Having read the minutes from The IMF Global Economic Outlook report, the first thing that popped into mind was that iconic line from the film Jaws, ‘we’re gonna need a bigger boat’. This appears to be the mantra extracted from the initial day of talks. Whilst a bolstering of the bailout fund was expected and very much welcomed, it’s more the worry that this seemed to be the main order of business.

It still remains unclear how the struggling economies are supposed to implement cuts and reduce debt but at the same have the investment required to generate growth. As it stands the peripherals have no real growth; they are barely meeting debt repayment deadlines, and according to the latest IMF report, are way behind on their deficit targets. There is an unrealistic expectation that any country can “turn it around” by being given access to LTRO injections in the short term, it all just seems counter-intuitive.

GBPEUR didn’t trade too widely on the back of IMF data as results were expected for the most part. The IMF Economic Outlook Report revised growth figures upwards for the global economy by 0.2% for 2012 and 2013. UK figures were also raised with GDP forecasts expected to rise to 0.8%. It expects the Eurozone to contract by 0.3% with Italy and Spain shrinking by 1.9% and 1.8% respectively this year.

UK CPI figures this morning saw inflation rise by 0.1% on the back on rising oil prices. This will more than likely be temporary and will not be taken as a sign of UK economic weakness. Minutes from the BoE are out later this morning with inflation progress and further QE updates included on the agenda.

European equities showed promise today. The German manufacturing machine was the backbone of the market rally. Higher than expected figures set the pace early in the morning. A relatively successful Spanish auction, along with a 60bn donation to the bailout kitty from the Japanese, all helped European market momentum continue over the course of the day.

A hawkish outlook from the BoC saw the Canadian Dollar soar in early market trading. Firmer growth and inflation prospects will more than likely see an earlier than expected tweak in interest rates. The prospect of higher rates will more than likely see an influx of capital flows which will strengthen the Canadian Dollar further.

Asian Markets performed well during last night’s sessions, digesting the positive IMF towards Asian growth and performance.

BoE minutes at 8.30 may provide insight as to the latest thoughts on further QE. Jobless claims figures from the UK will give us an idea on employment in the afternoon. We expect GBP volatility on the back of these figures The IMF are going to be playing a huge role all week in the markets with the Global Financial Stability Report due at 9am.

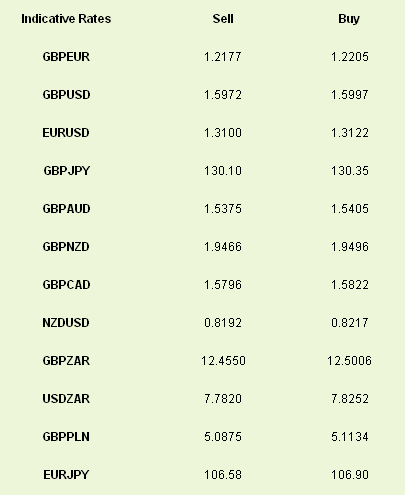

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

IMF Commences Week Long Talks

Published 04/18/2012, 08:06 AM

Updated 07/09/2023, 06:31 AM

IMF Commences Week Long Talks

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.