ImmunoGen Inc. (NASDAQ:IMGN) announced a strategic collaboration and option agreement with Jazz Pharmaceuticals PLC (NASDAQ:JAZZ) for the development and commercialization of two early-stage, hematology-related antibody-drug conjugate (ADC) programs, and also another l program which will be designated during the term of the agreement.

The programs include IMGN779 - a CD33-targeting ADC and which is in phase I study for the treatment of acute myeloid leukemia (AML) and IMGN632 also being evaluated in a preclinical study for treating hematological malignancies including AML. IMGN632 is expected to enter the clinic before the end of 2017.

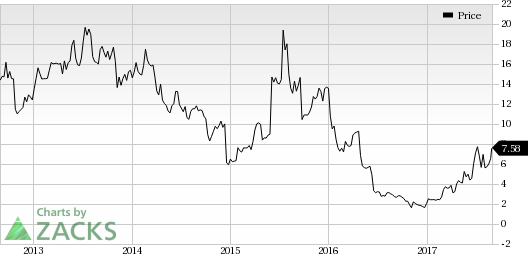

Consequently, ImmunoGen’s shares rose by almost 17% following the news. The shares have also outperformed the industry year to date. The stock has skyrocketed 288.7% against the industry’s decline of 1.2% in the same time frame.

Per the agreement, Immunogen will take care of the the development of the three ADC programs prior to any potential opt-in by Jazz. Following any opt-in, Jazz will be responsible for any further development as well as for potential regulatory submissions and commercialization.

Per the deal, Jazz will make an upfront payment of $75 million to ImmunoGen. Additionally, it will also pay up to $100 million in development funding over seven years to support the three ADC programs. For each program, Jazz may exercise its opt-in right at any time prior to a pivotal study or any time prior to a biologics license application (BLA). For each program for which Jazz elects to opt-in, ImmunoGen would be eligible to receive milestone payments based on certain pre-decided conditions

Immunogen believes that the deal with Jazz will enable it to advance and speed up the development of its early-stage novel ADC assets. The deal also provides Immunogen with sufficient funding to support these programs, and gives the right to co-commercialize one of these assets.

On the other hand, Jazz believes that this collaboration will help it to expand its oncology portfolio with the potential addition of multiple innovative antibody drug conjugates.

ImmunoGen is focused on the development of targeted cancer therapeutics using its proprietary ADC technology. ImmunoGen's ADC technology is also used in Roche's (OTC:RHHBY) marketed product, Kadcyla, in three other development-stage candidates, in its own pipeline, and in development programs by its partners Amgen (NASDAQ:AMGN) , Bayer AG (DE:BAYGN), Biotest, CytomX, Eli Lilly, Novartis, Sanofi (PA:SASY) and Takeda.

Zacks Rank

ImmunoGen currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank(Strong Buy) stocks here.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off. See Stocks Now>>

Roche Holding (SIX:ROG) AG (RHHBY): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Jazz Pharmaceuticals PLC (JAZZ): Free Stock Analysis Report

ImmunoGen, Inc. (IMGN): Free Stock Analysis Report

Original post

Zacks Investment Research