It has been about a month since the last earnings report for Illinois Tool Works Inc. (NYSE:ITW) . Shares have lost about 7.4% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Second-Quarter 2017 Highlights

Illinois Tool Works Inc. reported impressive bottom-line results for second-quarter 2017. Earnings in the quarter came in at $1.69 per share. Excluding benefits of $0.03 from a legal settlement, adjusted earnings were $1.66, surpassing the Zacks Consensus Estimate of $1.63.

Also, the bottom-line of $1.63 topped the year-ago tally of $1.46 by 13.7%. Further, it exceeded the guidance range of $1.55-$1.65. The year-over-year improvement can be attributed to a 3.1% reduction in the company's share count due to its ongoing share buyback activity. Earnings were also boosted by its enterprise initiatives.

Revenues in the quarter totaled $3.599 billion, slightly below the Zacks Consensus Estimate of $3.62 billion. However, the top line grew 4.9% year over year. The improvement was driven by 2.6% positive impact from organic revenue growth and 3.5% gain from the acquired assets of Engineered Fasteners & Components (completed in 2016). However, the positives were partially offset by 1.2% adverse impact from unfavorable foreign currency movements.

Segmental Details: Illinois Tool Works reports its revenues under the segments discussed below:

Test & Measurement and Electronics' revenues increased 2.5% year over year to $519 million. Revenues from Automotive OEM (Original Equipment Manufacturer) grew 22.2% to $820 million. Food Equipment generated revenues of $529 million, dipping 1.4% year over year.

Welding revenues came in at $385 million, growing 2.9% year over year. Construction Products' revenues were up 0.4% to $425 million while revenues of $490 million from Specialty Products reflected growth of 1.1%. Polymers & Fluids' revenues of $437 million declined 1.3% year over year.

Margins: In the quarter, Illinois Tool Works' cost of sales increased 6.1% year over year, representing 58% of total revenue compared with 57.3% in the year-ago quarter. Selling, administrative, and research and development expenses, as a percentage of total revenue, came in at 16.3%.

Operating margin improved 120 bps year over year to 24.3%, driven by roughly 100 bps contributions from enterprise initiatives. Excluding the impact from the Engineered Fasteners and Components business (EF&C) acquisition, operating margin in the quarter was 24.9%.

Balance Sheet & Cash Flow: Exiting the second quarter, Illinois Tool Works had cash and cash equivalents of approximately $2,496 million, slightly above $2,493 million recorded in the previous quarter. The company's long-term debt grew 2.2% sequentially to $7,360 million.

In the quarter, Illinois Tool Works generated net cash of $464 million from its operating activities, down 13.3% year over year. Capital expenditure on purchase of plant and equipment totaled $77 million. Adjusted free cash flow was $502 million, reflecting a conversion rate (as a percentage of net income) of 85%.

Outlook: Impressed with its second-quarter results, Illinois Tool Works increased its earnings guidance to $6.32-$6.52 per share for 2017 from the earlier projection of $6.20-$6.40.

Total revenue is anticipated to come in a $14.1-$14.2 billion range versus the prior projection of $13.9-$14.1 billion. Organic revenue growth is expected to be 2-4% while operating margin is expected to be 24%. Full-year free cash flow is anticipated to be 100% of net income. Effective tax rate will be roughly 29%.

For third-quarter 2017, earnings per share are expected within $1.57-$1.67. Organic revenues are expected to be 1-3%.

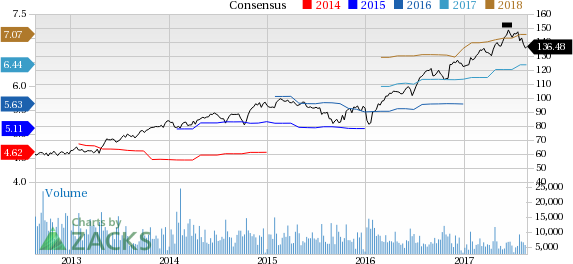

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed an upward trend in fresh estimates. There have been two revisions higher for the current quarter compared to one lower.

VGM Scores

At this time, Illinois Tool's stock has an average Growth Score of C, a grade with the same score on the momentum front. Charting a somewhat similar path, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Zacks' style scores indicate that the company's stock is suitable for growth and momentum investors.

Outlook

While estimates have been broadly trending upward for the stock, the magnitude of these revisions has been net zero. Notably, the stock has a Zacks Rank #3 (Hold). We are expecting an inline return from thestock in the next few months.

Illinois Tool Works Inc. (ITW): Free Stock Analysis Report

Original post

Zacks Investment Research