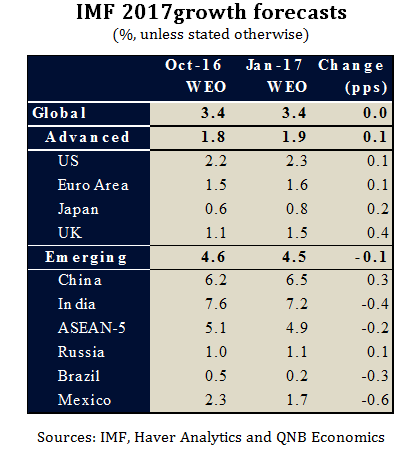

The International Monetary Fund (IMF) kept its forecasts for global growth in 2017 unchanged at 3.4% in the latest update of its World Economic Outlook. The overall number masked some tinkering with the composition of global growth since the IMF’s last round of forecasts made in October 2016.

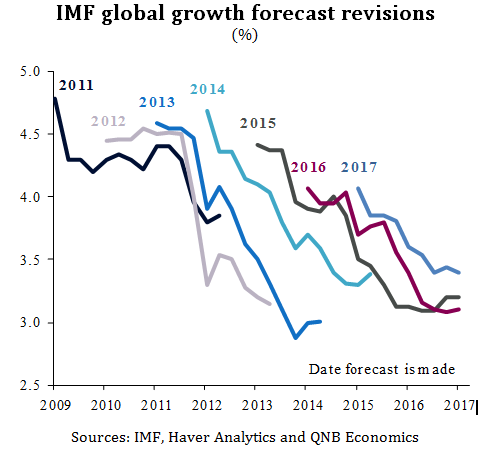

The projection for growth in advanced economies (AEs) was revised up by 0.1 percentage points (pps) to 1.9%, while growth for emerging markets (EMs) was revised down by 0.1 pps to 4.5%. However, we view the forecasts as over-optimistic and expect them to be revised down in the future, particularly given the IMF’s track record in recent years of consistent downward revisions to global growth projections (see chart, spot the trend!).

The IMF revised up its growth forecasts across most AEs, mainly in response to surprisingly strong recent economic data, but also due to some other factors. In the U.S., growth picked up to 2.5% in the second half of 2016 compared with 1.4% in the first half. In addition, fiscal stimulus is now expected in the U.S. following the election of President Trump. As a result, the IMF revised its forecast for U.S. growth in 2017 by 0.1 pps to 2.3%.

In Europe, the envisioned fallout from Brexit has not yet fully materialised, with consumption holding up better than expected. Reflecting these developments, the IMF has revised its 2017 forecasts for the Euro Area and UK by 0.1 pps and 0.4 pps, respectively.

In EMs, the downward forecast revisions were mainly the result of tighter financial conditions as well as specific factors impacting a number of countries. Starting with tighter financial conditions, U.S. 10-Year bond yields rose around one percentage point since the IMF’s last report in October. As a result, capital flows to EMs weakened considerably (see last week’s commentary, Capital flows to EMs improved in 2016, but prospects are subdued), downgrading the outlook for a number of EMs. For example, ASEAN-5 (Indonesia, Malaysia, Philippines, Thailand and Vietnam) growth projections were revised down by 0.2 pps to 4.9%.

Turning to country-specific factors,India’s demonetisation (see our commentary, India’s growth to dip on demonetisation) is expected to have a temporary, but sharp impact on economic activity and the IMF has lowered its 2017 forecast by 0.4 pps to 7.2%. Mexico is particularly exposed to the potential protectionism of the Trump administration and its forecasts are down 0.9 pps. Brazil’s recovery has not been as strong as expected and its projections are down 0.3 pps to 0.2%. It is notable that the EM outlook would have been considerably worse had China not bucked the trend. The IMF revised China’s forecasts by 0.3 pps to 6.5%, as policy stimulus has propped growth up more than expected.

The IMF’s 3.4% projection for 2017 would be a considerable acceleration from 3.1% in 2016. The pickup would come from both AEs (1.9% vs 1.6%) and EMs (4.5% vs 4.1%). In our view, this broad-based acceleration in global growth seems a little too optimistic.

In AEs, a number of factors are likely to result in disappointing growth. Firstly, U.S. fiscal stimulus may be harder to enact than previously expected and is likely to be offset by tighter Fed monetary policy. Secondly, rising commodity prices will likely drag on consumption. Thirdly, so many political risks abound—from a hard Brexit to security risks—that some negative growth shocks are highly probable. Finally, rising protectionism could offset potential gains from fiscal stimulus in AEs with spillovers to the rest of the world. The recent decision by Trump to pull out of the Trans Pacific Partnership shows that this risk is material.

In EMs, a large acceleration in growth is unlikely given that financial conditions will be considerably tighter in 2017. Easy monetary policy in AEs has supported EMcapital flows since the financial crisis, but this is now going into reverse. U.S. yields have risen and monetary easing in other AEs is nearing its limits, speculation about ECB tapering has already begun. Policy stimulus in China may not be sustained given high corporate debt and rising risks of disorderly capital flight. A sharper than expected slowdown in China would impact EM growth directly, but also indirectly as many EMs rely heavily on exports to China.

Therefore, we doubt the IMF’s projections will be realised. The IMF itself states that its forecasts are particularly unpredictable at this juncture, with the lack of clarity surrounding the policies of the incoming U.S. administration. Therefore, we expect growth to come in below the IMF’s forecasts, closer to the 3% mark.