Introduction

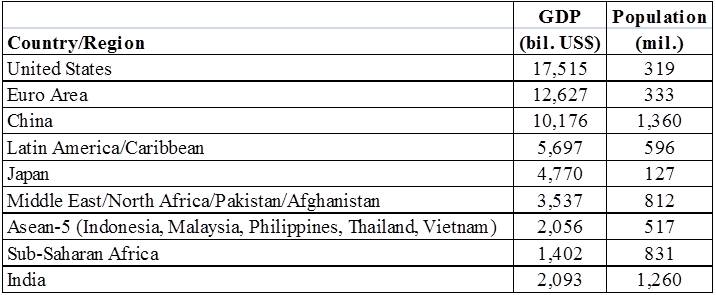

The world watches the ongoing economic problems of the Eurozone. Is there hope? Need the rest of the world care? Let’s start by placing the Eurozone in a global context. As Table 1 indicates, the Eurozone is a large region. While not rivaling either China or India in population, it ranks just behind the US in GDP. And that is big enough for non-Eurozone members to care.

Table 1. – GDP, Population of Largest Countries/Regions

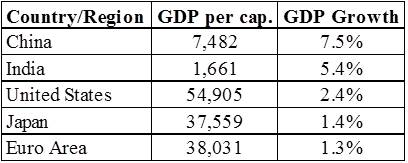

In Table 2, the Eurozone’s per capita income and GDP growth are compared to other leading countries. While its GDP is second to the US, its projected GDP growth for the 2013 – 2015 period is a paltry 1.3%.

Table 2. – Per Capita Income and GDP Growth

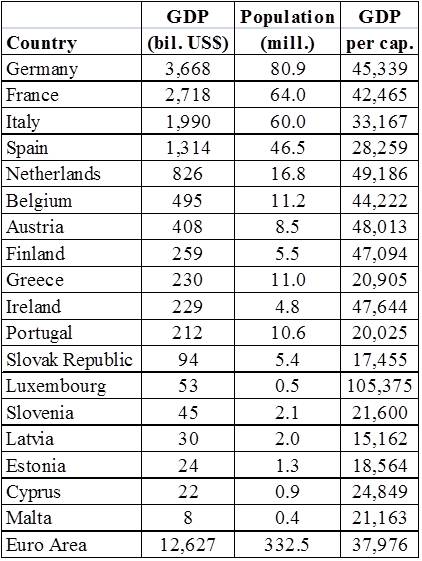

However, as indicated in my last piece on the Eurozone, it is misleading to view the region as a single economic entity. Rather, the Eurozone consists of 18 separate countries facing very different economic challenges. Table 3 provides GDP and population data for Eurozone members. Germany is clearly dominant, both in terms of GDP and population. To give a real sense of Germany’s dominance, its GDP is greater than the GDP sum of 14 of the other 17 Eurozone countries. Per capita income differences are notable, ranging from $15,162 for Latvia to $105,375 for Luxembourg.

Table 3. – GDP and Populations of Eurozone Countries

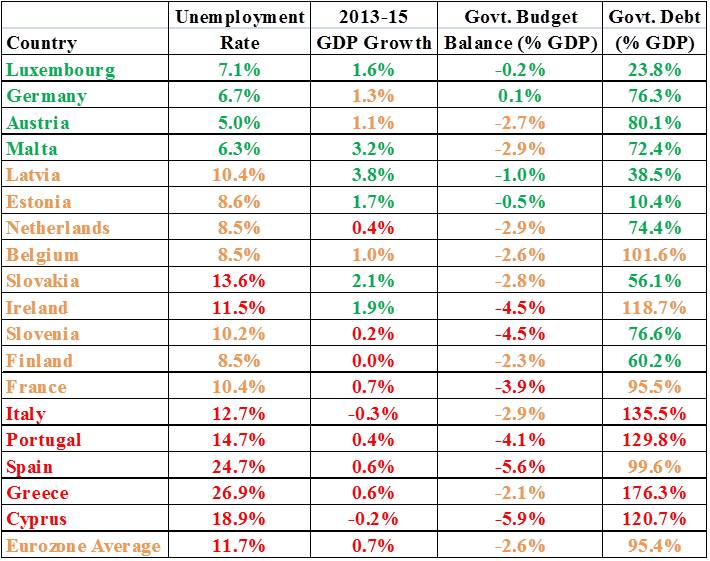

It is useful to group Eurozone countries by the severity of their economic problems and this is attempted in Table 4. The colors designate economic conditions to be good, worrisome, or critical. Here is how the colors were determined:

- Unemployment is taken as the primary economic problem.

- Unemployment can be mitigated by economic growth. Low economic growth will worsen unemployment.

- A country can also mitigate unemployment via deficit finance. However, use of this mechanism is limited if a country is already running a large deficit and/or the government debt is already high.

Accordingly, I have assigned the following values to these items in Table 4:

Note first the Eurozone average. Unemployment and GDP growth are in the critical range. Cyprus gets the lowest rating because all four items are in the critical range. Greece is quite special. Austerity promoted by Germany resulted in the unemployment rate going from 7.7% in 2008 to 27% today and GDP declining for 6 straight years. And after one major devaluation, another one is inevitable. Spain’s overall debt is sustainable, but not if it keeps running such large deficits. And if it reduces the government deficit, unemployment could rise even further.

Table 4. – Economic Indicators, Eurozone Countries

Both Italy and Portugal have very large debt burdens and Italy’s GDP is declining. France’s situation is worth watching – the government is fumbling and citizens have little confidence in it. Ireland remains worrisome, but its GDP growth is promising.

German Policies

As suggested above in the discussion of Greece, the German solution for the economic woes of other Eurozone countries has been austerity: reduce government deficits and lower wages. At first, the IMF agreed. But when it realized that austerity was causing unemployment to skyrocket, the IMF changed its policy and said more emphasis should be given to growth-oriented policies.

The German emphasis on austerity has now come full cycle. According to UNCTAD, total German exports between 2008 and 2013 fell 1%. German exports to other Eurozone countries fell by 17%. In no small part this was attributable to the German-induced Euro recession.

Another Greek Default

Question: how was it that the first Greek default went so smoothly while Argentina has had all sorts of problems? According to the Italian Minister of Finance, “Greece was saved at the request of large European Banks.”

And how about the next default? I quote from an IMF spokesman:

There’s an agreed framework in place for ensuring debt sustainability with Greece’s European partners agreeing to provide any additional debt relief as needed to help bring Greece’s debt down to 124 percent of GDP by 2020, and to substantially below 110 percent of GDP by 2022 as long as Greece continues to deliver on its program commitments.

We will see.

Investment Implications

Anyone considering an investment in the Eurozone via such mechanisms as the iShares MSCI EMU ETF (NYSE:EZU)) has to enjoy downside risks. There are just too many bad things that could happen. Far better to keep your “developed country” investments in the US where the economy is improving, albeit gradually.