Tepid trading as China rebalances

Another night of tepid trading. US Q3 earnings season begins in earnest aftermarket with JP Morgan (N:JPM) and Intel (O:INTC). The market is waiting to see if its low expectations come true.

A few stats that have caught my attention around the US earnings seasons over the past few years:

Expectations for Q3 are for EPS to contract by 7.7% and revenue to contract by 6.1%

However, US companies have beaten the combined estimate every quarter for the last 27 reporting quarters

US companies over that period beat EPS estimates 71% of the time and 62% of the time was on the revenue line

My expectation is that these stats will continue in Q3. Yes, the USD will have impacted US earnings with 62% of US companies deriving the majority of their earnings offshore. But a combined 7.7% EPS decline is pessimism bordering on perennial gloom.

China’s OPEX rebalance

China remains a source of market debate, the bears see a hard-landing as inevitable, the bulls continue to see bright spots here and there, and have an unrelenting belief that the PBoC will be the shining white knight riding in with a rate slashing sword to save the day.

Which side is right is still years away from being proven, but it will fall somewhere very much in the middle and that can been seen in the trade balance.

The trade balance yesterday was very much a mixed bag. Exports beat expectations, contracting 3.7% in USD terms versus an expected 6% contraction, yet it is still a contraction. One could argue that the second half of 2014 had a lower base having had a soft first half and was playing catch up this time last year. So, on an adjusted basis, exports are actually growing.

US exports were particularly strong considering this, and EU exports are showing a healthy recovery having declined in the first half of the year.

The issue from numbers is the import side, a decline 20.4% in USD term in September – this will spark further fears of Chinese demand.

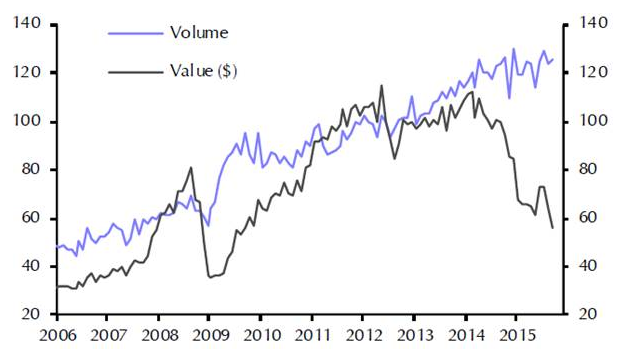

This is where I see things as overplayed, the contraction in imports has being focusing in on industrial commodities which have indeed receded over the past 12 months. However, these falls appear more to be a reaction to falling import prices rather than a collapse in Chinese demand (volumes).

The chart below illustrates this very clearly.

(Source: Capital Economics)

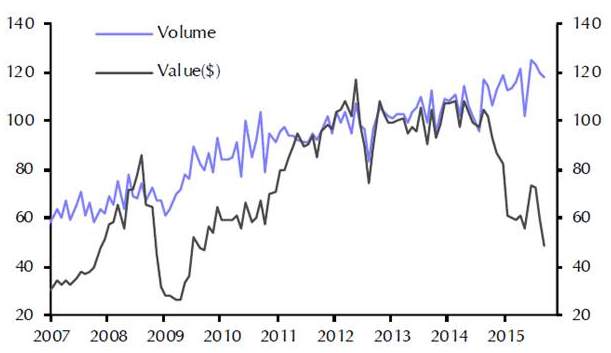

The second part of the import report that is catching my attention is oil imports. It is also seeing a volume versus price disconnect. The market very much believes we are in an oversupplied market and that demand is muted. However, looking at the China numbers, it could be argued that the supply demand ratio is closer to equilibrium rather than skewed to the left.

Oil imports into China

(Source: Capital Economics)

The trade balance does show a possible rebalancing in China from CAPEX commodities such as steel, iron ore and building materials to OPEX commodities (consumption commodities) such as oil, aluminium and soft commodities. This is why the oil trade remains an interesting one in the current environment, from my perspective.

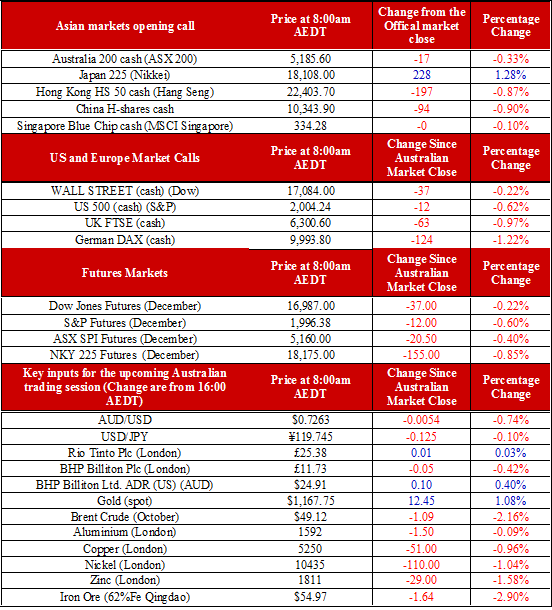

Ahead of the open, we are calling the ASX down 17 points to 5185. China CPI will a major driver of trade. If it does, as forecasted contract quarter-on-quarter, the market’s belief that the PBoC will be back in play will grow even stronger. Positive for cyclicals, but negative initially for the AUD.

IG provides round-the-clock CFD trading on currencies, indices and commodities. The levels quoted in this email are the latest tradeable price for each market. The net change for each market is referenced from the corresponding tradeable level at yesterday’s close of the ASX. These levels are specifically tailored for the Australian trader and take into account the 24hr nature of global markets.