Gold has been an interesting asset class this year with many multi-day and -week swings in both directions. This can be either a traders mecca or worst nightmare depending on their paradigm and strategy. Patience can be vital in a quick-moving market.

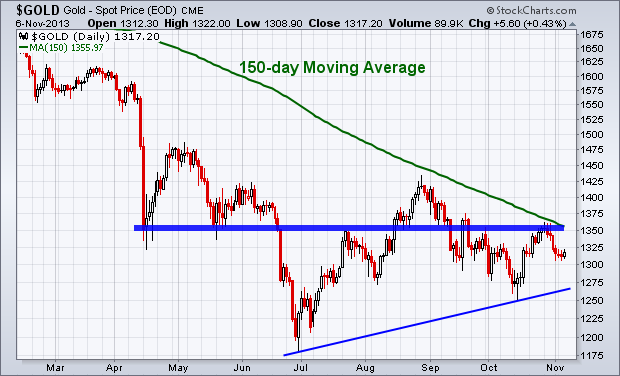

There are two charts of gold I want to take a look at today. The first one is of the last seven months. The two lows in April and May created resistance that we’ve been unable to clear except for a short period of time in Aug/Sept. On the downside we have a simple trend line connecting the two most recent lows which could act as support if end up breaking $1275.

We also have the long-term trend line going back to 1999 that I mentioned in early October which could act as potential support on any further weakness we see in the gold market. But what I’m watching the closest is the 150-day moving average, which we’ll look at in more detail on the next chart.

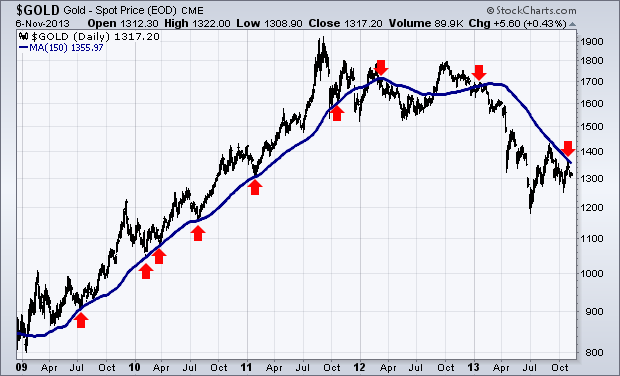

Below is a chart of gold going back to 2009. The blue line is the 150-day moving average. I’ve put red arrows to better show the past importance of this moving average as support and resistance for the shiny metal. As you can see in the chart above, we have come very close to testing the 150-day MA recently. The risk associated with gold this close to critical resistance just doesn’t interest me. Again, patience is key.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer.