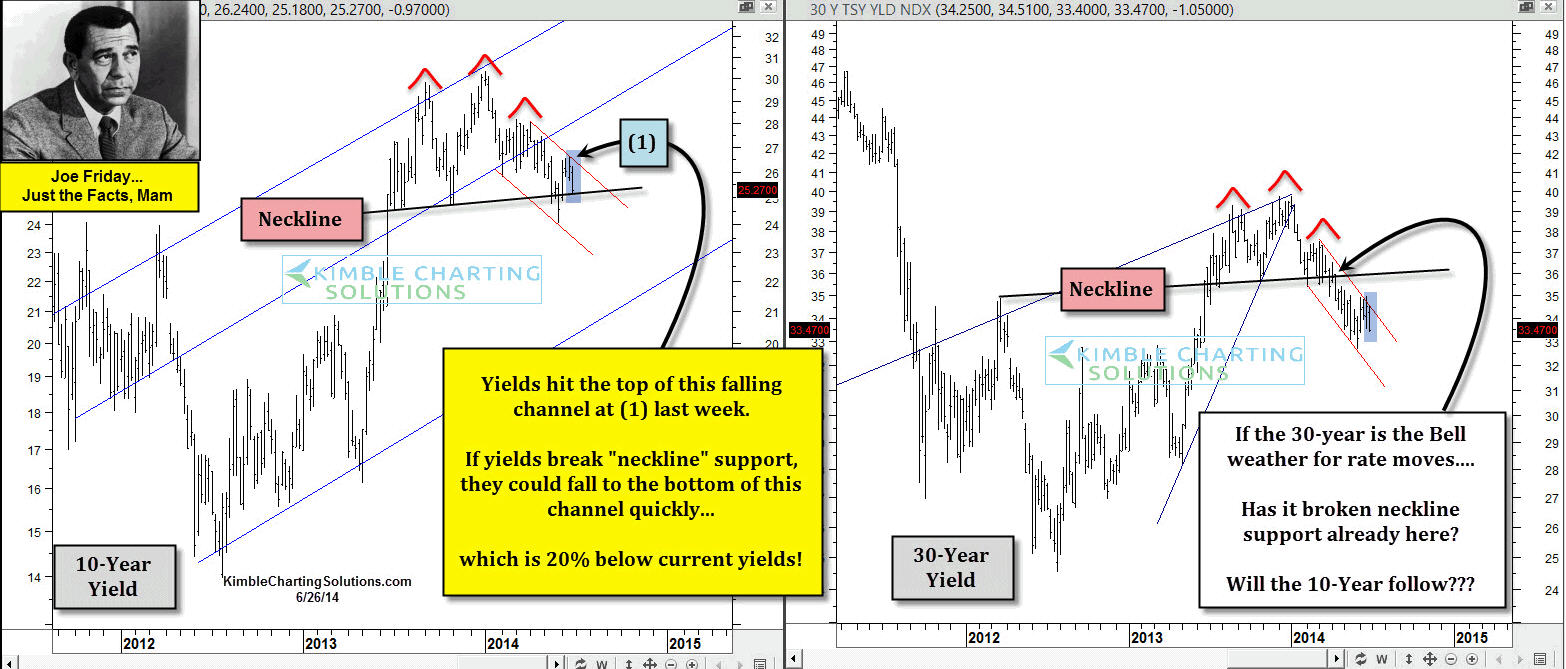

The yield on the U.S. 10-year note and U.S. 30-Year bell weather bond look to be creating head-&-shoulders tops. The 30-year yield (right chart) looks to have broken its neckline and continues to decline inside of a falling channel since the start of 2014.

The Neckline Test

The yield on the 10-year note now looks to be testing its neckline of the bearish pattern right now, as it too remains inside of a falling channel since the start of the year.

iShares Barclays 20+ Year Treasury (ARCA:TLT) is up over 10% this year. If support breaks, it could push TLT a good deal higher in short order ... that is, if the head-&-shoulders top is a correct read. Some might think if rates fall sharply that it could impact the stock market. Well we know it can. Yet so far this year, a sharp rally in bonds/decline in yields hasn't impacted stocks.

Quick Fall

If support breaks and this is the neckline of a H-&-S topping pattern, yields could decline to the 2% zone quickly.