On Thursday the US Dollar traded significantly lower due to disappointing labour market statistics from the US and the remarks from ECB President Draghi, even though he postponed decisions in the monetary policy regarding rates and the future of the quantitative easing in the Euro zone to the meeting next month. The US Dollar lost 0.77 % against a basket of major currencies (US Dollar Index USDX) and is now close to its low from January 2015.

Gold on the other hand continued its rally boosted by the weak Dollar and still unresolved global political issues especially surrounding North Koreas nuclear and missile program. Oil traded mostly unchanged following its significant recovery starting last Thursday, as the oil stockpile figures published by the EIA this Thursday indicated a significant rise in oil stockpiles.

US equity indices traded slightly up, with the exception of the Russell 2000. In Thursday’s trading especially bank stocks were under significant pressure with the US Banks ETF trading down by 2.5%.

The Bitcoin had difficulty with its resistance around the $4,600 mark and did not continue the recovery from Tuesday and Wednesday. Other cryptocurrencies also traded slightly down with Ethereum and Litecoin trading down by around 1% on Thursday.

On Friday we will see the publication of German trade statistics and French industry production statistics. The United Kingdom will release a wealth on fundamental data about their global trade and the manufacturing sector. Canada releases its employment statistics and after the markets and the United states wholesale trade and consumer credit data.

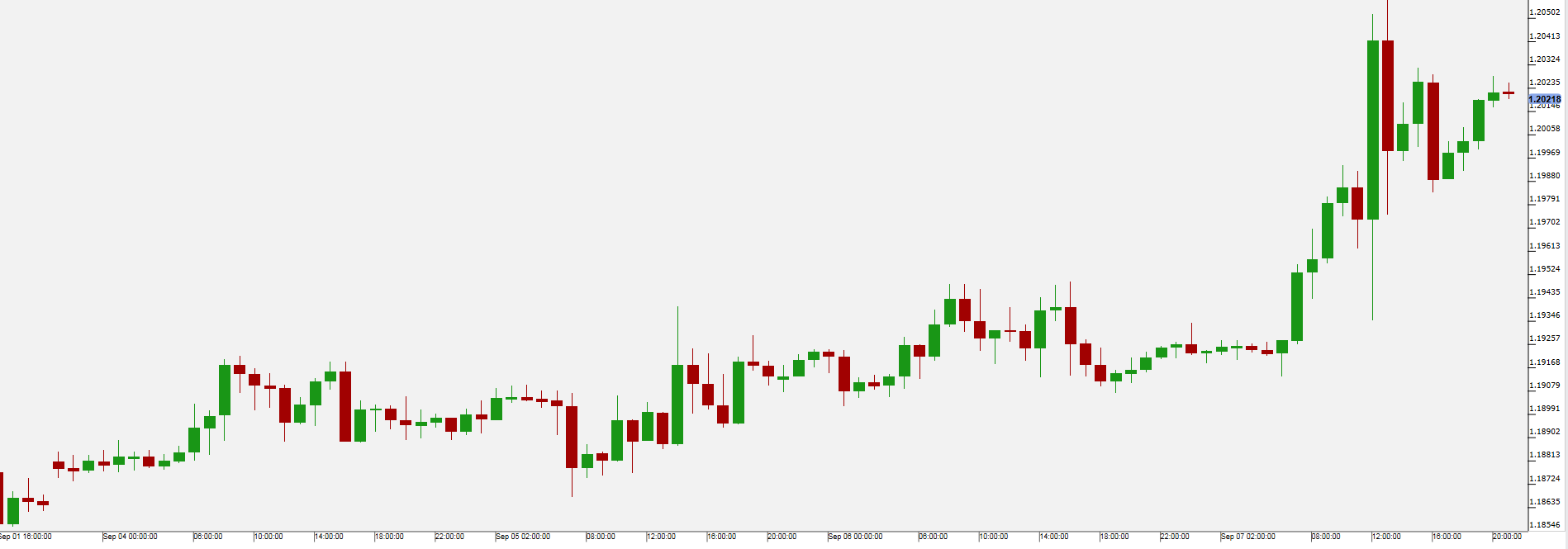

EUR/USDThe Euro gained significant momentum before the ECB’s meeting statement on Thursday hitting the mark of 1.20614, which is only slightly below last week’s high.

However European Central Bank president Mario Draghi’s comments that they would only decide in October about their future position on their quantitative easing policy, led to some losses in the EUR/USD while still remaining bullish.

On Friday we will see the release of the German foreign trade statistics, the French industrial production and US data on consumer credit and wholesale trade.

Pivot: 1.1945

Support: 1.1945 1.191 1.1875

Resistance: 1.207 1.207 1.215

Scenario 1: long positions above 1.1945 with targets at 1.2070 & 1.2100 in extension.

Scenario 2: below 1.1945 look for further downside with 1.1910 & 1.1875 as targets.

Comment: the RSI is supported by a rising trend line.

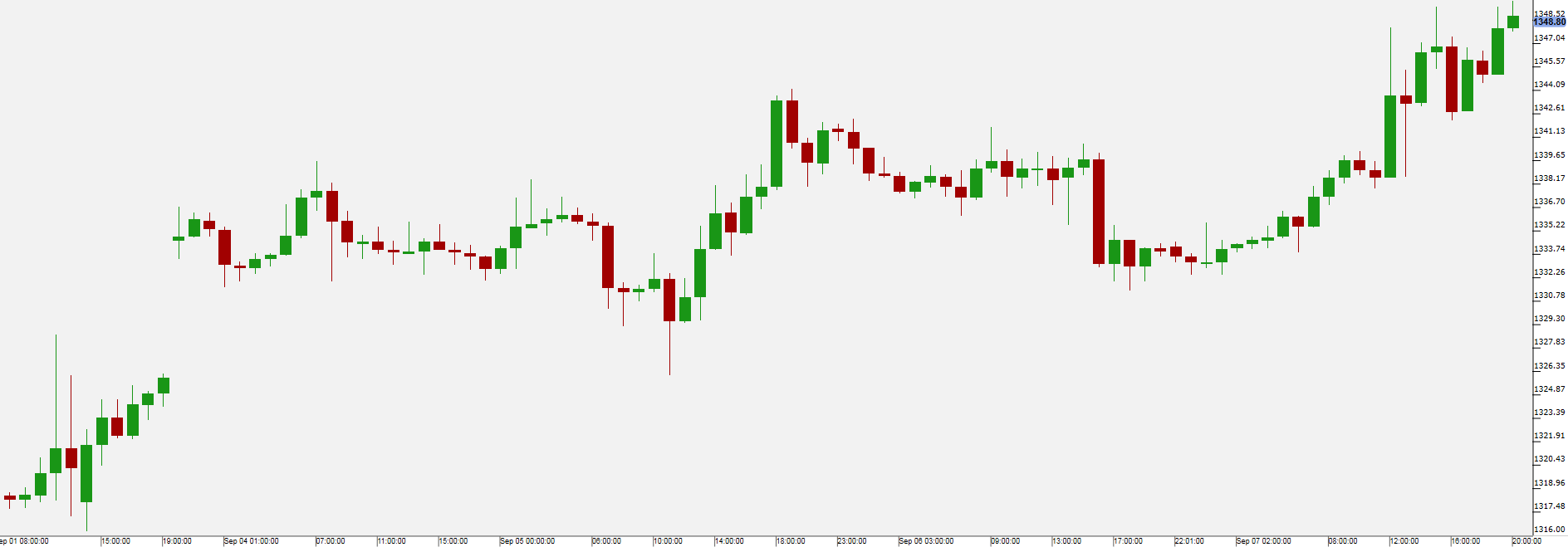

Gold rallied on Thursday amidst a weak US Dollar and hit a new high for 2017. The statement from the ECB that they would review their policy only next month reduced the bullish momentum for a short while and could not stop the rally of the precious metal.

As the worry about the effects of oncoming storm Irma remain and the situation surrounding North Korea’s nuclear problem is still far from resolved gold keeps momentum as a safe haven.

Gold traders will continue watching the level of geopolitical stability and watching out for any extraordinary market data. As China increases its global influence markets are increasingly watching its economic data. China will publish in the Asian trading session on Friday morning its merchandise trade statistic and follow up on that with inflation data early on Saturday.

Pivot: 1337.5

Support: 1337.5 1332.5 1326

Resistance: 1350 1356 1362

Scenario 1: long positions above 1337.50 with targets at 1350.00 & 1356.00 in extension.

Scenario 2: below 1337.50 look for further downside with 1332.50 & 1326.00 as targets.

Comment: the RSI is supported by a bullish trend line.

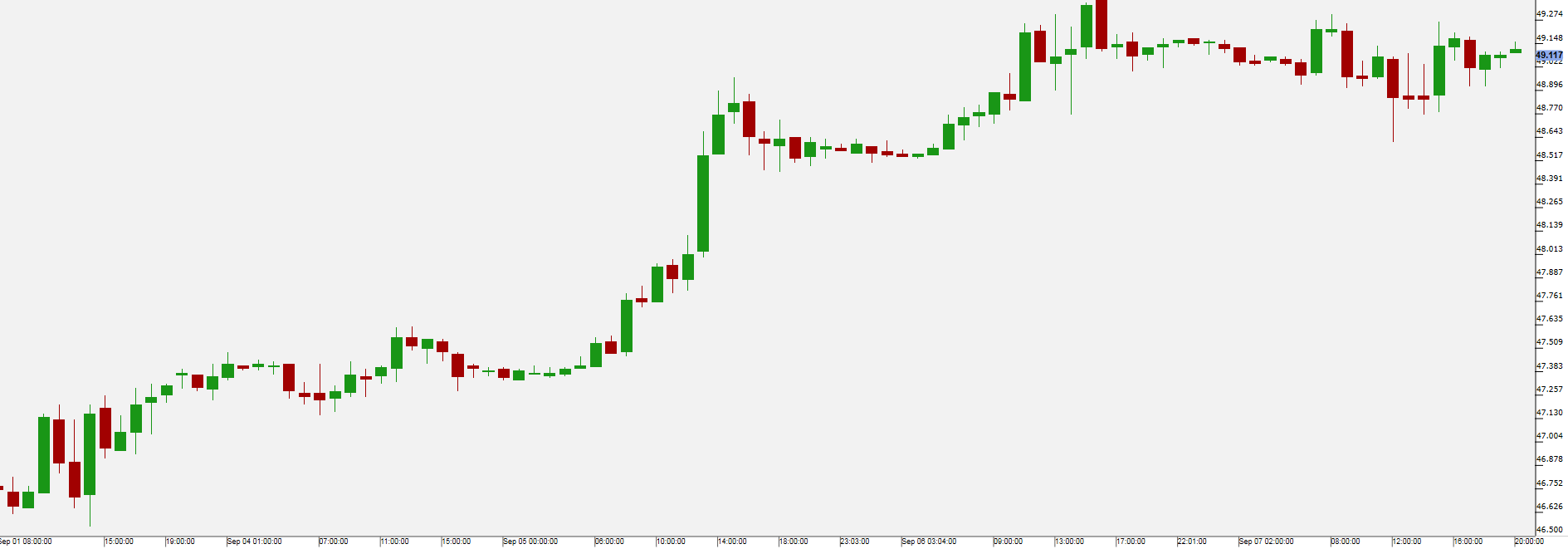

WTI oil settled in a relatively calm trading session almost unchanged on Thursday.

Statistics from the Energy Information Administration (EIA) showed a rise in US oil stockpiles for the first time in over two months. This growth in inventories, attributed at least in part to hurricane Harvey, stopped the recovery of oil on Thursday after its significant recovery starting one week ago.

The Baker Hughes oil rig count for North America, published on Friday, could give further insight in the level of the normalization of the oil sector following hurricane Harvey.

Pivot: 48.5

Support: 48.5 48.2 47.6

Resistance: 49.55 49.9 50.35

Scenario 1: long positions above 48.50 with targets at 49.55 & 49.90 in extension.

Scenario 2: below 48.50 look for further downside with 48.20 & 47.60 as targets.

Comment: the RSI is mixed to bullish.

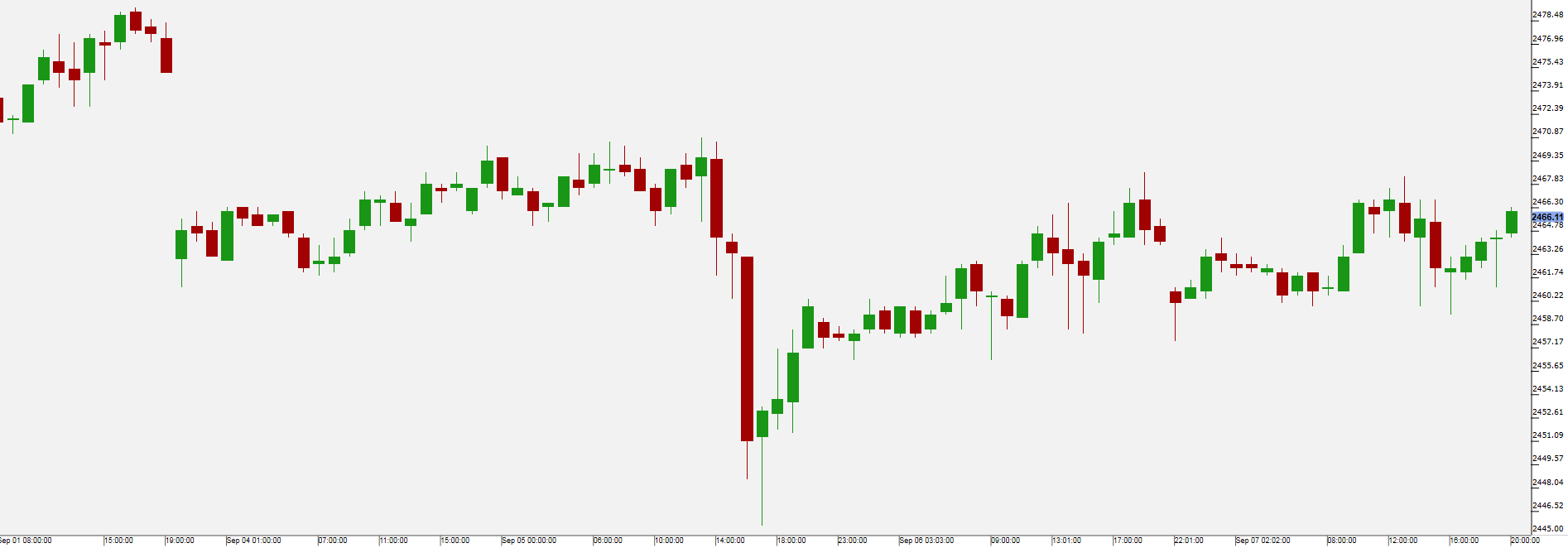

The major US equity indices closed slightly higher on Thursday, with the exception of small losses in the Russel 2000 (US 2000).

Investors were concerned about the effect of storm Irma which will soon hit the US coast in Florida, so that the reconciliatory positions US President Trump showed to the Democrats could not significantly move the market up.

Major losses were recorded again in the banking sector, with the US Banks ETF losing 2.5% of its value on Thursday with major banks like Goldman Sachs (NYSE:GS), Citigroup (NYSE:C) and Bank of American showing significant losses.

Snapchat gained 4.48% in Thursday’s trading being now less than 2 Dollars short its IPO value, as people in Florida increasingly download communications apps to be prepared for storm Irma.

Wholesale trade data will be released shortly after the beginning of the North American trading session on Friday with consumer credit data following at the end of the trading session.

Pivot: 2455

Support: 2455 2450 2444

Resistance: 2467 2472 2477

Scenario 1: long positions above 2455.00 with targets at 2467.00 & 2472.00 in extension.

Scenario 2: below 2455.00 look for further downside with 2450.00 & 2444.00 as targets.

Comment: the RSI is mixed to bullish.