Much like the situation in China, the debate surrounding the German economy through the past year has been not whether it can be unaffected by the chaos that surrounds it, but whether it would be able to engineer a “soft” or “hard” landing. In the past 6 months data has started to show that the former was more likely, but yesterday’s IFO release has caused the naysayers to drift back to the front of the pack.

Following last week’s better than expected ZEW figure we, and a good deal of the market, forecast that the IFO index would also show some optimism. Not so, and in fact it fell to its lowest level in 2.5 years. The falls in the business climate component and the expectations index in particular, point now to at least one quarter of negative growth in Germany, if not two and the subsequent recession that would follow.

For those who read the sterling update yesterday “Manufacturing Bonded to the European Future” it will come as no surprise that the manufacturing sector was the major laggard. The IFO report itself summarises the mood well in the following sentences “Expectations concerning the six-month business outlook remained clearly negative and dropped for the fifth month in succession. In terms of the outlook for exports, last month’s slightly negative trend continued.”

The euro crashed lower on the announcement and is eating away considerably at the gains it made post the ECB and Fed’s most recent decisions. GBP/EUR has come nicely above the 1.25 level following the move lower in EUR/USD. Yields on UK government debt have also come back from recent highs as safe-havening into GBP assets has continued despite the relative increase in optimism surrounding the entire European question.

We are still wary of GBP through the end of the year and believe that political issues may rain on its parade somewhat. At the moment however it is showing a good bit of resilience on all crosses.

Mid October is looking like hotting up as a potential week or two of volatility and general nerves. We already have the scheduled troika report from Greece, although this could be delayed into November. Add into that Spanish regional elections, the latest IMF/World Bank meetings in Tokyo during which growth expectations are going to be cut and the lead-up to preliminary GDP releases for Q3 globally, and you can see why we’re worried.

Nothing as exciting today however although the latest consumer confidence numbers from the States should show some move higher from the Fed’s decision to go with QE-infinity as people are calling it.

Merkel and Draghi are meeting in Berlin today and any joint statement or comments to the press will be closely monitored for any change in language.

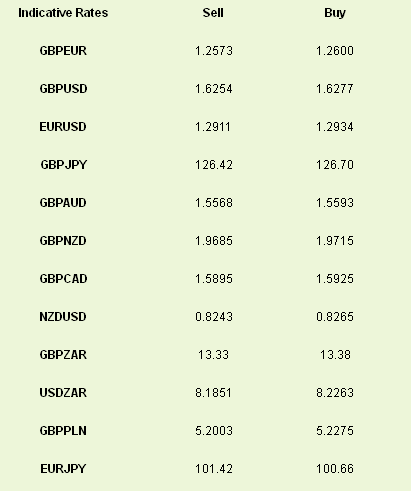

Latest exchange rates at time of writing:

Following last week’s better than expected ZEW figure we, and a good deal of the market, forecast that the IFO index would also show some optimism. Not so, and in fact it fell to its lowest level in 2.5 years. The falls in the business climate component and the expectations index in particular, point now to at least one quarter of negative growth in Germany, if not two and the subsequent recession that would follow.

For those who read the sterling update yesterday “Manufacturing Bonded to the European Future” it will come as no surprise that the manufacturing sector was the major laggard. The IFO report itself summarises the mood well in the following sentences “Expectations concerning the six-month business outlook remained clearly negative and dropped for the fifth month in succession. In terms of the outlook for exports, last month’s slightly negative trend continued.”

The euro crashed lower on the announcement and is eating away considerably at the gains it made post the ECB and Fed’s most recent decisions. GBP/EUR has come nicely above the 1.25 level following the move lower in EUR/USD. Yields on UK government debt have also come back from recent highs as safe-havening into GBP assets has continued despite the relative increase in optimism surrounding the entire European question.

We are still wary of GBP through the end of the year and believe that political issues may rain on its parade somewhat. At the moment however it is showing a good bit of resilience on all crosses.

Mid October is looking like hotting up as a potential week or two of volatility and general nerves. We already have the scheduled troika report from Greece, although this could be delayed into November. Add into that Spanish regional elections, the latest IMF/World Bank meetings in Tokyo during which growth expectations are going to be cut and the lead-up to preliminary GDP releases for Q3 globally, and you can see why we’re worried.

Nothing as exciting today however although the latest consumer confidence numbers from the States should show some move higher from the Fed’s decision to go with QE-infinity as people are calling it.

Merkel and Draghi are meeting in Berlin today and any joint statement or comments to the press will be closely monitored for any change in language.

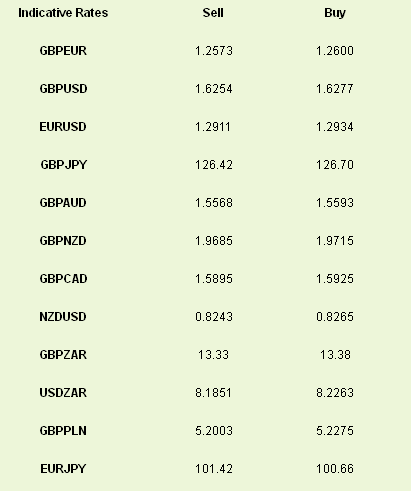

Latest exchange rates at time of writing: