The US Dollar traded lower against a basket of other major currencies on Wednesday with the US Dollar Index (USDX) closing 0.18% lower as the consumer confidence and pending home sales numbers in the US did not match their expectations. The South African Rand (ZAR) continued its recovery and traded almost 2% stronger against the US Dollar on Wednesday supported by positive sentiment of the election of C. Ramaphosa as leader of the ANC ahead of the presidential elections as well as by higher metal prices. Within just one month the USD/ZAR pair fell by over 10%.

Oil retraced slightly from its 2.5 year high as the Forties pipeline at the United Kingdom in the North Sea restarted its operation. Gold continued to rise supported by a weaker US Dollar and lower US Treasury yields.

US equity indices closed mostly lower as fundamental economic data (consumer confidence / home sales) were below expectations. Bank stocks were the weakest in this trading session, while energy and utilities stocks closed higher.

Most cryptocurrencies traded lower Wednesday after their recovery of the two previous days. Bitcoin retraced from its recent high close to $16,500 and traded only at around $15,000. Other cryptocurrencies such as Litecoin and Ethereum suffered similar single digit percentage losses. The notable exception was Ripple, which rallied to a new all-time high as a consortium of Japanese payment cards will integrate Ripple’s blockchain technology in its payment system.

On Thursday in the United Kingdom the Nationwide Housing Price Index (HPI) will be released. Russia publishes manufacturing PMI and GDP numbers. In the US new jobless claims numbers, M2 monetary supply and the Federal Reserve Bank credit and total asset statistic will be published in the US.

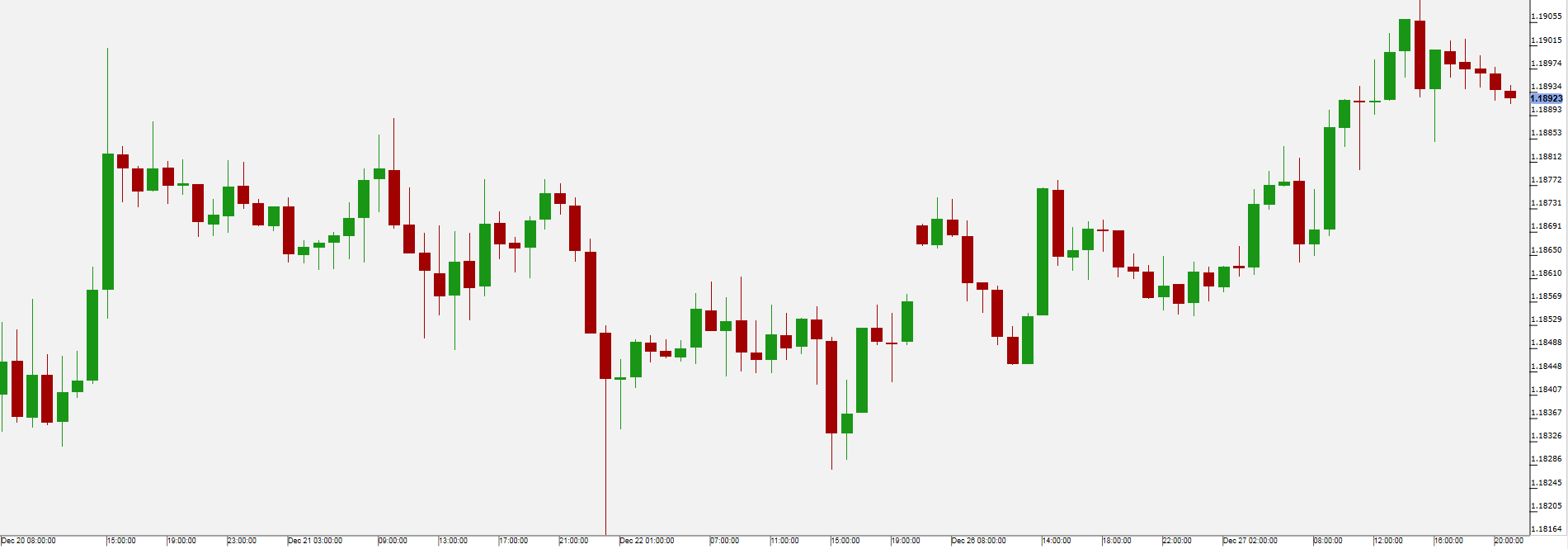

The Euro traded stronger against the Dollar on Wednesday as the Dollar remained under pressure by consumer confidence and pending home sales numbers being actually below market expectations. While markets were initially bullish on the tax reform being passed, some concerns are yet to be fully understood and could possibly for some time weigh down on the Dollar.

On Thursday new jobless claims numbers, M2 monetary supply and the Federal Reserve Bank credit and total asset statistic will be published in the US.

Pivot: 1.1875

Support: 1.1875 1.186 1.1845

Resistance: 1.192 1.1935 1.196

Scenario 1: long positions above 1.1875 with targets at 1.1920 & 1.1935 in extension.

Scenario 2: below 1.1875 look for further downside with 1.1860 & 1.1845 as targets.

Comment: the RSI shows upside momentum.

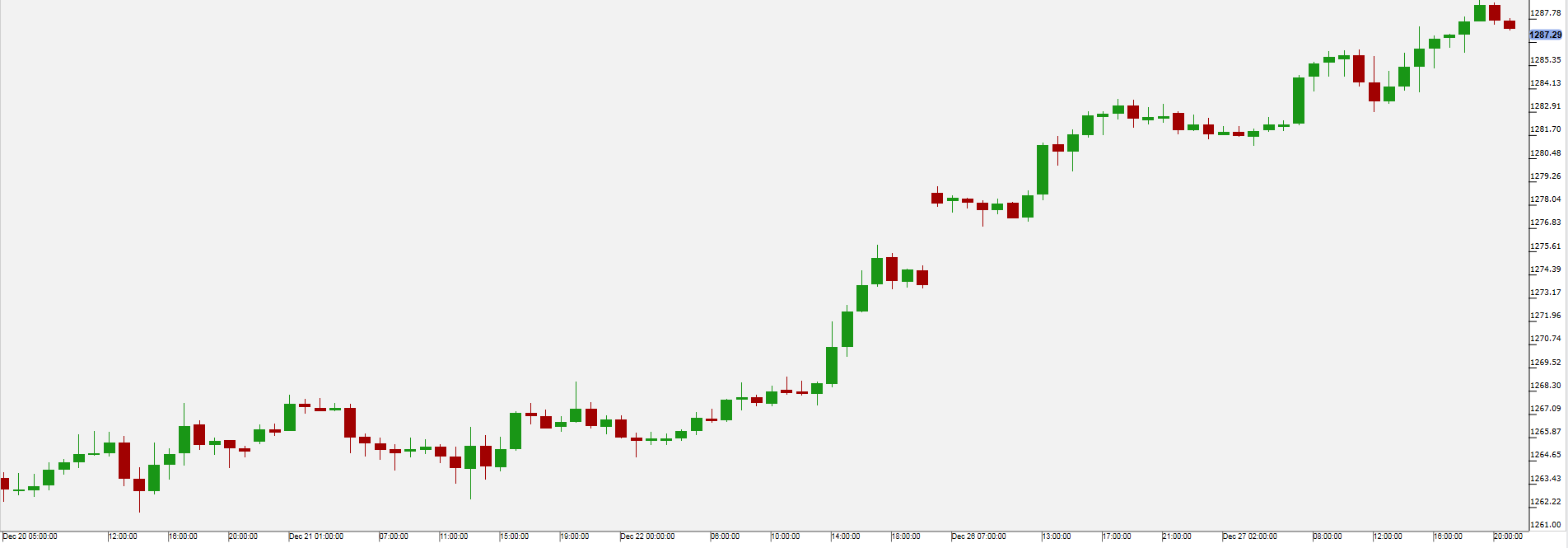

Gold

Gold continued its upwards trend on Wednesday, closing higher for the seventh consecutive trading day in a row. Gold is supported by the weaker US Dollar as well as lower US Treasury yields. Weaker home sales and consumer confidence numbers on Wednesday further pushed the precious metal higher. On Thursday in the US jobless claims will be announced and on Friday the result from the Chicago PMI Business Barometer.

Pivot: 1281

Support: 1281 1276.5 1273

Resistance: 1290 1295 1300

Scenario 1: long positions above 1281.00 with targets at 1290.00 & 1295.00 in extension.

Scenario 2: below 1281.00 look for further downside with 1276.50 & 1273.00 as targets.

Comment: the RSI is mixed to bullish.

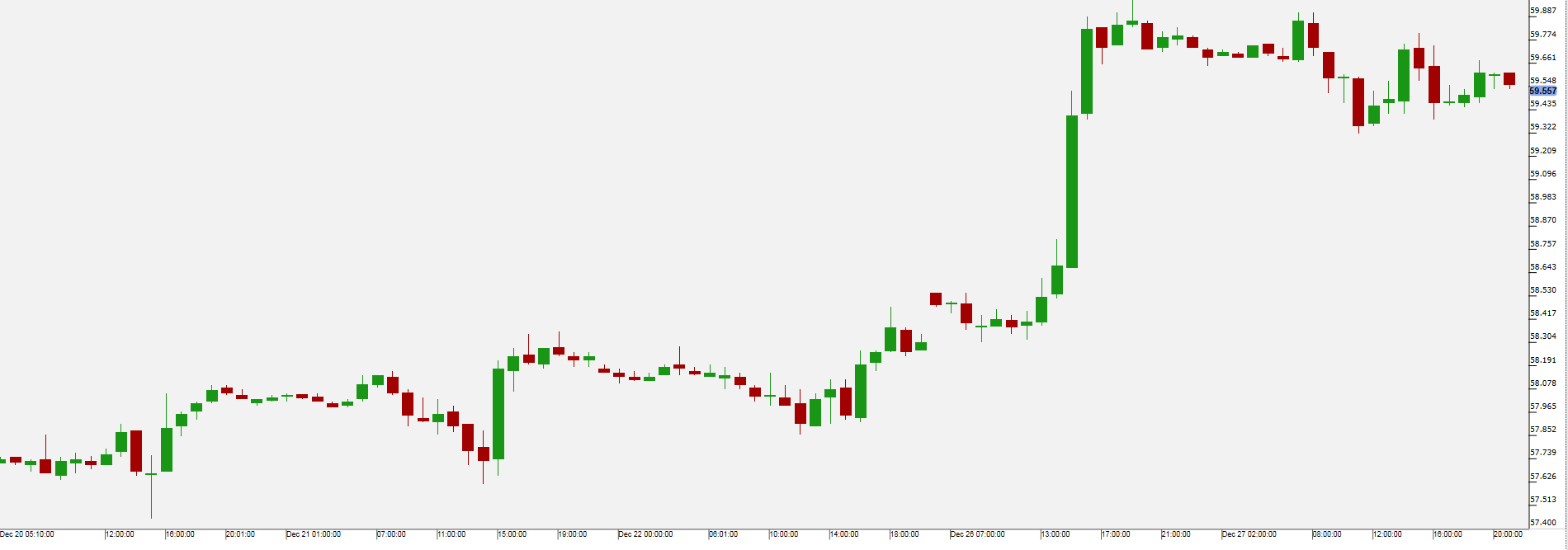

WTI Oil

Oil fell slightly from its 2.5 years high as the ‘Forties’ pipeline in the North Sea, which carries a major part of the United Kingdom’s oil supply restarted its operation after a week-long outage. The stockpiles of crude oil in the United States according to the American Petroleum Institute (API) fell for the fourth week in a row, now by 6 million barrels (previous -5.2 million barrels). The market initially did not show any significant reaction to these numbers. On Thursday the Energy Information Administration (EIA) will release its oil stockpile data.

Pivot: 59.15

Support: 59.15 58.65 58.3

Resistance: 60 60.5 61

Scenario 1: long positions above 59.15 with targets at 60.00 & 60.50 in extension.

Scenario 2: below 59.15 look for further downside with 58.65 & 58.30 as targets.

Comment: the RSI is mixed to bullish.

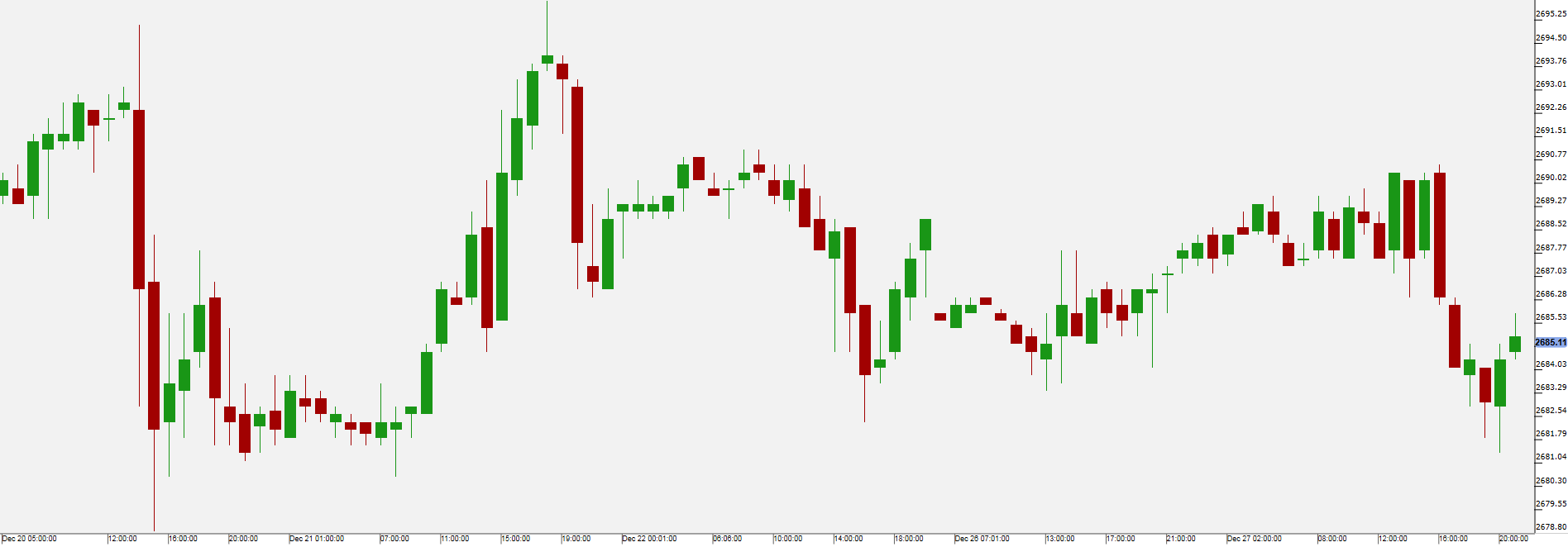

US 500

US equity indices traded lower on Wednesday as the consumer confidence was at a level of only 122.1 (previously 129.5 / expected 128.0) and pending home sales were compared to the previous month only 0.2% up (previously +3.5% / expected +0.5%). Best performing stocks were in the utilities (US Utilities ETF +0.40%) and real estate (US Real Estate ETF +0.37%) sector, while the worst performers were bank (US Banks ETF -0.5%) and energy (US Energy ETF (NYSE:XLE) -0.37%) stocks.

Tesla (NASDAQ:TSLA) stocks traded 1.82% lower as an analyst predicted lower deliveries and margin of the new Model 3, which was plagued by delivery issues before.

On Thursday new jobless claims statistics as well as data from the Federal Reserve will be released. On Friday Chicago PMI Business Barometer numbers will be published.

Pivot: 2687.75

Support: 2680 2674.25 2668

Resistance: 2687.75 2691 2696

Scenario 1: short positions below 2687.75 with targets at 2680.00 & 2674.25 in extension.

Scenario 2: above 2687.75 look for further upside with 2691.00 & 2696.00 as targets.

Comment: the RSI broke below a rising trend line.