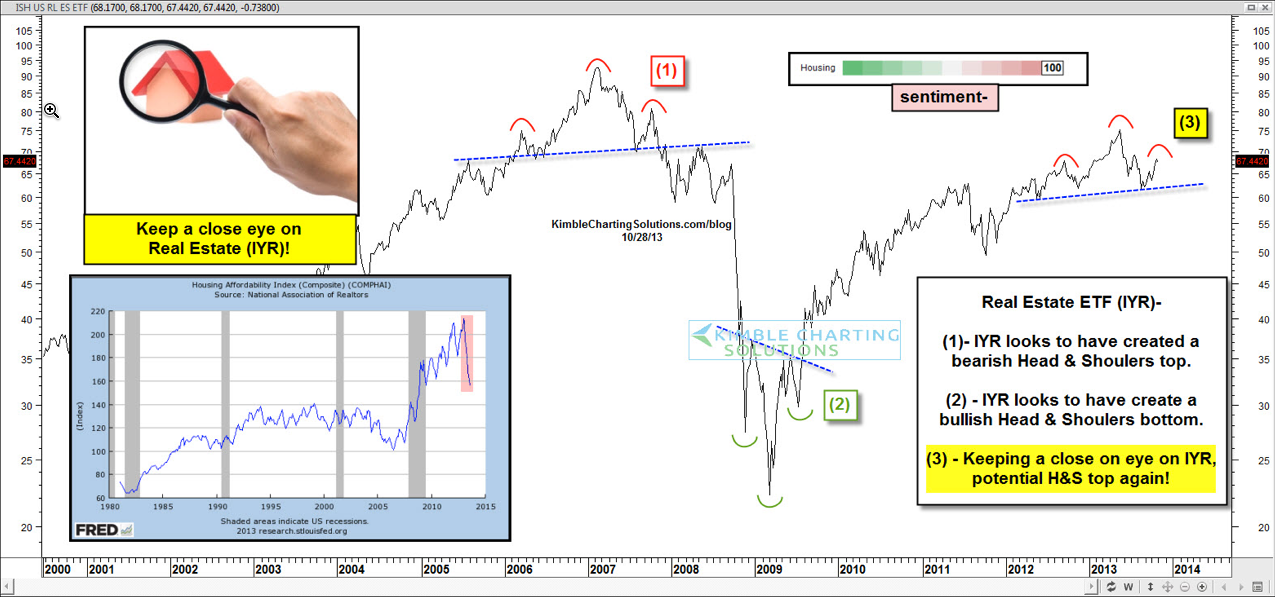

Saying that Real Estate is important to the economy is an understatement, to say the least. The iShares Trust DJ US Real Estate ETF (IYR) created what looks to be a head-and-shoulders topping pattern back in 2006 to 2008 at (1) and in turn fell hard, along with the broader market.

In 2008-2009, IYR looks to have created a head-and-shoulders bottoming pattern at (2) and then proceeded to have a large rally, again following the broad market.

Affordability Decrease

I am keeping a close eye on IYR at this time because a potential head-and-shoulders topping pattern could be forming and the inset chart reflects a sharp decrease in the housing affordability index.

This pattern is NOT true or complete at (3) until the neckline would break to the downside so....at this time the jury is still out on this pattern.

Still, it's worth watching closely!