The data continues to pile up on the negative side of the ledger. The deficit in June was $59.7 billion which was only slightly less than expectations of $60.0 billion. The sharp decline in petroleum costs, and a recession in the Eurozone, were the biggest drivers to this change. More importantly we should not forget that May showed a $125 Billion deficit, and $59 Billion in April. June was also $16.7 billion higher compared to last June. Total debt in June increased by $85.7 billion and the cumulative deficit in Fiscal 2012 is now $904 billion through June, compared to $970 billion last year over the same period. The continued policies of ultra low interest rates, a weak dollar policy and continued interventions by the Fed continue to push negative export prices which are ultimately very negative for the economy.

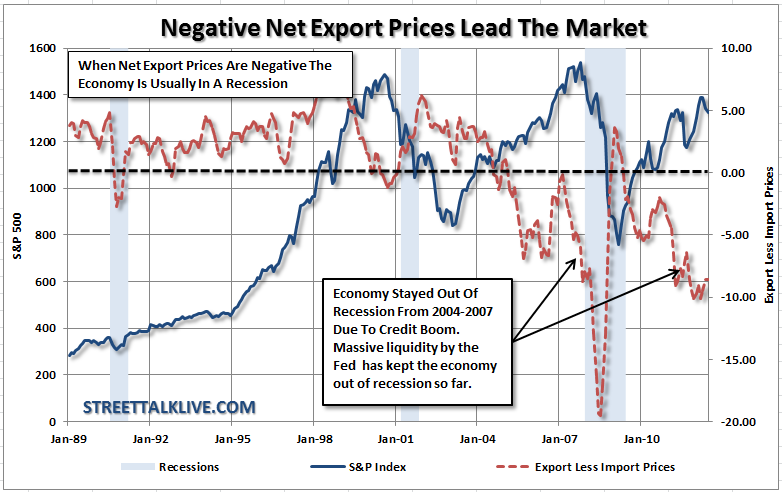

The chart of negative net export prices shows the continued problem. Historically, when exports go negative it has typically been associated with a recession. With the initial economic support driven by the housing bubble from 2004-2007, even as net exports went negative, the economy was able to hold together for a longer than expected period. Today, with continued interventions by the Fed, and the Administration, the economy is once again bucking the trend of negative net exports - the only question is sustainability? Furthermore, import prices are now down for a third month in a row, falling a very steep 2.7 percent in June following a downwardly revised 1.2 percent plunge in May and a 0.1 percent decline in April. This is the first time since the last recession that this has occurred.

Finally, negative trends continue for a second month in a row and contaminate almost every component with prices for imported petroleum products down 10.5 percent, finished goods prices show a decline for capital goods, down two of the last three months, and a second straight decline for imported consumer goods. The export side of "negative net exports" showed a negative run rate of 1.7 percent with a 4.0 percent monthly plunge in agricultural exports - a heavy negative. Finished prices showed a slight decline for exported capital goods but a moderate increase for consumer goods where, however, the year-on-year rate is only plus 0.5 percent.

Overall, like the majority of all of the other economic related reports as of late, the news is not good for the economy, or the markets, in the near term.

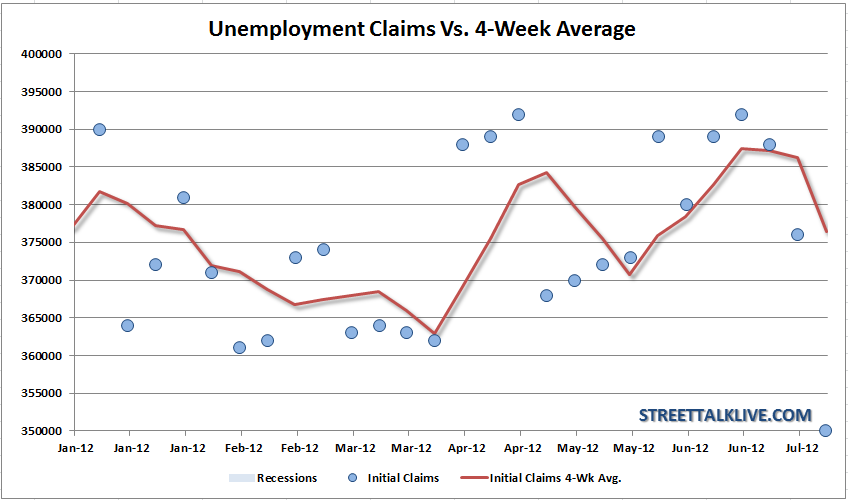

The most recent release of jobless claims was very puzzling on the surface showing an large drop to 350,000 claims in the latest week. What was puzzling was the sharp decline that followed recent weeks of gains in complaints as the economy has run into signs of trouble. This latest read appears to be skewed by auto manufacturers continuing to manufacture autos at a time when they normally shut down to retool. This action skews the seasonally adjusted data which means that we are likely to reverse the most recent drop in the weeks ahead.

While auto manufacturing remains at full tilt in order to keep up with "demand", even though GM is currently being sued for "dealer channel stuffing" - it is also important to remember that it was a holiday shortened week. The "Not Seasonally Adjusted" claims number rose by 70K which, without the seasonal adjustment skews, may be a much more relevant number even as the BLS stated: "onetime factors such as fewer auto-sector layoffs than normal likely caused the sharp decline."

As the last several days have shown - the economic data continues to weaken (See here, here and here) While the evidence is clearly tilted toward economic weakness - we are still not a recessionary levels just yet. However, as I have been discussing over the last several days in recent interviews - the likelyhood in mounting that the Fed will act with further "balance sheet expansion" programs before a recession sets in. This is likely to occur between August and September after Bernanke gets the 2nd estimate of 2nd quarter GDP to work off. With August fast approaching, a seasonally weak month for the markets, it likely be a bumpy ride as markets rise and fall in anticipation, followed by disappointment, of immediate intervention by the Fed.

We continue to recommend remaining underweight equities and overweight fixed income and cash for the current time. Eventually, the data will turn into a much more productive and positive trend. When it does we will have the dry powder necessary to take advantage of the buying opportunity when it occurs.

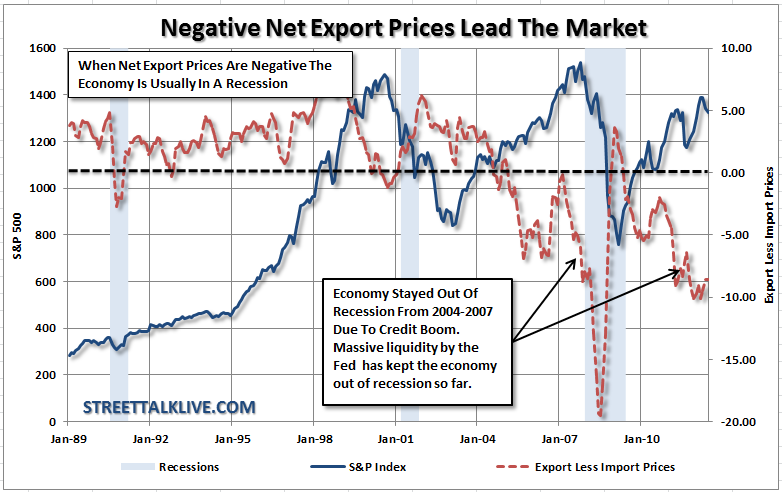

The chart of negative net export prices shows the continued problem. Historically, when exports go negative it has typically been associated with a recession. With the initial economic support driven by the housing bubble from 2004-2007, even as net exports went negative, the economy was able to hold together for a longer than expected period. Today, with continued interventions by the Fed, and the Administration, the economy is once again bucking the trend of negative net exports - the only question is sustainability? Furthermore, import prices are now down for a third month in a row, falling a very steep 2.7 percent in June following a downwardly revised 1.2 percent plunge in May and a 0.1 percent decline in April. This is the first time since the last recession that this has occurred.

Finally, negative trends continue for a second month in a row and contaminate almost every component with prices for imported petroleum products down 10.5 percent, finished goods prices show a decline for capital goods, down two of the last three months, and a second straight decline for imported consumer goods. The export side of "negative net exports" showed a negative run rate of 1.7 percent with a 4.0 percent monthly plunge in agricultural exports - a heavy negative. Finished prices showed a slight decline for exported capital goods but a moderate increase for consumer goods where, however, the year-on-year rate is only plus 0.5 percent.

Overall, like the majority of all of the other economic related reports as of late, the news is not good for the economy, or the markets, in the near term.

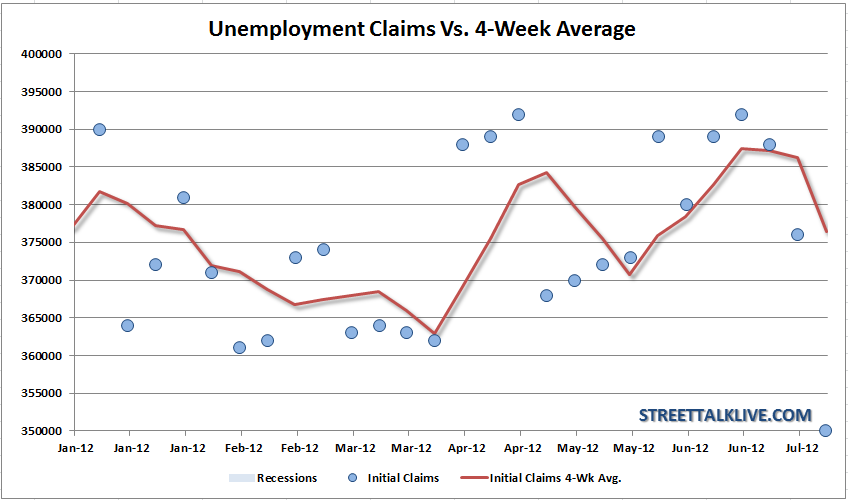

The most recent release of jobless claims was very puzzling on the surface showing an large drop to 350,000 claims in the latest week. What was puzzling was the sharp decline that followed recent weeks of gains in complaints as the economy has run into signs of trouble. This latest read appears to be skewed by auto manufacturers continuing to manufacture autos at a time when they normally shut down to retool. This action skews the seasonally adjusted data which means that we are likely to reverse the most recent drop in the weeks ahead.

While auto manufacturing remains at full tilt in order to keep up with "demand", even though GM is currently being sued for "dealer channel stuffing" - it is also important to remember that it was a holiday shortened week. The "Not Seasonally Adjusted" claims number rose by 70K which, without the seasonal adjustment skews, may be a much more relevant number even as the BLS stated: "onetime factors such as fewer auto-sector layoffs than normal likely caused the sharp decline."

As the last several days have shown - the economic data continues to weaken (See here, here and here) While the evidence is clearly tilted toward economic weakness - we are still not a recessionary levels just yet. However, as I have been discussing over the last several days in recent interviews - the likelyhood in mounting that the Fed will act with further "balance sheet expansion" programs before a recession sets in. This is likely to occur between August and September after Bernanke gets the 2nd estimate of 2nd quarter GDP to work off. With August fast approaching, a seasonally weak month for the markets, it likely be a bumpy ride as markets rise and fall in anticipation, followed by disappointment, of immediate intervention by the Fed.

We continue to recommend remaining underweight equities and overweight fixed income and cash for the current time. Eventually, the data will turn into a much more productive and positive trend. When it does we will have the dry powder necessary to take advantage of the buying opportunity when it occurs.