts attracted just $110 million.

The corporate investment-grade debt funds macro-group (+$4.0 billion), taking in the largest net inflows of the taxable bond fund group for the week, attracted net new money for the thirty-second consecutive week. Flexible funds (+$1.7 billion) and government-Treasury funds (+$715 million) attracted the next largest inflows.

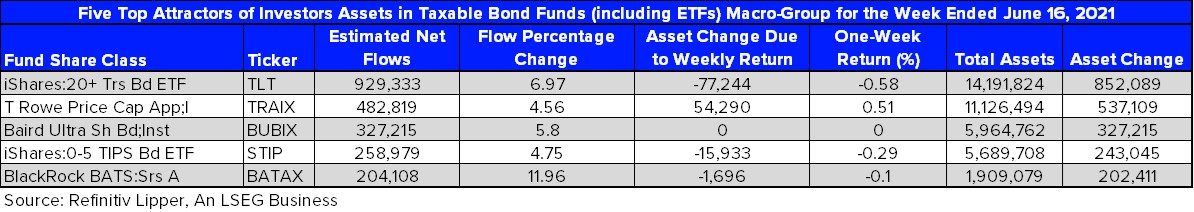

On the taxable side, Short Investment-Grade Debt Funds (+$884 million) attracted the largest draw of net new money of all the classifications, followed by General U.S. Treasury Funds (+$822 million), Core Bond Funds (+$817 million), and Inflation Protected Bond Funds (+$780 million). High Yield Funds (-$2.3 billion) suffered the largest redemptions for the week.

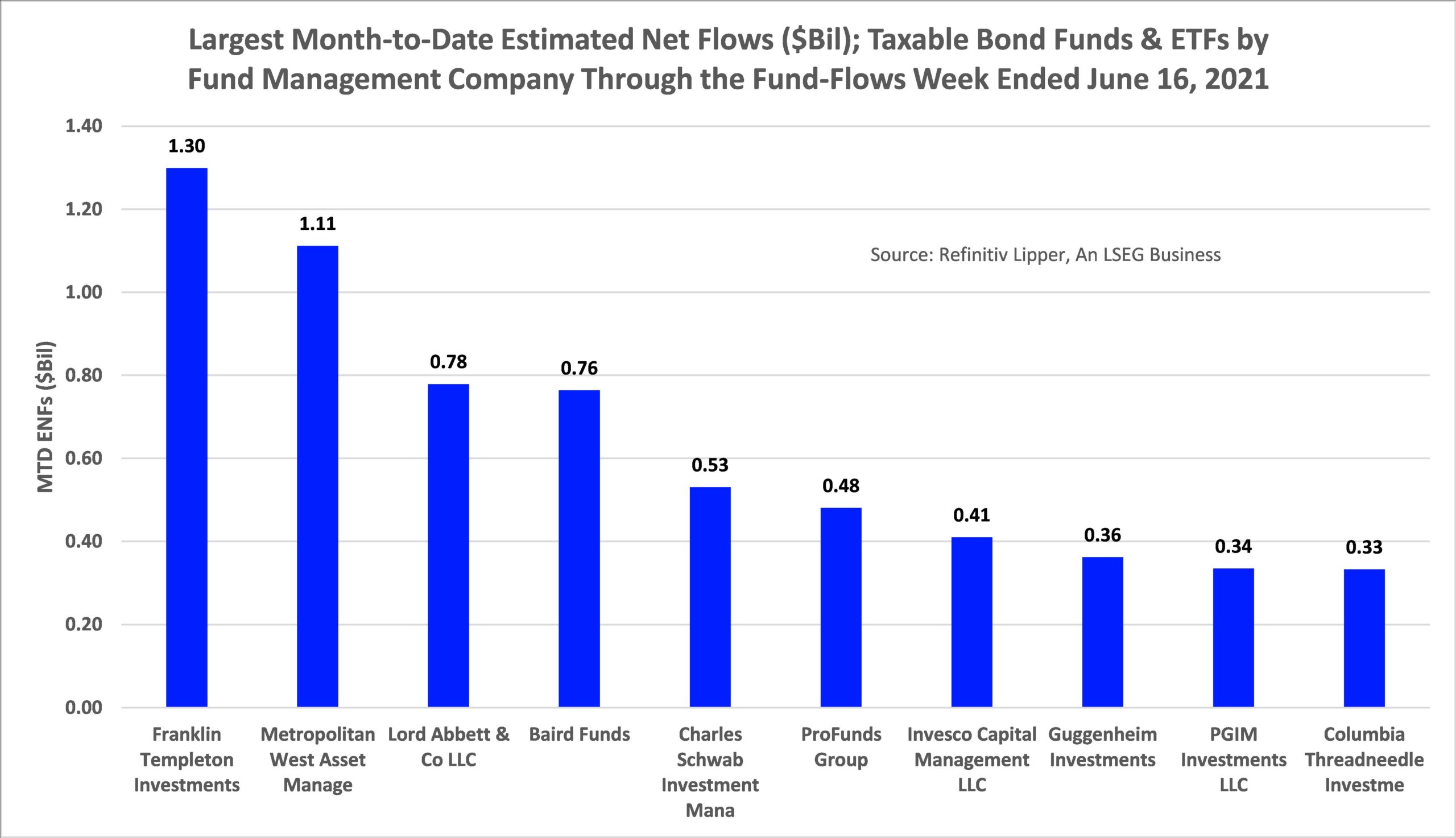

Month to date through the week ended June 16, 2021, taxable bond funds have attracted $8.8 billion, with Franklin Templeton Investments attracting the largest sum of net inflows of all the fund management companies for the period.

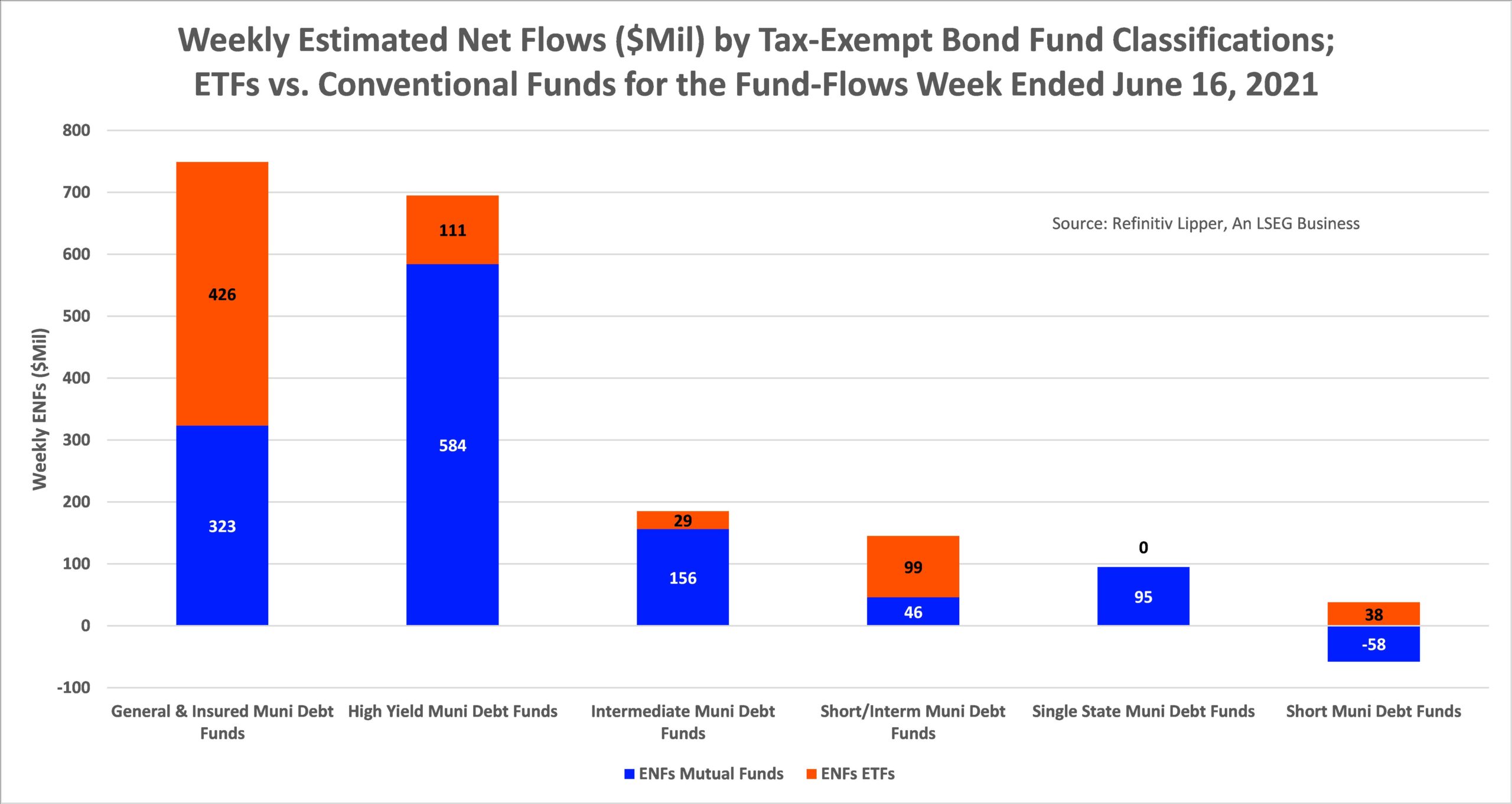

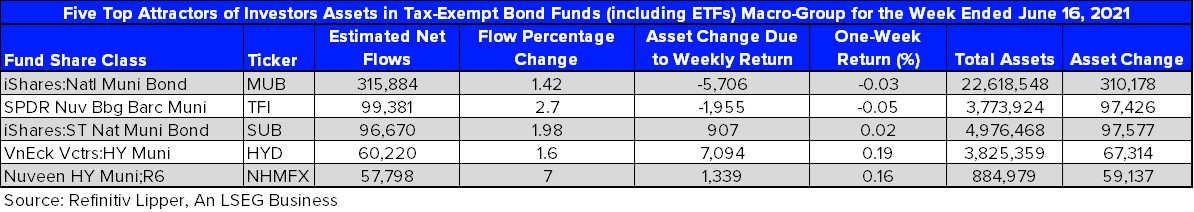

On the tax-exempt side, conventional tax-exempt bond funds took in a net $1.1 billion for the week, while their ETF counterparts attracted $704 million—their largest weekly net inflows on record extending back to Sept. 12, 2007, when Lipper began tracking weekly flows into municipal bond ETFs. The General & Insured Municipal Debt Funds (including ETFs) classification attracted the largest net inflows for the week, taking in $749 million, followed by High Yield Municipal Debt Funds (+$695 million) and Intermediate Municipal Debt Funds (+$185 million). In the table below, we rolled together the estimated net flows of the 15 unique single-state municipal debt fund classifications for presentation purposes.

Year to date, municipal bond funds (including ETFs) have attracted a net $50.8 billion, a record amount for any first half of the year going back to 1992. The asset class has experienced 31 weeks of net inflows in the last 32, with the only weekly outflows witnessed on Mar. 3, 2021.

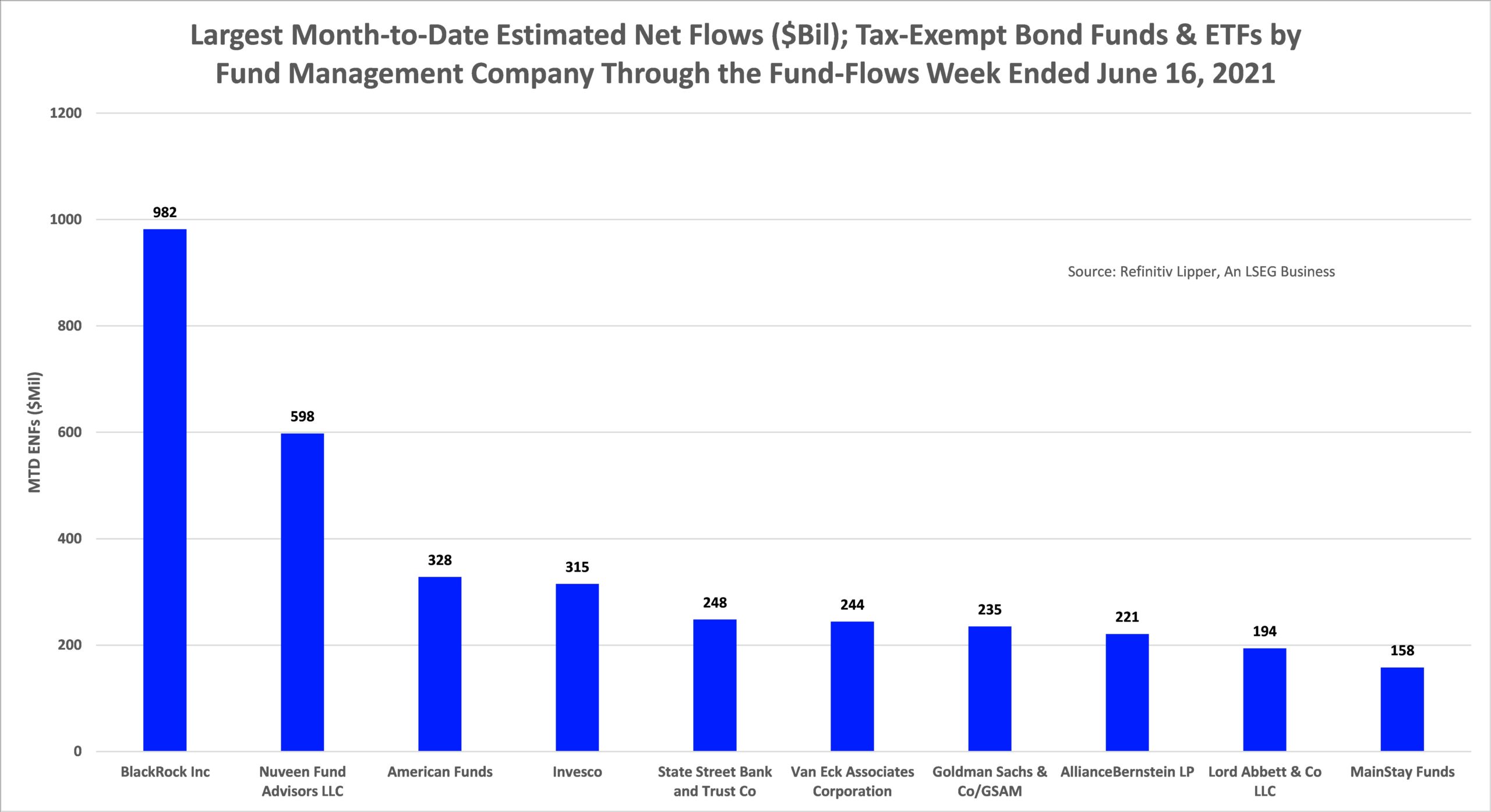

Month to date through the week ended June 16, 2021, tax-exempt bond funds have attracted $4.3 billion, with BlackRock (NYSE:BLK) taking in the largest sum of net new money of all the fund management companies for the period.