Immunovant (NASDAQ:IMVT), Inc. IMVT reported a net loss of 35 cents per share in the second quarter of fiscal 2022 (ended Sep 30, 2021), wider than the Zacks Consensus Estimate of a loss of 26 cents. In the year-ago quarter, the company reported a loss of 25 cents.

Currently, the company does not have any approved product in its portfolio. As a result, it is yet to generate revenues.

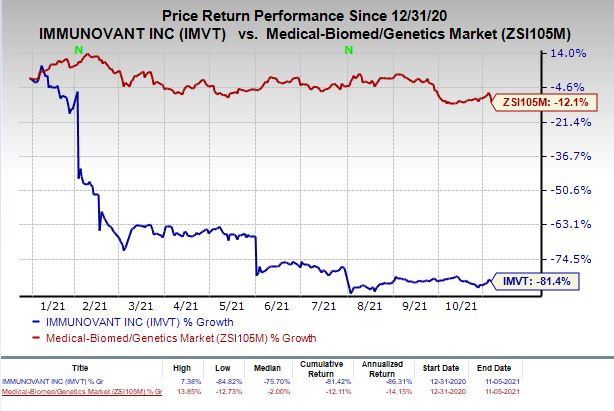

Shares of Immunovant have plunged 81.4% so far this year compared with the industry’s decrease of 12.1%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Quarter in Detail

In the reported quarter, research and development (R&D) expenses were $21.4 million, up 78.3% from the year-ago quarter. The year-over-year surge was due to increased personnel-related expenses and higher costs related to clinical activities.

General and administrative (G&A) expenses were $16.3 million in the reported quarter, up 81.1% on a year-over-year basis. The increase was primarily due to higher financial advisory fees, legal and other costs, and increased personnel-related expenses.

As of Sep 30, 2021, the company had cash balance of approximately $559 million compared with $379 million as of Jun 30, 2021.

Pipeline Update

Immunovant is developing its lead pipeline candidate, IMVT-1401, as a subcutaneous injection for the treatment of autoimmune diseases mediated by pathogenic IgG antibodies. The company is developing IMVT-1401 with an initial focus on the treatment of myasthenia gravis (“MG”), thyroid eye disease (“TED”) and warm autoimmune hemolyticanemia (“WAIHA”).

A pivotal study evaluating IMVT-1401 for treating MG is expected to begin in 2022. In July 2021, the FDA granted an Orphan Drug designation to IMVT-1401 for the treatment of MG.

Immunovant plans to resume the development of IMVT-1401 for WAIHA and TED in the upcoming quarters.

We remind investors, that in February 2021, the company voluntarily paused dosing in ASCEND GO-2 – a phase IIb study in TED, and in ASCEND-WAIHA – a phase II study on IMVT-1401 in WAIHA due to elevated total cholesterol and LDL levels observed in patients who were treated with IMVT-1401.

We note that Johnson & Johnson JNJ is also developing nipocalimab in mid-and late-stage studies for treating WAIHA, generalized MG and other rare diseases.

Zacks Rank & Stocks to Consider

Immunovant currently carries a Zacks Rank #2 (Buy). Other stocks worth considering in the biotech sector include Amicus (NASDAQ:FOLD) Therapeutics, Inc. FOLD and Athenex (NASDAQ:ATNX), Inc. ATNX, both carrying the same Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Amicus Therapeutics’ loss per share estimates have narrowed 1.3% for 2021 and 37.5% for 2022 over the past 60 days.

Athenex’s loss per share estimates have narrowed 9% for 2021 and 9.2% for 2022 over the past 60 days.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix (NASDAQ:NFLX) did to Blockbuster and Amazon (NASDAQ:AMZN) did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Amicus Therapeutics, Inc. (FOLD): Free Stock Analysis Report

Athenex, Inc. (ATNX): Free Stock Analysis Report

Immunovant, Inc. (IMVT): Free Stock Analysis Report

To read this article on Zacks.com click here.