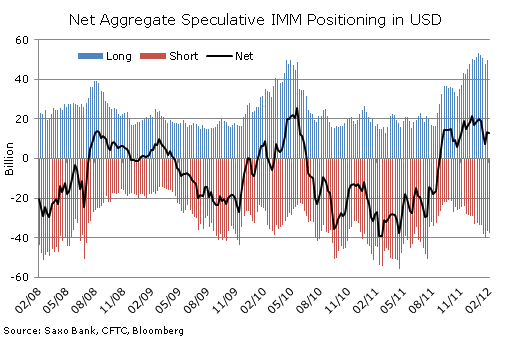

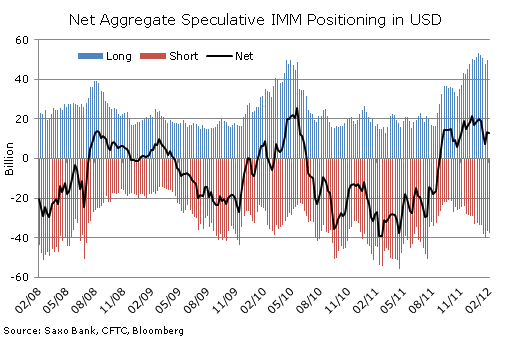

The net long dollar position held by hedge funds and other large speculators was reduced slightly according to the latest CFTC data for the period ending Tuesday 21 February. The selling of dollars against all eight IMM currencies except CHF and JPY only resulted in a net change of -0.5 billion dollars, leaving the aggregate long USD positioning at +12.8 billion. Speculators have now been long USD since September 2011.

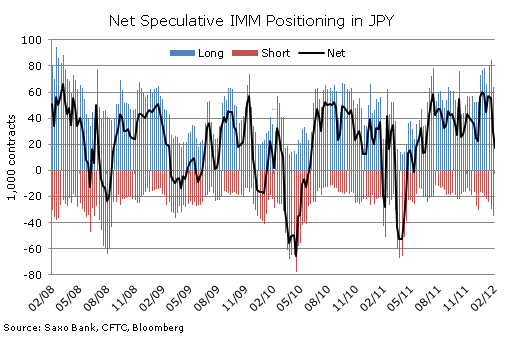

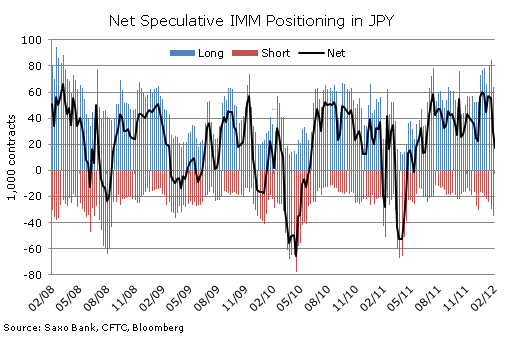

Most of the action was seen in JPY with another sizeable reduction in net long JPY positioning. The Bank of Japan's recent decision to ease monetary policy plus oil's continued ascent have caused a substantial shift in the attitude towards holding long JPY positions, so much so that the downtrend in USD/JPY since 2007 now appears to have been broken. Last week some 12.2k contracts were sold bringing the overall long down to 17.3k contracts and the continued selling that was seen after Tuesday suggests that the short USD/JPY position has now been eliminated.

Most of the action was seen in JPY with another sizeable reduction in net long JPY positioning. The Bank of Japan's recent decision to ease monetary policy plus oil's continued ascent have caused a substantial shift in the attitude towards holding long JPY positions, so much so that the downtrend in USD/JPY since 2007 now appears to have been broken. Last week some 12.2k contracts were sold bringing the overall long down to 17.3k contracts and the continued selling that was seen after Tuesday suggests that the short USD/JPY position has now been eliminated.  The dollar meanwhile was sold in decent size against both GBP and EUR. The GBP short was reduced by 9.3k contracts to -31.4k contracts while the EUR short saw a still moderate 6.5k reduction to -142.2k contracts. The market has been short EUR since August 2011 and the continued rally versus several currencies has undoubtedly begun to shake the conviction among many short sellers. So far we have seen nothing that resembles a capitulation move but as the EURUSD continued to climb towards the end of last week further short covering took place.

The dollar meanwhile was sold in decent size against both GBP and EUR. The GBP short was reduced by 9.3k contracts to -31.4k contracts while the EUR short saw a still moderate 6.5k reduction to -142.2k contracts. The market has been short EUR since August 2011 and the continued rally versus several currencies has undoubtedly begun to shake the conviction among many short sellers. So far we have seen nothing that resembles a capitulation move but as the EURUSD continued to climb towards the end of last week further short covering took place.

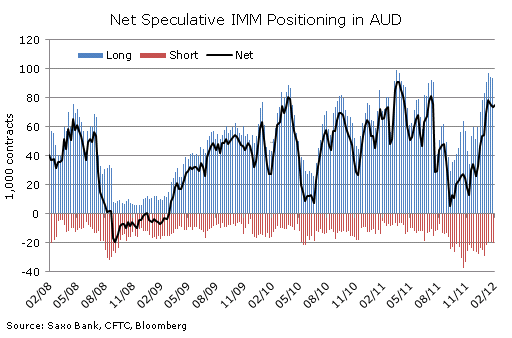

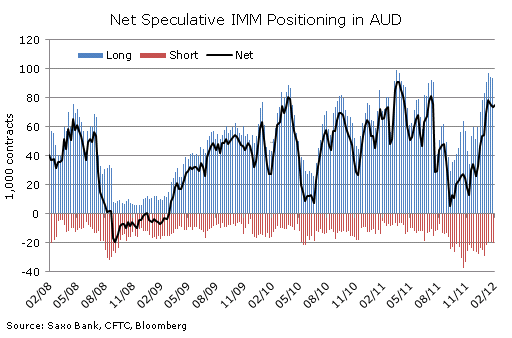

AUD and NZD only saw small additions as the commodity bull story centered more and more on energy thereby favouring CAD, the only IMM currency with a net export of oil. Speculators added 4.5k contracts bringing the net long to 14.1k contracts, following four weeks in a row of long additions. With both AUD and NZD positioning being somewhat extended they are both vulnerable to upside pressure from EUR/AUD and EUR/NZD crosses, something that we witnessed last Friday.

Most of the action was seen in JPY with another sizeable reduction in net long JPY positioning. The Bank of Japan's recent decision to ease monetary policy plus oil's continued ascent have caused a substantial shift in the attitude towards holding long JPY positions, so much so that the downtrend in USD/JPY since 2007 now appears to have been broken. Last week some 12.2k contracts were sold bringing the overall long down to 17.3k contracts and the continued selling that was seen after Tuesday suggests that the short USD/JPY position has now been eliminated.

Most of the action was seen in JPY with another sizeable reduction in net long JPY positioning. The Bank of Japan's recent decision to ease monetary policy plus oil's continued ascent have caused a substantial shift in the attitude towards holding long JPY positions, so much so that the downtrend in USD/JPY since 2007 now appears to have been broken. Last week some 12.2k contracts were sold bringing the overall long down to 17.3k contracts and the continued selling that was seen after Tuesday suggests that the short USD/JPY position has now been eliminated.  The dollar meanwhile was sold in decent size against both GBP and EUR. The GBP short was reduced by 9.3k contracts to -31.4k contracts while the EUR short saw a still moderate 6.5k reduction to -142.2k contracts. The market has been short EUR since August 2011 and the continued rally versus several currencies has undoubtedly begun to shake the conviction among many short sellers. So far we have seen nothing that resembles a capitulation move but as the EURUSD continued to climb towards the end of last week further short covering took place.

The dollar meanwhile was sold in decent size against both GBP and EUR. The GBP short was reduced by 9.3k contracts to -31.4k contracts while the EUR short saw a still moderate 6.5k reduction to -142.2k contracts. The market has been short EUR since August 2011 and the continued rally versus several currencies has undoubtedly begun to shake the conviction among many short sellers. So far we have seen nothing that resembles a capitulation move but as the EURUSD continued to climb towards the end of last week further short covering took place.AUD and NZD only saw small additions as the commodity bull story centered more and more on energy thereby favouring CAD, the only IMM currency with a net export of oil. Speculators added 4.5k contracts bringing the net long to 14.1k contracts, following four weeks in a row of long additions. With both AUD and NZD positioning being somewhat extended they are both vulnerable to upside pressure from EUR/AUD and EUR/NZD crosses, something that we witnessed last Friday.