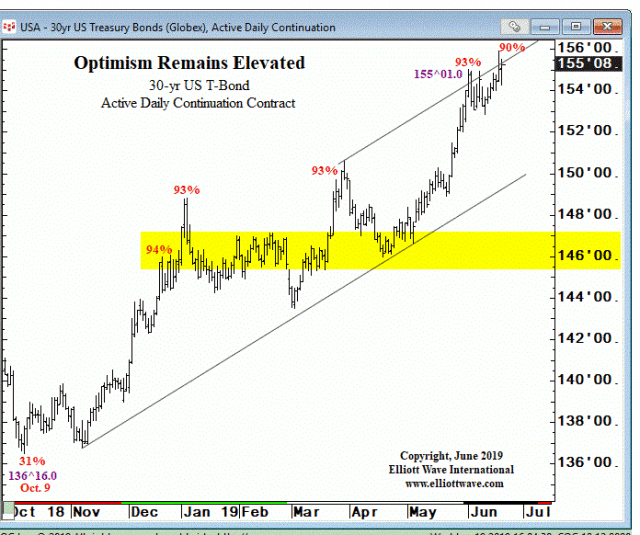

Kindly take a look at this graph from the good folks at Elliott Wave:

I try to keep my mouth shut about the reasons people do what they do in trading. Astrology, Gann analysis, point & figure charts, planetary cycles – whatever floats your boat, it’s none of my business, especially in cases where I know little to nothing about the technique in question.

But I’ve got to say, in my many years of looking at charts, I have never witnessed a situation where sentiment has been helpful. In virtually all cases, when I see the price chart of any financial instrument with its sentiment chart, they are basically mirror images. When the thing goes up in price, people feel good about it. When it goes down, people feel bad about it. Yes, sentiment does get to “extremes” prior to major reversals, but that’s only because the lines move in virtual lockstep.

What struck me about the chart above is this: bond bears have been pointing out the high sentiment reads in bonds as a rationale for shorting bonds for a long time. Most recently, the 90% sentiment reading is offered as evidence that bonds are about to fall to pieces.

Yet this is done…with a straight face...while on the very same chart are a whole host of other 90%+ readings which meant absolutely nothing. Take the one I’ve highlighted for example. The reading was even higher – 94% – and yet, here we are, another ten points higher.

My point is a simple one: in my experience, sentiment has absolutely no predictive value. Zippo. And that’s all I’ve got to say about that.