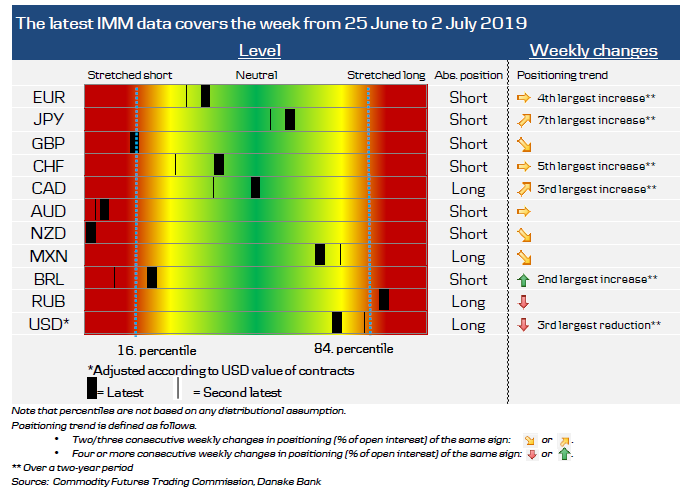

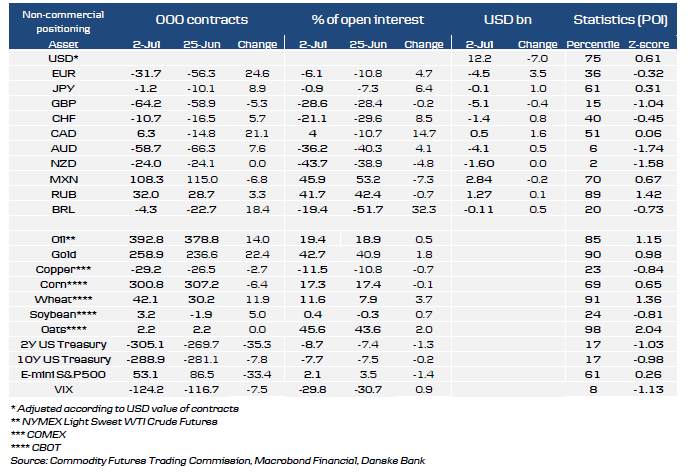

Non-commercial FX positioning

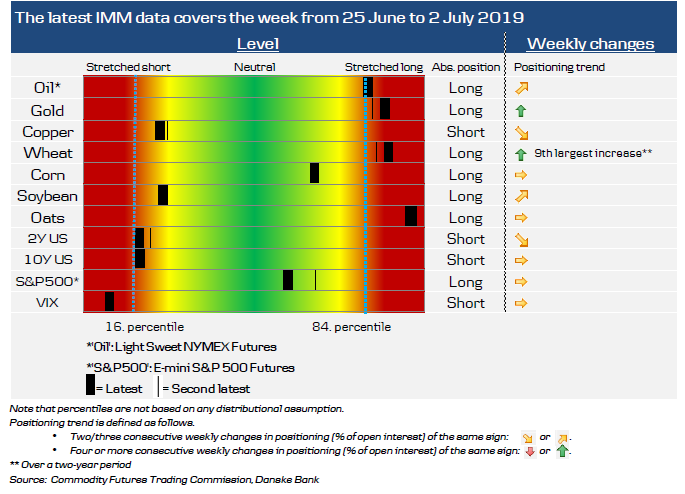

Non-commercial commodity positioning

IMM overview table for FX and commodities

Details

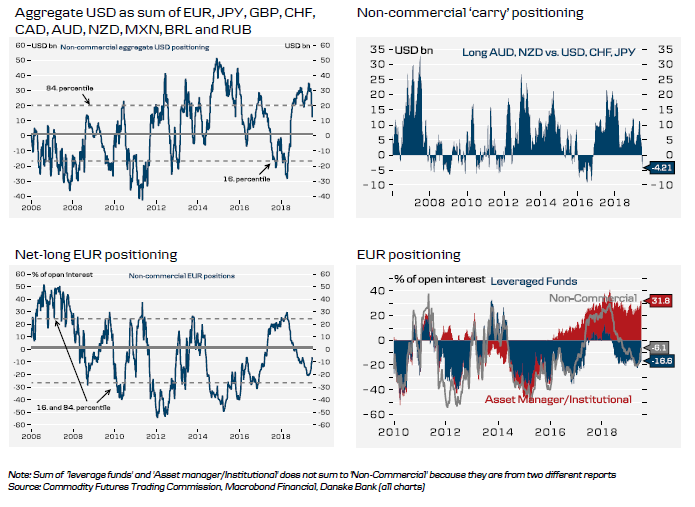

Historical FX (1 of 6)

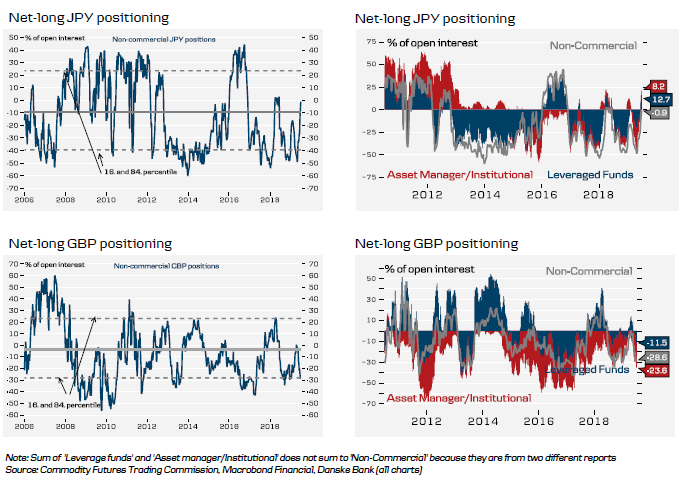

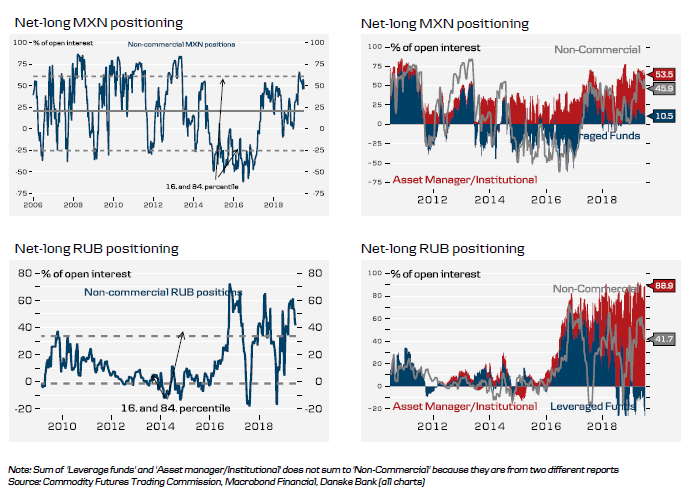

Historical FX (2 of 6)

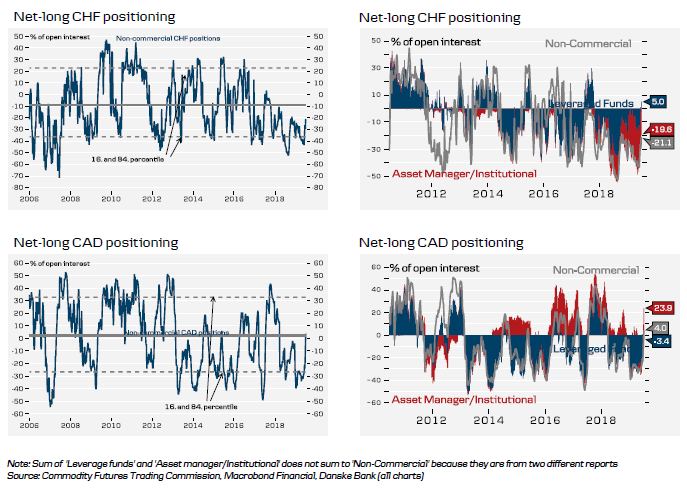

Historical FX (3 of 6)

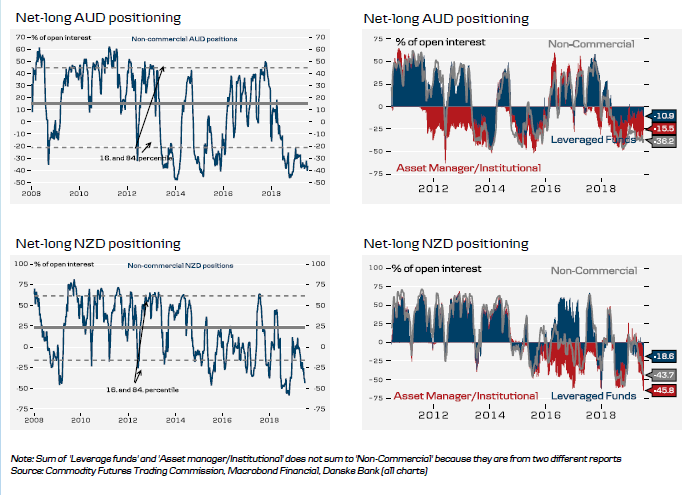

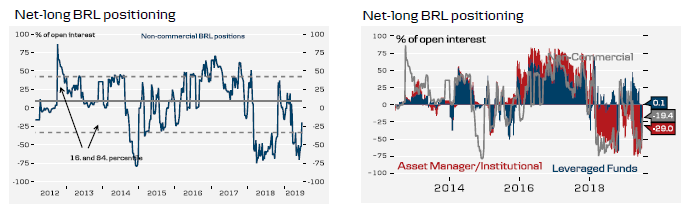

Historical FX (4 of 6)

Historical FX (5 of 6)

Historical FX (6 of 6)

Note: Sum of 'Leverage funds' and 'Asset manager/Institutional' does not sum to 'Non-Commercial' because they are from two different reports Source: Commodity Futures Trading Commission, Macrobond Financial, Danske Bank (all charts)

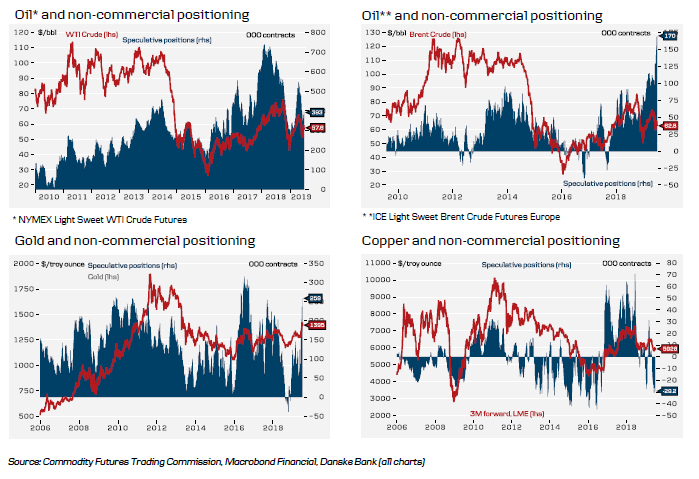

Historical commodities (1 of 2)

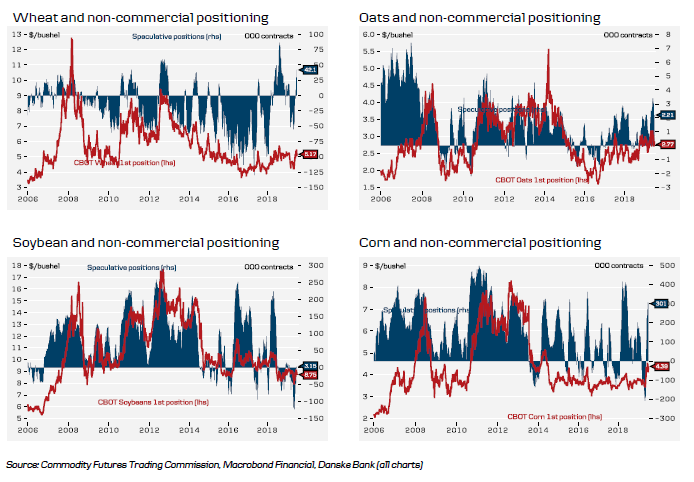

Historical commodities (2 of 2)

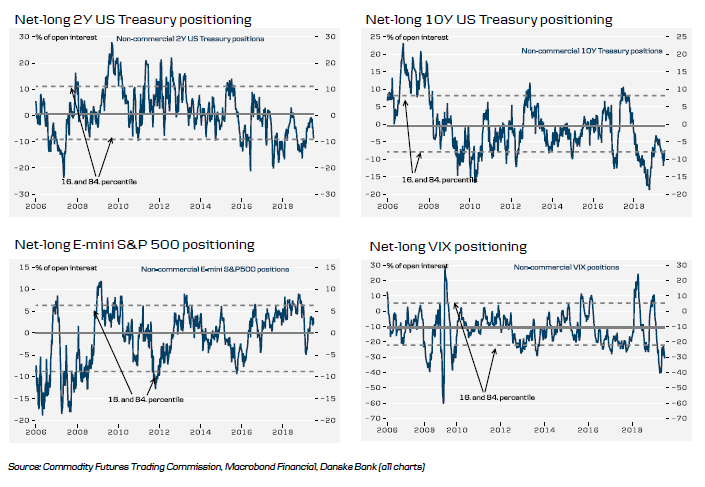

Historical financials

IMM data description

The IMM data

The IMM data is part of the Commitments of Traders (COT) reports published by the U.S. Commodity Futures Trading Commission (CFTC). The IMM data provides a breakdown of each Tuesday’s open futures positions on the International Money Market (IMM) a division of the Chicago Mercantile Exchange. All of a trader's reported futures positions in a commodity are classified as commercial if the trader uses futures contracts in that particular commodity for hedging as defined in CFTC Regulation 1.3(z), 17 CFR 1.3(z). A trader may be classified as a commercial trader in some commodities and as a non-commercial trader in other commodities.

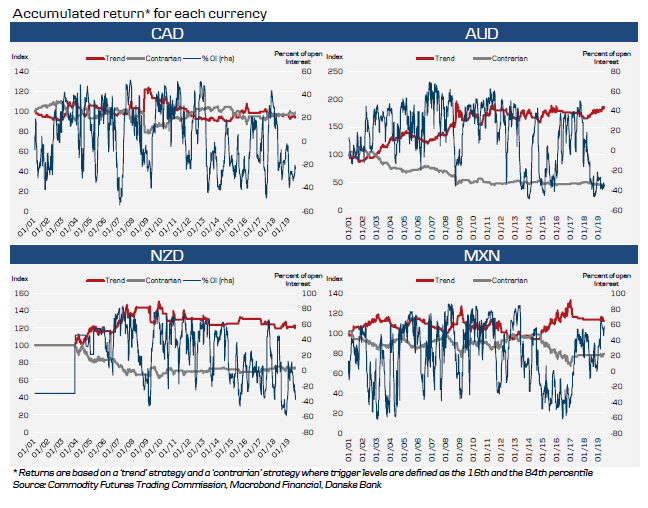

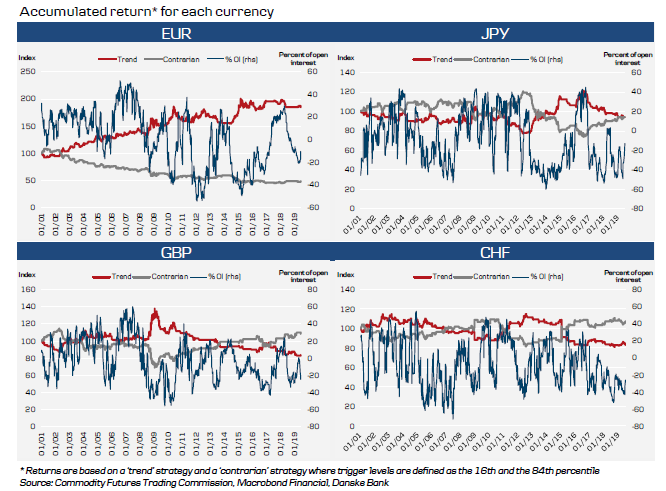

Trading strategies over time (1 of 2)

Trading strategies over time (2 of 2)