Investing.com’s stocks of the week

The failure of European leaders to come to yet another agreement, this time on additional loans to the IMF, has hurt the single currency yet again in the past 24hrs. We honestly believe there are members of the European political structure who would argue that the world was round and lightening is the anger of the Gods. It was expected that loans of EUR200bn would be agreed but following a conference call late afternoon it seems that only a figure of 150bn will be available. Some EU members had a problem with participating and will send the vote back to their parliaments for approval. These countries include Sweden, Poland, Czech Republic and Denmark, while the UK said it will pay up as long as countries outside of the EU also contribute. Basically a complete mess.

We also received a gargantuan speech from the new Spanish PM yesterday that laid out the task in front of him and his Popular Party government. This of course comes with ratings agency action still hovering over the country and borrowing costs remaining elevated. As such, it is likely that further austerity will be put to policymakers over the next couple of weeks as the government focuses in on reducing the debt to GDP level. Unfortunately it is also probable that Q4 GDP will be pretty horrific when it is published in the new year, making the battle even more difficult.

Asian markets have staged a small recovery overnight from their falls yesterday as a result of the death of North Korean dictator and all around fruit loop Kim Jong Il. Worry will still remain in that part of the world as the transition to his son Kim Jong Un could see the state slip closer to isolationism and paranoia.

The pound has seen a boost overnight as well as consumer confidence surveyed by the Nationwide building society rallied to 40 from a survey low of 36 in November. We would suspect that most of this rally has been as a result of the unseasonably warm weather (I’m normally happier when everything is not covered in snow) and the retail therapy that Christmas shopping holds. This has bumped GBP/EUR up to its recent highs and the pound is also stable against the dollar.

European data once again provides the main piece of pie for the markets today with German IFO business confidence and a deterioration in the figure is expected given the interminable annoyance that this debt crisis. The head of the IFO recently suggested that the Eurozone may need to shrink in the long-term and if this sentiment is aped in the wider reading then a fall is all but assured. A really poor figure combined with the recent sterling strength and thin liquidity conditions could be the catalyst for a run at 1.20 in GBP/EUR.

Other than that we have a short-term debt auction from Spain at 09.30 and Italian industrial sales but we forecast little movement given the market’s desire to just be anywhere else but at work!

Good luck.

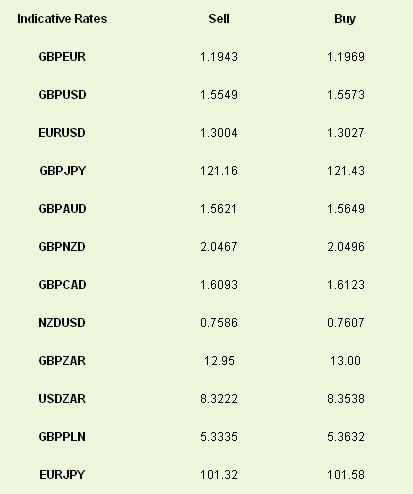

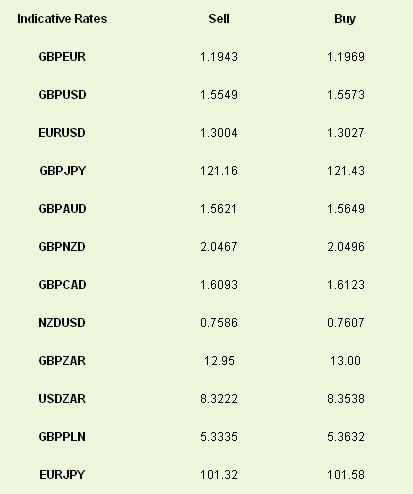

Latest exchange rates at time of writing

We also received a gargantuan speech from the new Spanish PM yesterday that laid out the task in front of him and his Popular Party government. This of course comes with ratings agency action still hovering over the country and borrowing costs remaining elevated. As such, it is likely that further austerity will be put to policymakers over the next couple of weeks as the government focuses in on reducing the debt to GDP level. Unfortunately it is also probable that Q4 GDP will be pretty horrific when it is published in the new year, making the battle even more difficult.

Asian markets have staged a small recovery overnight from their falls yesterday as a result of the death of North Korean dictator and all around fruit loop Kim Jong Il. Worry will still remain in that part of the world as the transition to his son Kim Jong Un could see the state slip closer to isolationism and paranoia.

The pound has seen a boost overnight as well as consumer confidence surveyed by the Nationwide building society rallied to 40 from a survey low of 36 in November. We would suspect that most of this rally has been as a result of the unseasonably warm weather (I’m normally happier when everything is not covered in snow) and the retail therapy that Christmas shopping holds. This has bumped GBP/EUR up to its recent highs and the pound is also stable against the dollar.

European data once again provides the main piece of pie for the markets today with German IFO business confidence and a deterioration in the figure is expected given the interminable annoyance that this debt crisis. The head of the IFO recently suggested that the Eurozone may need to shrink in the long-term and if this sentiment is aped in the wider reading then a fall is all but assured. A really poor figure combined with the recent sterling strength and thin liquidity conditions could be the catalyst for a run at 1.20 in GBP/EUR.

Other than that we have a short-term debt auction from Spain at 09.30 and Italian industrial sales but we forecast little movement given the market’s desire to just be anywhere else but at work!

Good luck.

Latest exchange rates at time of writing