It was again another mixed bag in markets yesterday with good data mixed in with bad and sentiment both damaged and encouraged by comments from various of the global economic elite.

The IMF led the charge yesterday with their latest World Economic Outlook lowering global growth estimations by another 0.75 per cent. Growth is now predicted in the global economy to expand by 3.25% in 2012 which has got a lot of people into a panic but shouldn’t necessarily do so. 3.25% growth is OK, middling, not bad and markets, politicians and members of the public need to forget the days of 6-7% global growth as they are not returning any time soon. The reasons behind the IMF outlook shift are pretty obvious; probable recession in Europe through 2012, the effects of bank deleveraging on businesses and consumers and fiscal contraction capping government spending.

The big slashes in growth came in Europe. Italy was forecast to grow by around 0.3% in 2012 according to the previous Outlook, yesterday saw that number slashed to -2.2%. This would contribute to a 0.5% fall in output Europe-wide. The UK was not able to escape the downgrades either with growth cut to 0.6% this year compared to 1.6% previously. While the IMF have previously been full-square behind the UK’s deficit reduction plans, yesterday they made sure to emphasise that “Among those countries, those with very low interest rates or other factors that create adequate fiscal space, including some in the Euro area, should reconsider the pace of near-term fiscal consolidation.”

The euro strengthened on this announcement strangely, probably as a result of the IMF calling the forthcoming recession in Europe “mild”. It had been marked lower on the day earlier as EURUSD pushed to 3 week highs and traders and investors took profits. EURUSD has managed to hold the 1.30 level overnight while GBPEUR is back below the 1.20 mark. It had moved higher on decent PMI numbers from Germany and France early in the day and a Spanish bill auction that was once again well bid for with lower yields than previous sales.

It is key day for the pound today with the first estimate of Q4 GDP for the UK coming out at 09.30. We were one of the most bearish forecasters in November with our call for growth of 0.1%; it now seems we will be near the top end of things. The market is looking for a number of -0.1% with the high number 0.2% and the low -0.7%. The risk is obviously balanced towards the downside but any positive figure could see sterling fly. Alongside this GDP number we have the latest Bank of England minutes which should be a bit of a non-event.

Before that we also have the latest German IFO reading of the current business climate which, like last week’s ZEW number, is expected to bounce positively. The main German news, and by extension European news, is Angela Merkel’s speech to the World Economic Forum in Davos. She takes to the lectern at 15.00 GMT.

The Fed also releases its latest monetary policy statement at 17.30 GMT and markets will be looking for indications of another round of QE sooner rather than later despite the recent uptick in the fortunes of the US economy.

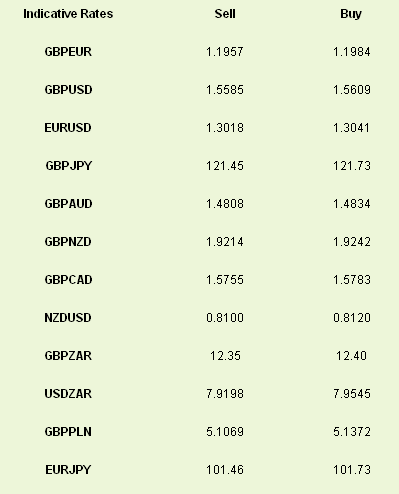

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

IMF Cut Global Growth Expectations as WEF Starts in Davos

Published 01/25/2012, 08:58 AM

Updated 07/09/2023, 06:31 AM

IMF Cut Global Growth Expectations as WEF Starts in Davos

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.