A strange week for me being down while markets are ripping higher.

I just didn’t hit the right stocks and that’s all there is too it.

That will change.

The metals tried to move up with silver leading but that effort failed quickly so if they can’t get going during this seasonally strong time of year, when can they?

With an expected interest rate rise coming Wednesday, expect some wild action across the board and doubly so in the metals.

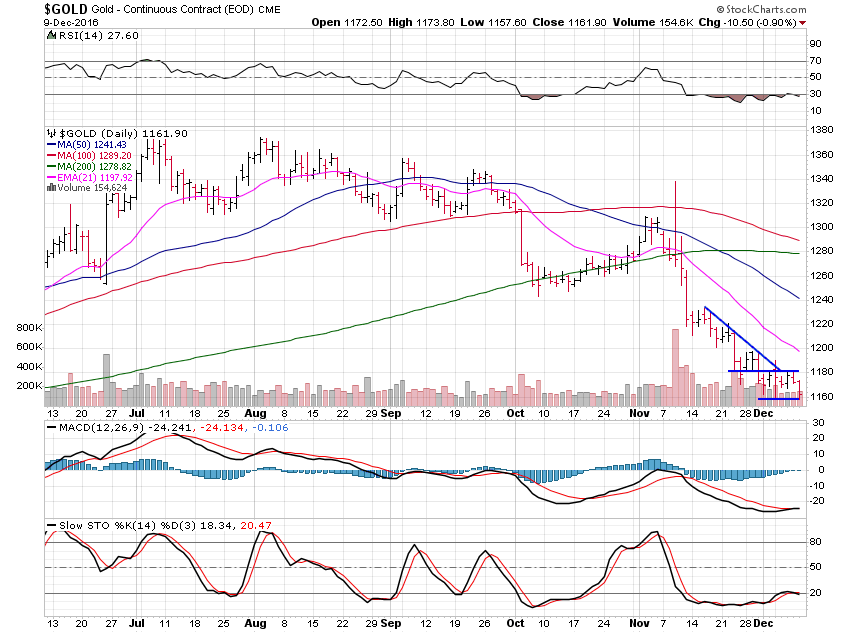

Gold lost 1.35%

Just not being able to move past the $1,180 resistance level isn’t great at all and now a break of $1,160 looks to be here.

Support sits below at $1,140 next.

Silver tried to rally past $17, then $17.25 but failed and ended the week up just 0.80%.

Not great action at all on this silver chart and we have to consider a move down to support at $15.30 as a real possibility before the year is out.

If we can somehow move above $17.25 then we should have a solid low in place but I’m not seeing much chance of that on this chart.

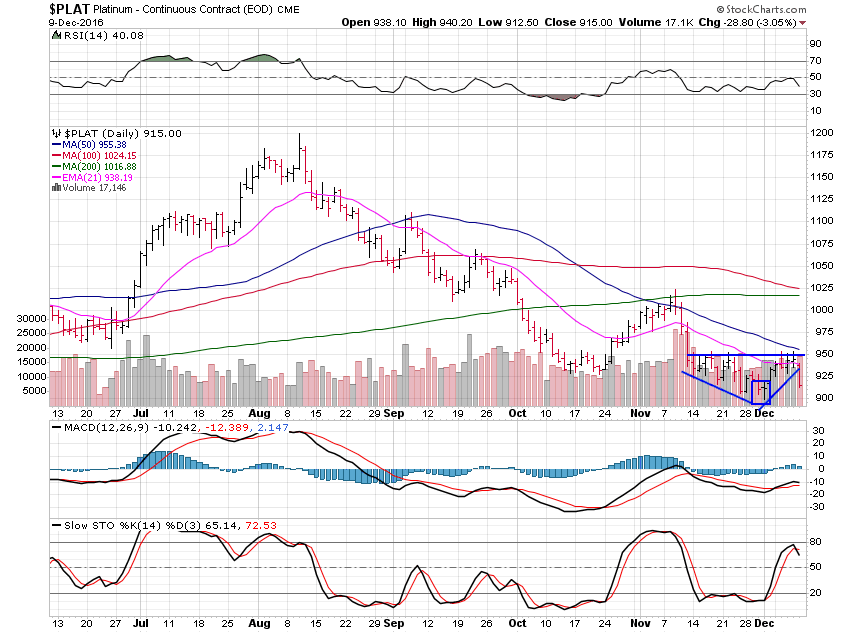

Platinum dropped 1.90% and looks set to continue lower.

Looks like some support at the $900 level will be tested over the next day or two.

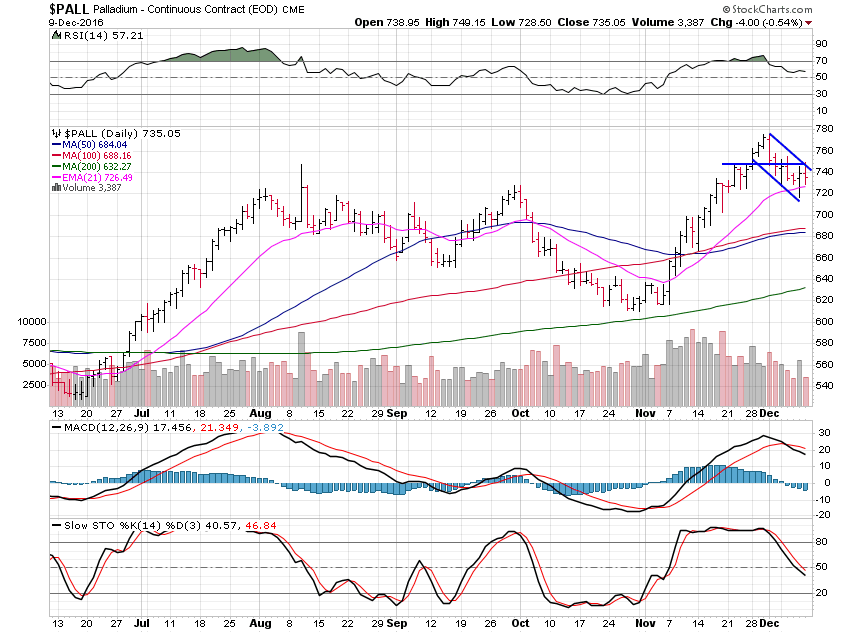

Palladium fell 1.40% but may be ready to turn higher again very soon.

We’re seeing the 21 day moving average hold very nicely here and if we can break above the downtrend channel around $750 then we should be at the start of a move to take us up to $800.

The big action will come Wednesday as we all but certainly will see interest rates increase and then we should see a trend established by Thursday or Friday.

The charts tell me that trend will be higher but time will tell.