The financial world is abuzz with the unexpected jump higher in our manufacturing and non-ISM(s). The world seems to think these two jumps are the result of the US economy suddenly getting back on track.

The whole thing smacks of political games. Is it really coincidence that the scandal-ridden Obama administration suddenly decided to focus on the economy (again) and the official economic data starts improving the next week?

Or is this an attempt to draw attention from the fact that even the mainstream financial media has caught on that the US’s employment, GDP, and inflation numbers are a joke (hence the sudden importance of ISM and non-manufacturing ISM data)?

Regardless, we cannot help but wonder where this incredible growth is occurring. Most of the growth in corporate profits over the last year have come from financials which are notorious for generating “earnings” through various accounting gimmicks.

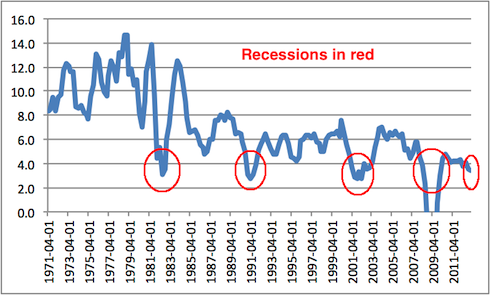

Indeed, when you remove financials from the picture, earnings for the S&P 500 are DOWN 2.9% for the second quarter of 2013. We also see that when you remove the Fed’s absurd GDP “deflator” (the way in which it accounts for inflation in its GDP numbers) that the US is clearly back in recession.

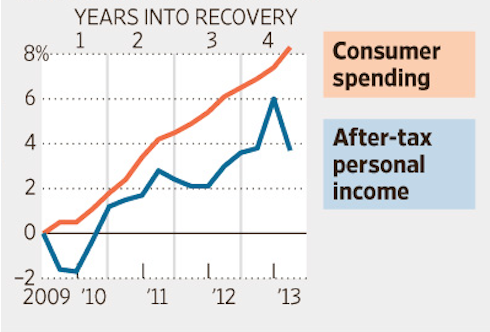

So, somehow the US economy is roaring back in a big way? Hard to see. Over 70% of the economy is consumer spending. And spending is driven by incomes. And incomes are… falling.

What could go wrong?

The Great Crisis, the one to which 2008 was just a warm up, is approaching. The time to prepare for it is BEFORE the US stock market bubble bursts.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

If The Economy Is Recovering, Why Is Nominal GDP In A Recession?

Published 08/06/2013, 03:22 AM

Updated 07/09/2023, 06:31 AM

If The Economy Is Recovering, Why Is Nominal GDP In A Recession?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.