Talking Points

- Important few days coming up for the Yen

- GBP/USD rebounds off key Gann support level

- GOLD testing important resistance zone

Foreign Exchange Price And Time At A Glance

USD/JPY" title="USD/JPY" height="332" width="681">

USD/JPY" title="USD/JPY" height="332" width="681">

Charts Created using Marketscope – Prepared by Kristian Kerr

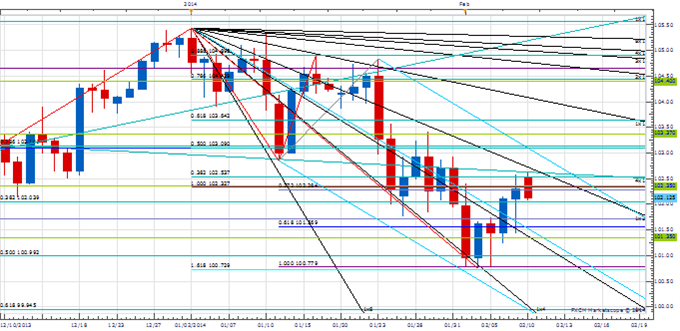

- USD/JPY traded to its lowest level since late November last week before rebounding off the 200% extension of the mid-January advance near 100.80

- Our near-term trend bias is lower in the exchange rate while below the 3rd square root relationship of the year-to-date high at 102.40

- Interim support is seen around 101.35, but a move back under 100.80 is really needed to kick off a more significant decline in the rate

- A minor cycle turn window is seen today

- Only a close over 102.40 would turn us positive on USD/JPY

USD/JPY Strategy: We like the short side while 102.40

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

*100.80 |

101.35 |

102.10 |

*102.40 |

102.85 |

GBP/USD" title="GBP/USD" height="332" width="681">

GBP/USD" title="GBP/USD" height="332" width="681">

Charts Created using Marketscope – Prepared by Kristian Kerr

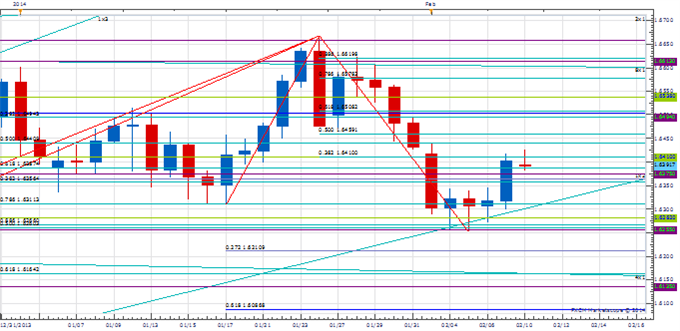

- GBP/USD fell to its lowest level since mid-January last week before rebounding off the 12th square root relationshipof the 2013 low at 1.6255

- Our near-term trend bias is lower in Cable while below 1.6505

- The 1.6255 is now important support with weakness below needed to signal a resumption of the broader decline

- A minor cycle turn window is seen around the middle of the week

- Only a daily close back over the 2nd square root relationship of last week’s low at 1.6505 would turn us positive on the Pound

GBP/USD Strategy: Like the short side while below 1.6505.

|

Instrument |

Support 2 |

Support 1 |

Spot |

Resistance 1 |

Resistance 2 |

|

*1.6255 |

1.6355 |

1.6390 |

1.6410 |

*1.6505 |

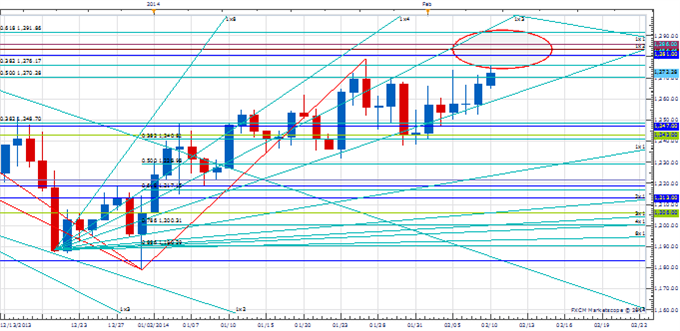

Gold re-tested the 38% retracement of the August to December decline at 1276 earlier today. The price zone between 1276 and 1292 is littered with several important Gann and Fibonacci resistance levels and needs to be watched closely. A move through the top end of this zone in the next few days would further confirm the cyclical importance of the reversal on December 31st and pave the way for a much more important advance in the medium-term. Failure, on the other hand, to gain any traction over 1292 followed by weakness below 1230 would send a clear signal that the move higher over the past month and a half has just been a correction within the primary downtrend. The next cycle turn window of importance in the metal looks to be around early next week.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com