The US Dollar traded lower on Tuesday with the US Dollar Index (USDX) being down by 0.35% which measures the strength of the Dollar against other major currencies. The tensions surrounding North Koreas nuclear program and the Trump’s administration stance on the situation pressured the dollar.

Gold reached a new year-to-date high as a safe haven amidst geopolitical turmoil and skepticism in the US about another rate hike by the Federal Reserve within 2017.

Oil made a sharp recovery of last week’s losses and the ongoing recovery of the oil and refinery operations in the gulf, while fear remains that the new hurricane Irma could again affect this area soon.

US equity indices fell across the board on Tuesday as a result of the geopolitical situation on the Korean peninsula with investors also being concerned about Trump’s trade war statements towards China.

Bitcoin and most other cryptocurrencies made a modest recovery after high losses on Monday as the People’s Bank of China curbed ICO (Initial Coin Offerings) within its jurisdiction. It remains to be seen how cryptocoin market participants will see this restriction in the longer term.

On Wednesday we will first see the publication of GDP data from Australia. In the European trading session Germany will release its manufacturers' orders data and Italy its retail sales statistics. In the North American trading session Canada will release its trade statistics (import/export) with the US also releasing its trade balance figures. Bank of Canada is set to announce its interest rate decision later that day.

In Thursday’s Asian trading session China will release its current merchandise trade statistics.

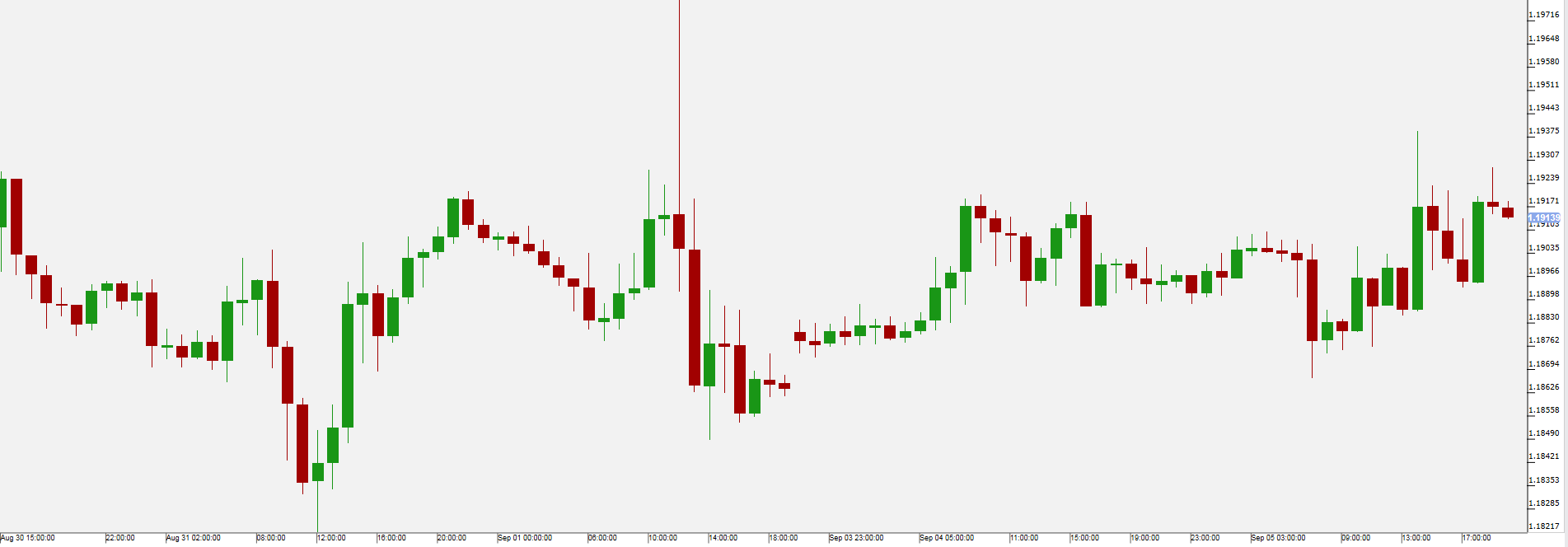

EUR/USDThe EUR/USD [i] traded higher on Tuesday as the tensions with North Korea weighted on the Dollar.

Investors are increasingly focused on the position of central banks regarding interest rate hikes, with Fed Governor Lael Brainard mentioning that there should be caution increasing rates as long as inflation is in its current subdued state.

The ECB will decide about the future of the Euro-zone interest rate on Thursday, while the US Fed will only hold its meeting on the 20th September. The US trade balance statistic, published by the Department of Commerce on Wednesday could give further insight in the state of the US economy and influence exchange rates.

Pivot: 1.1865

Support: 1.1865 1.185 1.182

Resistance: 1.194 1.198 1.2025

Scenario 1: long positions above 1.1865 with targets at 1.1940 & 1.1980 in extension.

Scenario 2: below 1.1865 look for further downside with 1.1850 & 1.1820 as targets.

Comment: the RSI broke above a declining trend line.

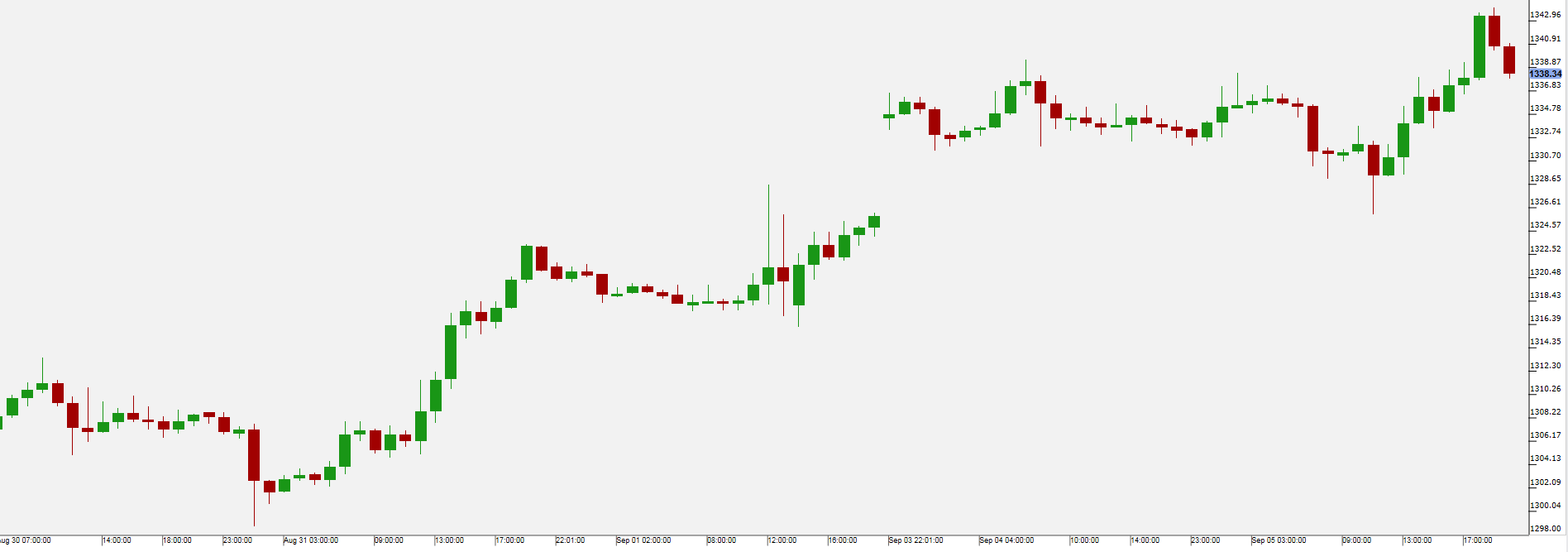

Gold [i] rose again on Tuesday hitting the highest value this year so far and hitting for the fourth day in a row a new high this year so far.

Gold traded up amidst geopolitical tensions surrounding North Korea and the falling expectations that there would be another hike to the US central bank rate this year.

Besides the development on the North Korean peninsula, the US trade balance statistics published on Wednesday as well as the ECB rate decision on Thursday could further influence the demand for the safe haven.

Pivot: 1332

Support: 1332 1326 1322

Resistance: 1345 1350 1355

Scenario 1: long positions above 1332.00 with targets at 1345.00 & 1350.00 in extension.

Scenario 2: below 1332.00 look for further downside with 1326.00 & 1322.00 as targets.

Comment: the RSI advocates for further upside.

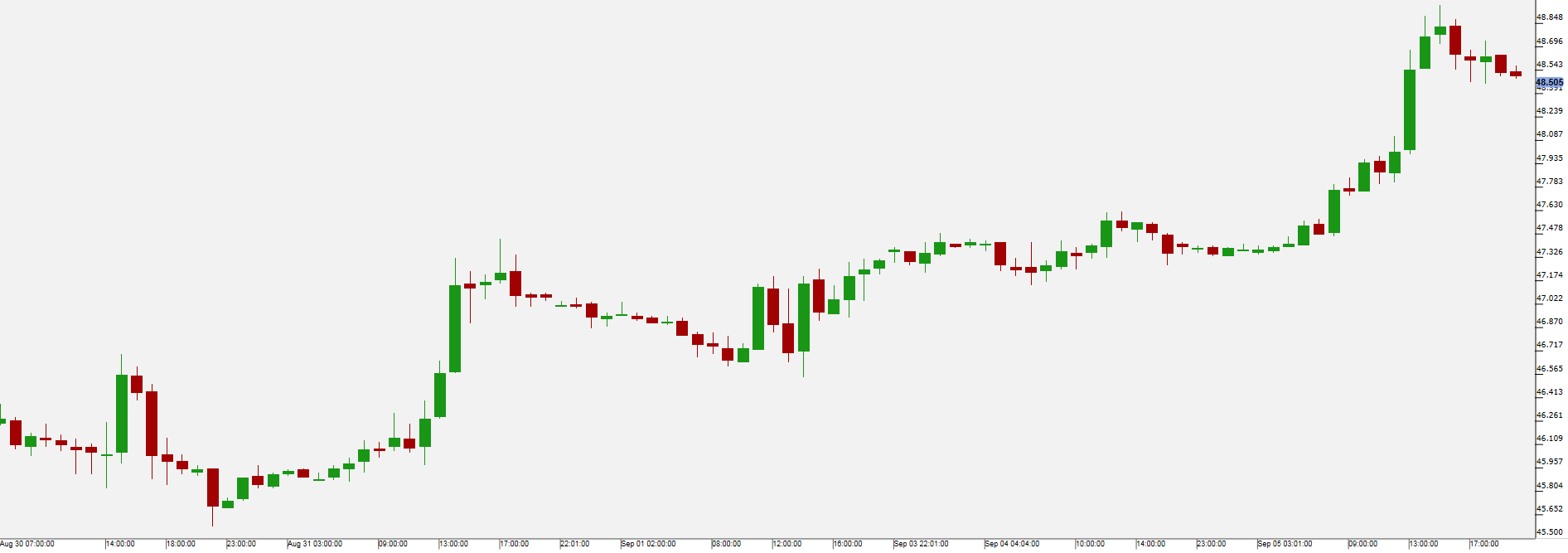

WTI oil [i] traded significantly up on Tuesday as refineries previously affected by hurricane Harvey resumed their operation. Some analysts predict that by now only around 2 million barrel per day refinery capacity is still offline, which is already an improvement from the figures during the storm.

Oil traded up for the fourth day in a row as refineries and pipelines in Texas and Louisiana resumed their operations.

The EIA oil, gasoline and distillate stockpile statistics published by the EIA on Thursday will give further information how the market is processing the aftermath of the storm. Meanwhile another hurricane – Irma – increased in intensity and forecasters suggest that it could move further west and possibly also affect oil and gas production in the gulf.

Pivot: 47.95

Support: 47.95 47.6 47.2

Resistance: 49.23 49.53 49.9

Scenario 1: long positions above 47.95 with targets at 49.23 & 49.53 in extension.

Scenario 2: below 47.95 look for further downside with 47.60 & 47.20 as targets.

Comment: the RSI broke above a bearish trend line.

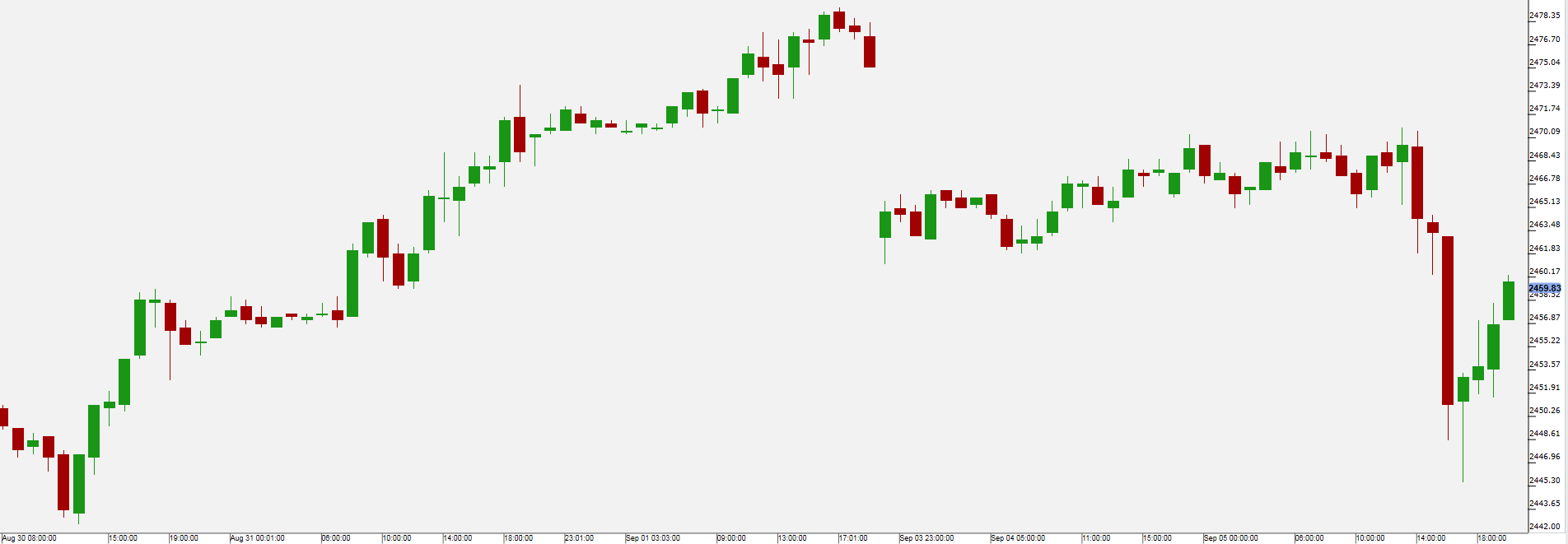

The stock market in the US [i] reopened on Tuesday from the Labour Day weekend and initially suffered heavy losses due to the geopolitical instability brought by the conflict surrounding North Koreas nuclear and missile program.

The biggest losers of the day were bank stocks with the US Banks ETF down by 3.05% with Goldman Sachs (NYSE:GS) losing 3.65% and Bank of American falling by 3.4% amidst an uncertain market sentiment and global political situation.

Among the winners of Tuesday’s trading were on top energy companies with the US Energy ETF (NYSE:XLE) being up by 0.60% as oil production resumes after hurricane Harvey.

On Wednesday the MBA (Mortgage Bankers' Association) indices will be published giving some insight in the current state of the housing market. Later we will see trade balance figures and the ISM Non-Manufacturing Index published.

Pivot: 2460

Support: 2443 2436 2427

Resistance: 2460 2471 2480

Scenario 1: short positions below 2460.00 with targets at 2443.00 & 2436.00 in extension.

Scenario 2: above 2460.00 look for further upside with 2471.00 & 2480.00 as targets.

Comment: the RSI is bearish and calls for further downside.