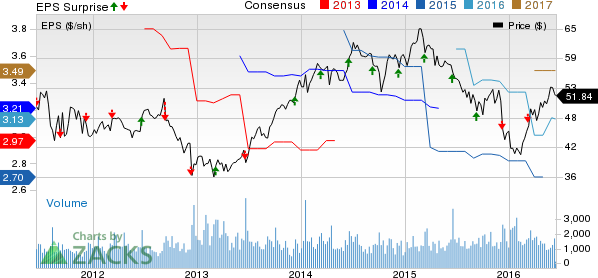

John Wiley & Sons Inc.’s JW.A reported positive earnings surprise after missing the Zacks Consensus Estimate in the trailing two quarters. The company reported adjusted earnings of 67 cents per share that beat the Zacks Consensus Estimate by a penny. However, adjusted earnings declined 17.3% year over year primarily due to increase in technology costs as well as higher expenses incurred to grow its share in Online Program Management and Corporate Learning.

On the other hand, the company reported revenues of $434.3 million, which marginally missed the Zacks Consensus Estimate of $435 million. The company’s revenues also dipped 1.7% year over year. Notably, the company’s revenues have lagged the Zacks Consensus Estimate in five out of the six quarters. Following the earnings announcement, the company’s shares declined 6.4% on Jun 14, 2016.

On a constant currency (cc) basis, adjusted earnings fell 19% year over year and revenues declined 1%. Including one-time charges, earnings per share of 59 cents plunged 25.3% year over year.

Adjusted operating profit came in at $51.1 million, down 18.9% (declining 20% at cc) from the year-ago quarter. Also, adjusted operating margin contracted 250 basis points to 11.8%.

Segment Details (at cc)

Research: The division’s adjusted revenues of $264.8 million deteriorated 3% year over year. However, revenues – excluding the $8 million transitional effect from the shift to time-based journal subscriptions – remained flat. The segment’s adjusted direct contribution to profit was $129.6 million compared with $140.6 million in the year-ago quarter. After accounting for shared services and administrative expenses, the division’s adjusted contribution to profit was $87.1 million, down 11% from the prior-year quarter.

Education: Revenues at the division inched up 1% year over year to $66.5 million, mainly buoyed by a 26% and 18% increase in WileyPLUS Course Workflow and Online Program Management, respectively. The upside was, however, limited by a 23% decline in revenues at the Print Textbooks segment. Adjusted direct contribution to profit by the division climbed 25% year over year to $14.8 million. In addition, contribution after allocating shared services and administrative expenses was a loss of $7.5 million, narrower than the year-ago loss of $8 million.

Professional Development: Revenues increased 3% to $103.1 million, primarily driven by 35% growth in Corporate Learning. The division’s adjusted contribution to overall profit was nearly $44.5 million, up 19% year over year. Adjusted contribution to profit after allocating shared services and administrative expenses soared 71% from the year-ago quarter to $20.5 million.

Other Financial Details

The company reported cash and cash equivalents of $363.8 million, inventories of $57.8 million and long-term debt of $605 million. The company recorded shareholders’ equity of $1,037.1 million in the quarter under review.

John Wiley, which shares space with Pearson (LON:PSON) plc (NYSE:PSO) and Thomson Reuters Corporation (TO:TRI) , reported free cash flow of $219 million in fiscal 2016. The company had reported free cash flow of $246.6 million in the year-ago period.

Nevertheless, the company bought back 216,186 shares for $10.3 million in the reported quarter.

Outlook

The company has provided fiscal 2017 guidance. The company expects earnings to be down by mid-single digits and revenues to be flat on a year-over-year basis, excluding both foreign exchange as well as the favorable impact from shifting to time-based journal subscription agreements. Moreover, the impact of the shift to time-based journal subscriptions will increase revenues and earnings by nearly $37 million and 42 cents, respectively.

Zacks Rank

John Wiley currently has a Zacks Rank #2 (Buy). Another favorably placed stock in this sector that warrants a look is Scholastic Corporation (NASDAQ:SCHL) , which holds the same Zacks Rank as John Wiley.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

THOMSON REUTERS (TRI): Free Stock Analysis Report

PEARSON PLC-ADR (PSO): Free Stock Analysis Report

SCHOLASTIC CORP (SCHL): Free Stock Analysis Report

WILEY (JOHN) A (JW.A): Free Stock Analysis Report

Original post

Zacks Investment Research