Last night’s Fed meeting was a lesson in expectation management. The FOMC had a difficult decision to make, and it had been made all the more tricky by recent improvements in data, in particular the US jobs market. The Fed acknowledged this improvement by saying that it expected “moderate” growth over the coming year and this to be backed up by a gradual decline in unemployment.

Equities took to this like a duck to water and pushed US markets to the highest level since the middle part of 2008. The dollar also found strength in the news as well with GBPUSD coming back into the mid-1.56s and EURUSD trading consistently below 1.31 in the aftermath.

The dollar’s rally was started yesterday by a good US retail sales number which rose by their fastest pace for 5 months while the results of a recent bout of stress-testing on US banks also soothed investor panic. The Fed released the results of the stress tests 2 days early following JP Morgan’s decision to announce that it had passed them in a release to shareholders. 15 of the 19 banks passed the tests with Citigroup the major failure.

GBPEUR bounced back from oversold levels yesterday in good order and now resides above the 1.20 level. Sterling was helped by some corporate buying but it was euro weakness that was the main driver of this move. A report from the EU/ECB/IMF troika that Greece will need further budget cuts within 2 months should it become evident that it is missing deficit reduction targets became public yesterday. This will cause further division come election time mid-April.

Sterling may be hard pressed to stay above 1.20 this morning with the publication of the latest round of unemployment figures. Unlike the US, the UK’s unemployment picture has gradually deteriorated in the past 6 months and expectations are that they will remain that way through 2012. The unemployment is expected to stay at 8.4%, the highest since 1996 while around 5,000 more people are expected to be new JSA claimants.

The euro crisis – are you protected? World First has teamed up with Charles Russell and haysmacintyre to host a unique event for business leaders. The seminar will feature a series of short presentations taking a closer look at the Eurozone crisis and how this will affect your business in 2012, before exploring some of the ways you can protect yourself from any potential fallout. Register for our free seminar on 29 March or ask for a copy of our whitepaper here

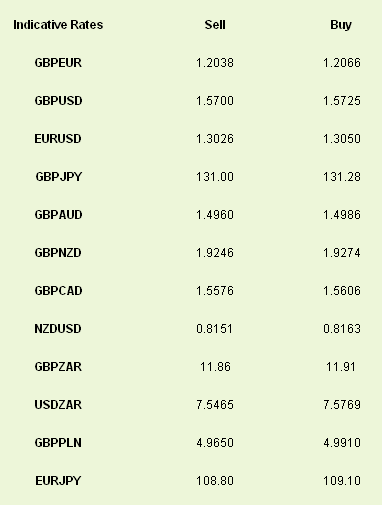

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Improving US Outlook Denies QE3

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.