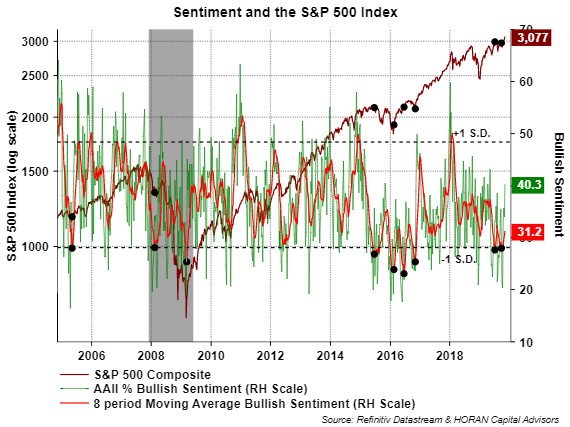

Bullish investor sentiment improved 6.3 percentage points to 40.3% from the prior week's reported level as noted by the American Association of Individual Investors. This is the highest bullishness level since the May 9 reading of 43.1%. Individual investor sentiment is certainly reacting positively to the upward trend in the equity markets, yet the current bullishness level only falls in the middle of a range of plus or minus one standard deviation of the average bullishness level. Due to the fact the weekly readings can be volatile one should evaluate a moving average of the bullishness level and in this case the 8-period moving average. This 8-period average remains at a low 31.2%.

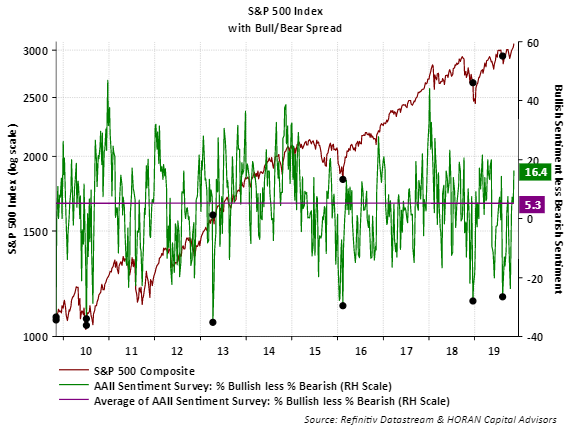

The jump higher in the bullishness level is also impacting the bull/bear spread which equals 16.4 in this weeks reading. The long-term average for the bull/bear spread is 5.3 percentage points.

The sentiment measures are contrarian ones and tend to be most actionable at their extremes. With this noted, the current bullish sentiment level is not at an extreme; however, investors will want to keep an eye on individual investor sentiment as the recent equity market move seems to be having a favorable impact on individual investor sentiment.