Investing.com’s stocks of the week

The latest IMF projections for the world economy have grabbed the headlines overnight as they have, needless to say, revised world growth lower once again. While they said that the failure of Europe and the US to address fiscal issues was threatening the recovery they also helped those opposed to austerity by saying that governments had “underestimated” the pain that the tightening process would cause.

Global growth will now only reach 3.6% according to the latest figures, a fall from 3.9% previously. China’s growth numbers were cut by 0.2% this year and next to 7.8% and 8.2% respectively with the UK taking a 0.6% hit from +0.4% to -0.2% through 2012. This is not too worrying in our eyes; the 1.1% forecast next year is more so. The IMF especially advised the UK in the report to relax its austerity regime as it continues to weigh on growth. George Osborne’s speech to the Conservative party conference yesterday outlined the opposite and called for patience and to keep going forward with Plan A. A rowing back of this plan would increase the political pressure on the coalition and would likely act as a sterling negative in our opinion. The conference continues today.

There are obviously significant risks to these latest projections from the IMF but they are hardly new. The most significant is seen as the US “fiscal cliff” while a lack of European consolidation and an inability to use the ECB’s bond buying program accounts for their fears on this side of the Atlantic.

Although we saw little market reaction yesterday the launch of the ESM in the Eurozone can hopefully trigger political impetus to resolve the remaining issues surrounding the bailout fund. While some of the money is ready everyone is still unsure as to how it can be allocated to sovereigns and banking sectors, without this clarification the much-hailed “bazooka” becomes little more than a piece of expensive piping.

Both euro and the pound had tough sessions yesterday; the single currency was sold on the political uncertainty stemming from Eurogroup and Ecofin meetings this week while GBP was largely sold following a pledge from George Osborne that benefits would have to be cut by an additional £10bn to keep the deficit reduction plan on track.

UK industrial production figures may continue to weaken the pound through today’s session. Recent manufacturing numbers have been poor and the slowdown in both domestic and export markets will not have helped them improve of late. We believe this could be the catalyst that sees GBPUSD break back into the 1.59s and GBPEUR possibly below 1.23.

We also have Angela Merkel’s visit to Greece today which is a tinderbox if we ever saw one. This’ll be the first visit of the Chancellor to the country since the crisis began and a security operation that would rival the D-Day landings is in place to make sure that the inevitable protests don’t end up in some form of diplomatic nightmare. Expect pictures of burning German flags from the streets of Athens by lunchtime and possible risk-off flows as a result.

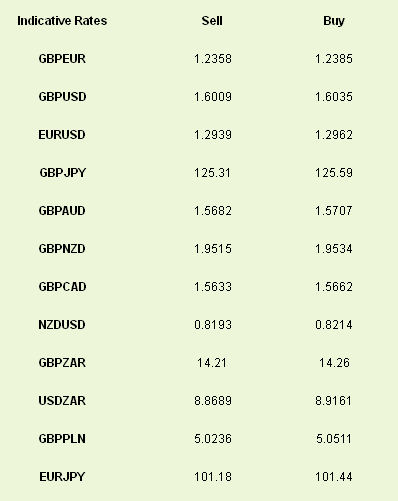

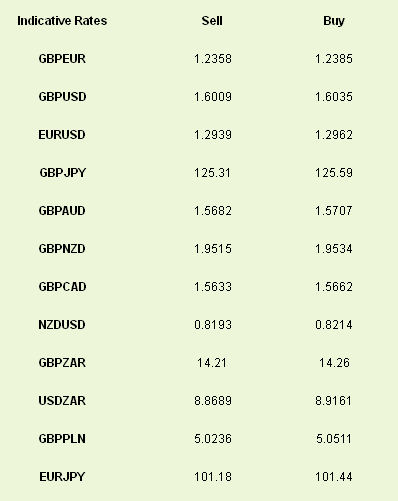

Latest exchange rates at time of writing

Global growth will now only reach 3.6% according to the latest figures, a fall from 3.9% previously. China’s growth numbers were cut by 0.2% this year and next to 7.8% and 8.2% respectively with the UK taking a 0.6% hit from +0.4% to -0.2% through 2012. This is not too worrying in our eyes; the 1.1% forecast next year is more so. The IMF especially advised the UK in the report to relax its austerity regime as it continues to weigh on growth. George Osborne’s speech to the Conservative party conference yesterday outlined the opposite and called for patience and to keep going forward with Plan A. A rowing back of this plan would increase the political pressure on the coalition and would likely act as a sterling negative in our opinion. The conference continues today.

There are obviously significant risks to these latest projections from the IMF but they are hardly new. The most significant is seen as the US “fiscal cliff” while a lack of European consolidation and an inability to use the ECB’s bond buying program accounts for their fears on this side of the Atlantic.

Although we saw little market reaction yesterday the launch of the ESM in the Eurozone can hopefully trigger political impetus to resolve the remaining issues surrounding the bailout fund. While some of the money is ready everyone is still unsure as to how it can be allocated to sovereigns and banking sectors, without this clarification the much-hailed “bazooka” becomes little more than a piece of expensive piping.

Both euro and the pound had tough sessions yesterday; the single currency was sold on the political uncertainty stemming from Eurogroup and Ecofin meetings this week while GBP was largely sold following a pledge from George Osborne that benefits would have to be cut by an additional £10bn to keep the deficit reduction plan on track.

UK industrial production figures may continue to weaken the pound through today’s session. Recent manufacturing numbers have been poor and the slowdown in both domestic and export markets will not have helped them improve of late. We believe this could be the catalyst that sees GBPUSD break back into the 1.59s and GBPEUR possibly below 1.23.

We also have Angela Merkel’s visit to Greece today which is a tinderbox if we ever saw one. This’ll be the first visit of the Chancellor to the country since the crisis began and a security operation that would rival the D-Day landings is in place to make sure that the inevitable protests don’t end up in some form of diplomatic nightmare. Expect pictures of burning German flags from the streets of Athens by lunchtime and possible risk-off flows as a result.

Latest exchange rates at time of writing