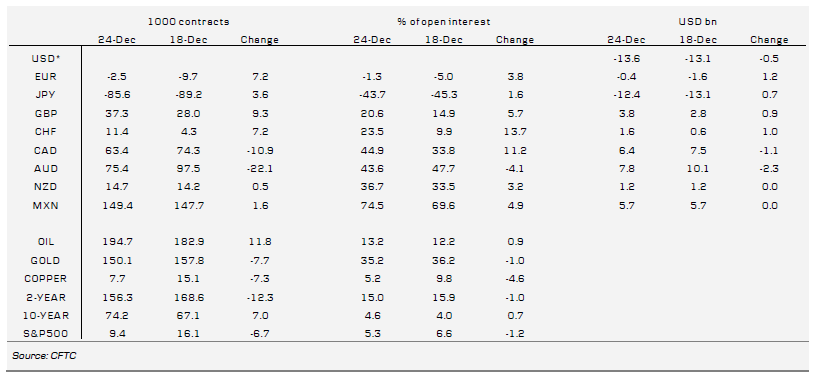

The latest IMM data cover the week from 18 to 24 December.

- Euro positioning almost neutral. Net short euro positions fell further to just 1.3% of open interest – the lowest level since September 2011. Interestingly, the move in net positions is no longer only driven by an unwind of short euro positions, but also by a build-up in long euro positions. This illustrates the sentiment shift that the ECB and Fed action has triggered over recent months and opens up for euro positioning to turn net long for the first time since the ECB hiked rates in 2011.

- Investors remain very short yen. The Japanese yen has lost more than 10% against the dollar and even more against the euro since the sell-off started in October. As a result, net short yen positions are above 40% of open interest and near recent years’ highs. Positioning as reported by the IMM data has been stretched since early December but the yen has continued its sell-off since then. This indicates that there are more than just speculative flows driving the yen depreciation.

To Read the Entire Report Please Click on the pdf File Below.