Opinions vary on Bitcoin. There have been a number of stock analysts and pundits who have rejected it as a fantasy - a bubble that would come crashing down shortly. Others, like Fundstrat founder Tommy Lee, have said the opposite, suggesting Bitcoin may hit all time highs by end of year.

No matter the opinion, however, Bitcoin, and the other cryptocurrencies it has spawned, have become a talking point around water coolers everywhere. What was once a shady way to buy drugs and guns online has become the darling of Wall Street hedge funds.

Cryptocurrencies are something of an enigma. Bitcoin, for example, is both technology and finance, digital and monetary. It crosses boundaries of asset and currency, stable and liquid.

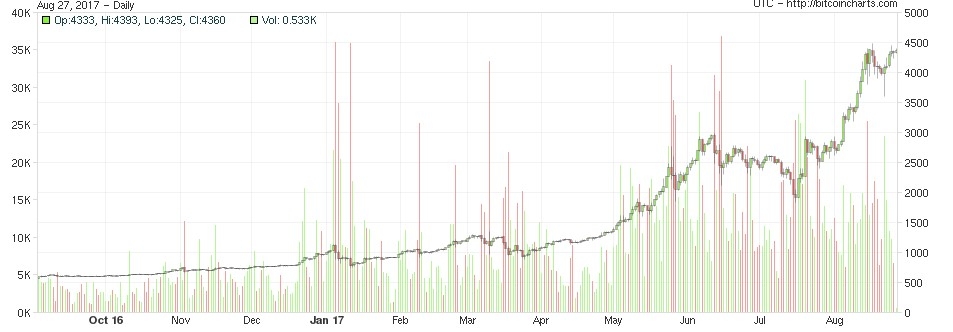

These complexities have broadened the scope and power of Bitcoin’s usefulness, driving it’s price to new record highs. The price of a single Bitcoin recently crossed over $4,500, driving investment analysts and computer geeks alike crazy.

And some, who are arriving at the crypto sphere late, may wish that they had purchased Bitcoin in January, back when it’s price was a mere $700. Those who did are certainly pleased with the results.

Bitcoin to the Moon

Holders of Bitcoin have been thrilled with the year. Many who purchased the cryptocurrency back in 2011 or 2013 are now sitting on huge piles of wealth, amassed simply through the accumulation of digital currency. A brief glance at the chart through 2017 should give some indication about the size of returns that investors have reaped.

The massive stock increase has been led by a greater awareness in the mainstream about the cryptocurrency, along with a widespread desire for stable investments. The fear of market collapse has been ever-present, especially as the Federal Reserve begins its monetary tightening policy.

This market shift, coupled with all-time stock highs and still excessively loose monetary policy, have moved investors into the crypto world, seeking stable investments with large scale returns. Whether a bubble or not, the Bitcoin price has certainly made some investors extremely rich.

Ethereum in Second

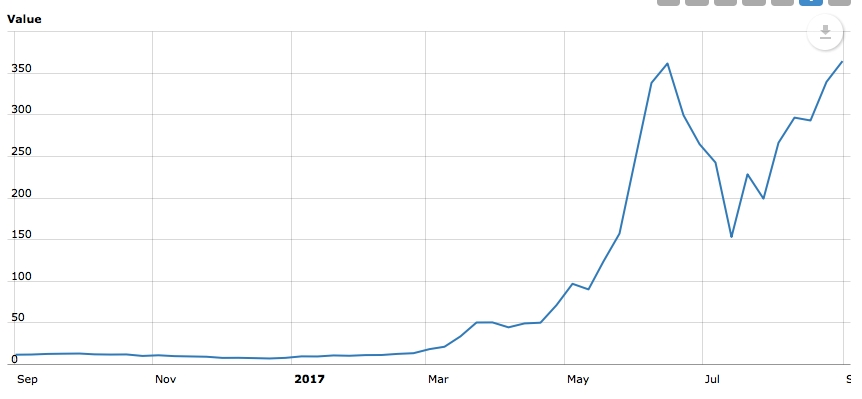

Riding on the back of the Bitcoin wave, investors have sought out other cryptocurrencies as well. Launched just four years ago, Ethereum is similar to Bitcoin in it’s fundamentals, but radically different in its functional capabilities.

Ethereum was created by Vitalik Buterin, and was conceived as a system where app builders and those seeking new ways to assure transactions could ride on the blockchain technology of Ethereum and use it for fool proof contracts (called smart contracts).

This dual-natured cryptocurrency has had a bumpy ride, first shooting up several thousand percent, then dropping again to half the value of its high, and now retracing to those levels again.

With such massive swings, some have said that Ethereum is a dangerous investment. While this may prove to be true, it offers something that Bitcoin does not - utility. The platform is designed to allow a myriad of other systems to run on it, fueling smart contracts with ‘gas’ (think digital fuel for transactions) and creating new and fascinating strategies for changing the way the internet is conceived.

As the price retraces and surpasses previous highs, investors will continue to look for ways to capitalize on the cryptocurrency. If even half of the many applications created on Ethereum are even partially successful, the price will continue to rise.

The NEO Guy in Town

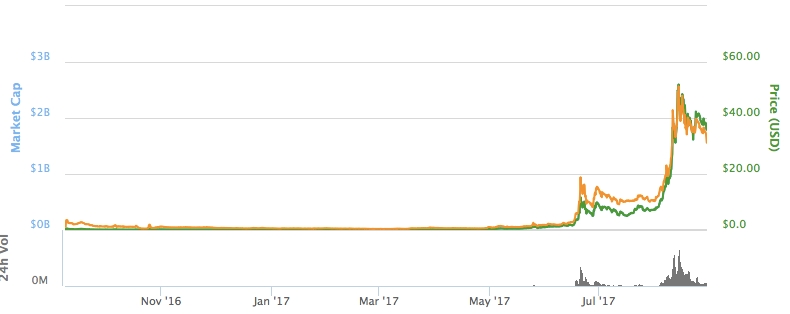

If you’re looking at these prices and kicking yourself for not being quicker to jump in, there may be time to still get in on the ground floor with a cryptocurrency called NEO. Promising to be the next Ethereum, NEO is a revitalized version of a coin called AntShares.

The price has already shown a similar pattern to Bitcoin and Ethereum, though with more stability than the latter. With a stabilized support at $35, the price appears set for a breakout. Already among the top ten of all crytpocurrencies, NEO has excellent fundamentals.

The platform is similar to Ethereum, in that it provides a blockchain system that allows for other contracts and programs to utilize it’s functionality. However, unlike Ethereum, NEO offers substantially more in its capability. While Ethereum offers only proprietary languages for smart contracts, NEO allows for a number of more common languages like .NET, Java, and soon Python and Go.

These languages allow for a far more robust and usable platform, providing a basis for a blockchain-based economy. The founder recently said, “NEO is a platform for smart economy: digital assets+smart contract+digital identity. Resistance to censorship is is not our primary design objective. NEO wishes itself to be integrated with real economy.”

Integration with the real economy, greater utility with programming languages, and all the benefits that already exist in Ethereum make NEO appear to be an unstoppable force. For investors kicking themselves for missing the Bitcoin boom, now may be the best time to get in on the ground floor of NEO.

The price has already shown a similar pattern to Bitcoin and Ethereum, though with more stability than the latter. With a stabilized support at $35, the price appears set for a breakout. Already among the top ten of all crytpocurrencies, NEO has excellent fundamentals.

Between Bitcoin, Ethereum, and NEO, there are plenty of options for buyers. Regardless, though, it is likely a good time to move at least some portion of a portfolio into the crypto sphere as both a hedge against downturn, and as a source of potentially huge gains.