On Monday the U.S. dollar fell below its 16-month low against other major currencies. Tropical storm Harvey that hit the south-east of the United States hard as well as the disappointing speech by FED chair Yellen on Friday contributed to the pressure on the greenback.

U.S. equity indices showed a mixed picture on Monday with energy and financial stocks down and with significant gains from biotech stocks.

Gold rallied to its highest level since December last year and passed the $1,300 barrier with ease early in the North American trading session. On the other hand oil had significant losses as traders expect that the lack of refinery capacity in the storm-affected area of the U.S. will drive up oil inventories, which the EIA will publish on Wednesday.

Bitcoin experienced some losses on Monday which it could mostly recover. The major cryptocurrency is still can’t breach its resistance level of around $4,500. Litecoin hit a record high on Monday, while Ripple was up after falling since last Wednesday.

On Tuesday Germany will publish consumer sentiment data, while France publishes statistics about its GDP and manufactured goods consumption which will give the first insight in the economic impact of Emmanuel Macron's government. From the U.S. we expect the publication of the S&P/Case-Shiller House Price Index and consumer confidence statistics.

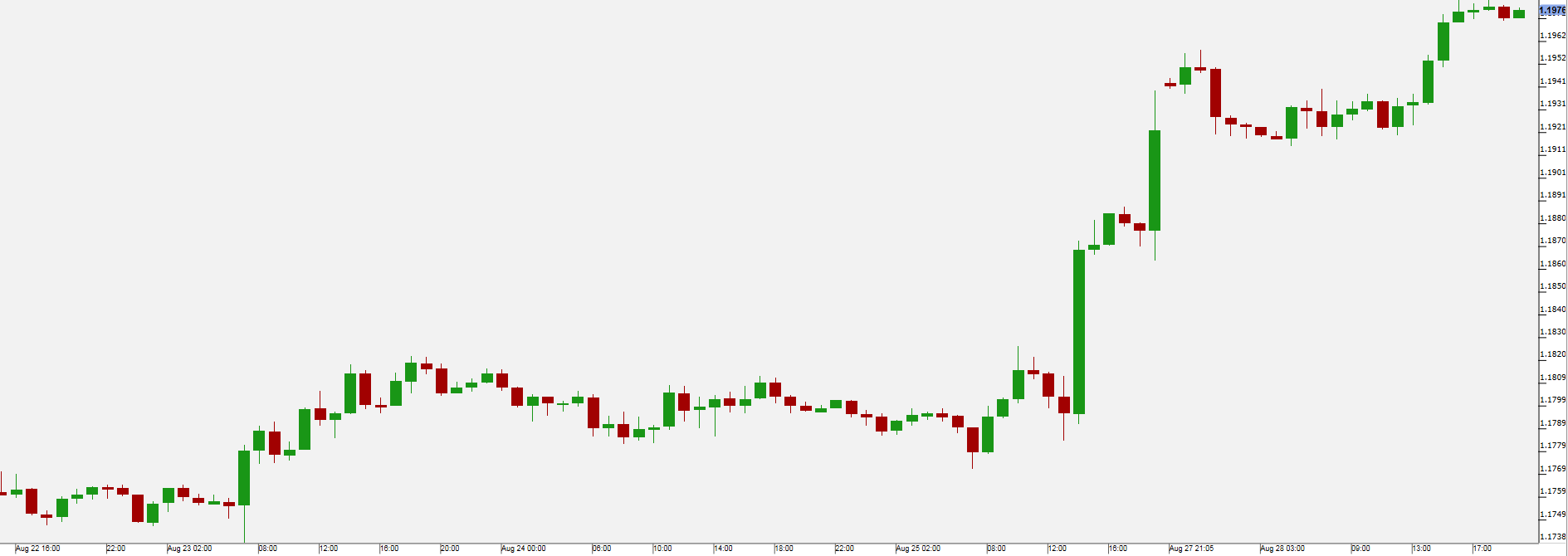

EUR/USDThe EUR/USD [i] rose further on Monday amid a disappointing speech by U.S. Federal reserve chair Yellen and a positive attitude to the Euro-Zone economy by ECB president Draghi at the same time.

EUR/USD reached a high of 1.1985 for the first time since January 2015. The EUR/USD had its low before in July 2012 at 1.2043. The U.S. Dollar Index USDX fell also to a new low this year.

On Tuesday EUR/USD traders will be looking at consumer sentiment data from Germany and GDP data from France. In the North American trading session data on the U.S. consumer sentiment and house prices will be released.

Pivot: 1.1915

Support: 1.1915 1.1865 1.183

Resistance: 1.2 1.204 1.211

Scenario 1: long positions above 1.1915 with targets at 1.2000 & 1.2040 in extension.

Scenario 2: below 1.1915 look for further downside with 1.1865 & 1.1830 as targets.

Comment: the RSI advocates for further upside.

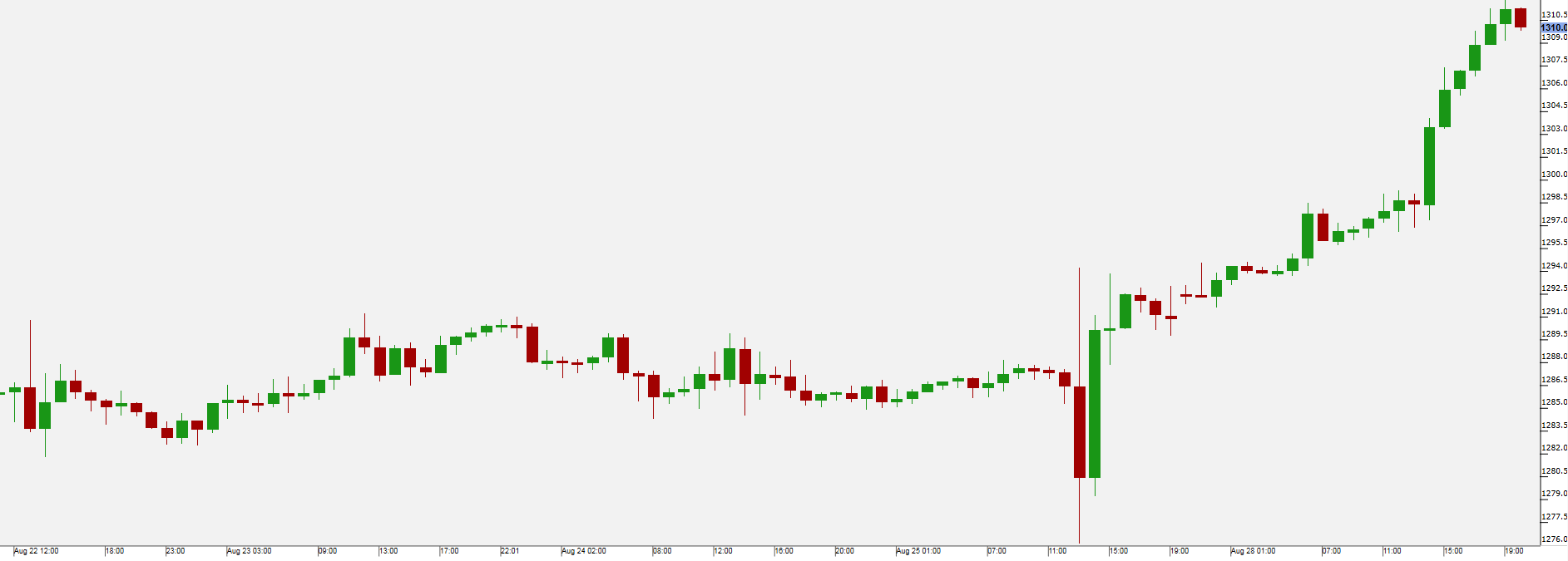

Janet Yellen’s speech on Friday was understood by traders as a signal that there would be no more rate hikes this year which in turn pushed Gold [i] finally above $1,300 on Monday. The fall of the U.S. dollar to a new low on Monday also contributed to the Gold rally as Gold become comparably cheaper in other currencies than the U.S. dollar.

Market participants also received no calming words from the Trump administration as fears of a possible government shutdown still worry investors.

Market participants will continue watching for news from the White House and the impact of tropical storm Harvey as to gauge what the destabilizing effects will be. U.S. inflation data published on Thursday and the Nonfarm Payrolls (NFP) on Friday could also show more details about the state of the economy and move the markets.

Pivot: 1297

Support: 1297 1293 1288

Resistance: 1315 1319 1324

Scenario 1: long positions above 1297.00 with targets at 1315.00 & 1319.00 in extension.

Scenario 2: below 1297.00 look for further downside with 1293.00 & 1288.00 as targets.

Comment: the RSI is bullish and calls for further upside. Prices broke above a bullish channel.

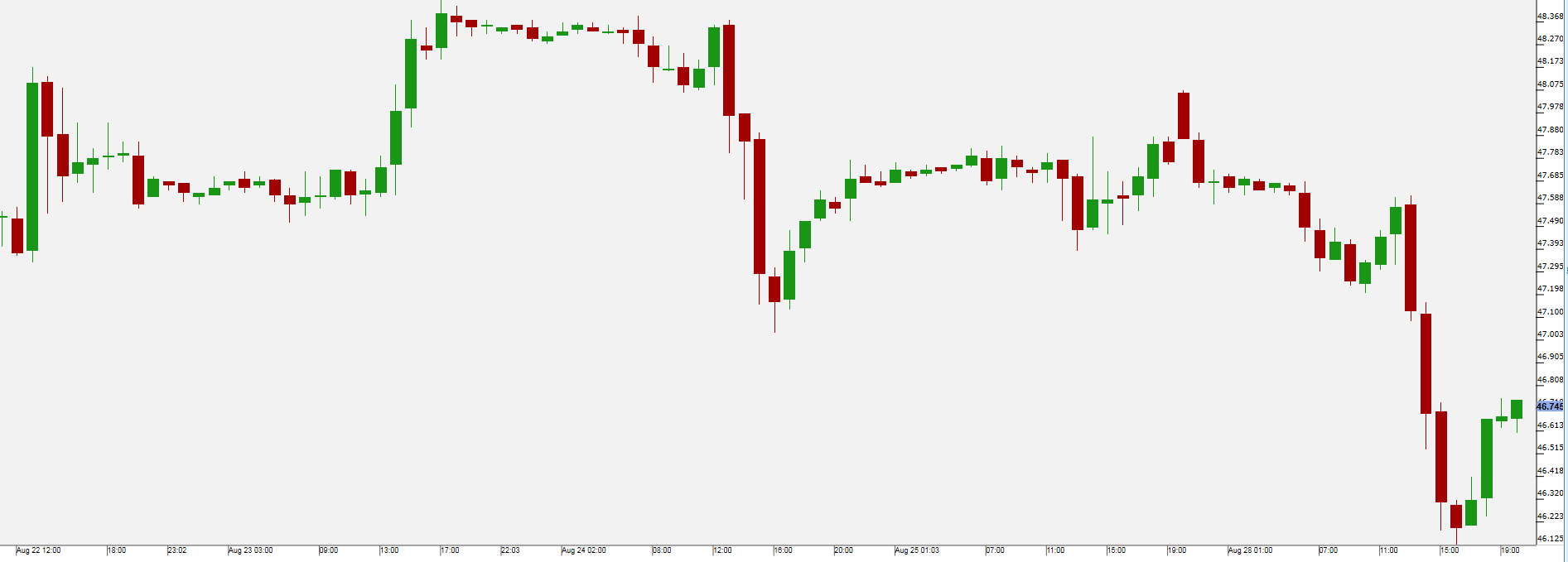

Oil [i] settled lower on Monday as activities of refineries in the south-east of the U.S. are still disrupted by the effects of tropical storm Harvey. There are fears that the lack of oil processing capacity will lead to greater supplies and inventories of crude oil.

The U.S. Bureau of Safety and Environmental Enforcement estimated that the production of oil in the Gulf of Mexico is down by about 19% but this is still not enough to make up for the lack of refinery capacities.

Storm Harvey could continue having an effect on oil prices this week. Energy Information Administration (EIA) inventory data published on Friday will give a first look into what the actual impact on the inventories will be.

Pivot: 47.2

Support: 46.05 45.7 45.35

Resistance: 47.2 47.5 47.8

Scenario 1: short positions below 47.20 with targets at 46.05 & 45.70 in extension.

Scenario 2: above 47.20 look for further upside with 47.50 & 47.80 as targets.

Comment: the RSI is mixed to bearish.

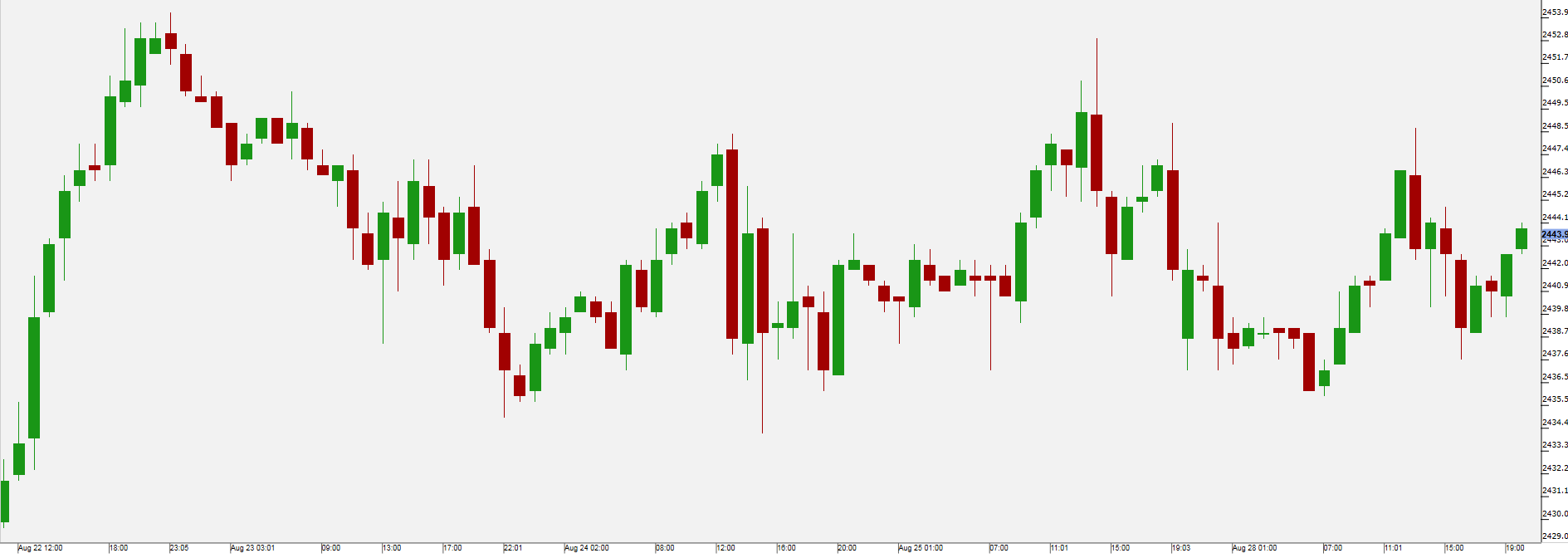

U.S. equity indices [i] closed on Monday mostly slightly higher with the exception of the Dow (US 30) which was down by 0.05%. Traders were mostly concerned by the impact of the tropical storm Harvey which negatively impacted companies in the energy sector while financial companies still felt the effect of the speech from FED’s chairwoman Janet Yellen on Friday which did not satisfy the traders’ expectations.

Biotech companies were the biggest winners of the day with the US Biotech ETF being up by 1.92%. Among them Abbott Laboratories (NYSE:NYSE:ABT) was one of the winners of the day following the FDA’s approval for one of its new heart pump systems.

U.S. equity trader will look forward to the publication of the S&P/Case-Shiller House Price Index and consumer confidence data.

Pivot: 2436

Support: 2436 2429 2422

Resistance: 2451 2455 2462

Scenario 1: long positions above 2436.00 with targets at 2451.00 & 2455.00 in extension.

Scenario 2: below 2436.00 look for further downside with 2429.00 & 2422.00 as targets.

Comment: the RSI is mixed to bullish.