- Shares of Activision Blizzard, a heavyweight in game development, are up about 19% in 2022, changing hands just shy of $80.

- On Jan. 18, Microsoft announced plans to acquire ATVI at $95.00 per share—pending regulatory approval.

- Investors who believe the transaction will complete successfully could consider investing in ATVI stock or the gaming segment

Investors in video game publisher Activision Blizzard (NASDAQ:ATVI) stock have been on a rollercoaster ride over the past 12 months. About a year ago, on Feb.16, 2021, ATVI stock hit a record high of $104.53. But by early December, it was at $56.40, a decline of over 45% from the peak.

Then on Jan. 18, 2022, Microsoft (NASDAQ:MSFT) announced it would “acquire Activision Blizzard for $95.00 per share, in an all-cash transaction valued at $68.7 billion.” The same day, to the delight of shareholders, ATVI shares saw an intraday high of $86.90.

Since then, though, the stock has given up some of those early gains, according to some reports, "reflecting concerns the deal could get stuck in regulators' crosshairs." On Friday shares closed at $79.25. Wall Street is concerned about antitrust uncertainties since the deal cannot close until regulatory authorities, not only in the US but also in other countries, provide their seal of approval to the deal. Hence the current discount in the price of ATVI stock.

At current levels, ATVI shares would need to climb close to 20% to reach the proposed transaction price of $95.

Investors are now wondering whether they should buy ATVI stock, in hopes the price will rally if the transaction is approved in the near future. Here are a few ways potential investors could approach this deal.

What To Expect From ATVI Stock

Recent metrics show the gaming industry, which was worth around $173 billion in 2021, is forecast to reach almost $315 billion by 2027. Such an increase would mean a compound annual growth rate (CAGR) of well over 9.5% between 2022 and 2027.

Santa Monica, California-based Activision Blizzard has an impressive portfolio. Its franchises include Call of Duty, Diablos, World of Warcraft, StarCraft and Pet Rescue, among others. With a market capitalization (cap) of about $61.7 billion, it is one of the most important names in interactive entertainment.

Activision Blizzard issued Q4 metrics on Feb 3. Revenue was $2.16 billion. Non-GAAP EPS came in at $1.01. A year ago, it had been 76 cents. Finally, for the quarter, Monthly Active Users (MAUs) were 371 million.

On the results, CEO Bobby Kotick said:

“As we look to the future, with Microsoft’s scale and resources, we will be better equipped to grow existing franchises, launch new potential franchises and unlock the rich library of games we have assembled over 40 years.”

If Microsoft’s purchase of Activision Blizzard goes through, Microsoft will become the third largest gaming company in the world, behind China-based Tencent (OTC:TCEHY) and Japan-based Sony (NYSE:SONY). This move by Microsoft is in part due to the tech giant’s ambition to gain dominance in the metaverse—a market that could reach $600 billion by 2027. And gaming is expected to be at the center of the mixed reality (MR) experience that the meta universe will offer users.

Microsoft expects the deal to close during Microsoft’s fiscal year ending June 30, 2023. However, Wall Street seems divided on the result of the transaction. As such, there is currently a discount in ATVI’s share price, which is trading shy of $80.

We expect ATVI stock to be fairly quiet in the coming weeks unless some development regarding the transaction occurs. Nonetheless, we expect Microsoft to clear all possible hurdles and buy Activision Blizzard in several months.

Adding ATVI Stock To Portfolios

Activision Blizzard bulls who believe the transaction will go through successfully and that ATVI shares will reach Microsoft’s offer price of $95 could consider investing in the stock now.

Alternatively, investors could consider buying an exchange traded fund (ETF) that has ATVI as a holding. Examples would include:

- ProShares On-Demand ETF (NYSE:OND)

- VanEck Video Gaming and eSports ETF (NASDAQ:ESPO)

- First Trust S-Network Streaming & Gaming ETF (NYSE:BNGE)

- Invesco S&P 500 Equal Weight Communication Services ETF (NYSE:EWCO)

- Innovator Loup Frontier Tech ETF (NYSE:LOUP)

Finally, many analysts suggest that other video gamers could also become acquisition targets, providing tailwinds to their share prices as well as the industry gaming segment in general. Therefore, a number of investors might want to look at ATVI peers, including Electronic Arts (NASDAQ:EA), for potential opportunities.

Those who believe EA stock could benefit from potential developments gaming and interactive entertainment later in the year could consider setting up a bull call spread—a strategy we covered in detail recently. So far in the year, EA stock is up 4.4%. However, it is still down 2.5% in the past 12 months.

Yet, like ATVI stock, Electronic Arts shares had seen a record high of $148.98 in February 2021, almost a year ago. Now they are at $137.71.

Understandably, long-term EA shareholders are hoping that the stock will soon hit a new all-time high.

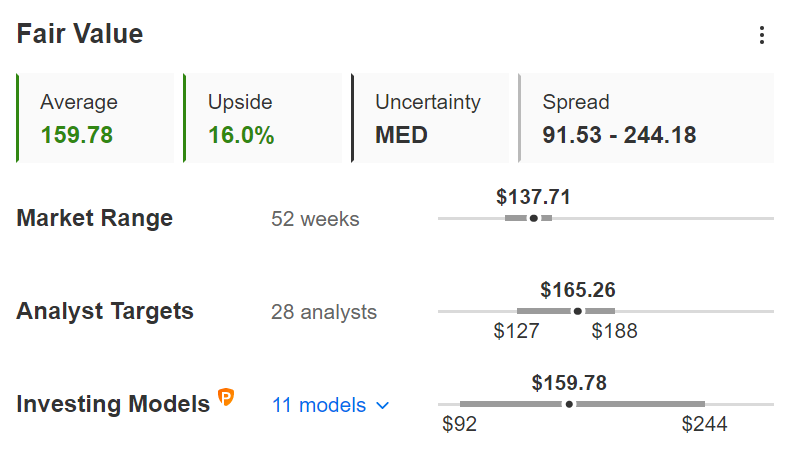

Source: InvestingPro

In fact, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for EA stock via InvestingPro stands at $159.78, implying an increase of 16% from current levels.

So here’s how experienced traders could put together a bull call spread. However, as it involves options, this set-up is not appropriate for most retail investors.

Bull Call Spread on EA Stock

In a bull call spread, a trader has a long call with a lower strike price and a short call with a higher strike price. Both legs of the trade have the same underlying stock (i.e. Electronic Arts) and the same expiration date.

The trader wants EA stock to increase in price. But the expectation is for a moderate increase in Electronic Arts shares.

Thus, in a bull call spread both the potential profit and the potential loss levels are limited. Such a bull call spread is established for a net cost (or net debit), which represents the maximum loss.

Today’s bull call spread trade involves buying the June 17 expiry 140 strike call for $9.50 and selling the 150 strike call for $5.60.

Buying this call spread costs the investor around $3.90 or $390 per contract, which is also the maximum risk for this trade.

We should note that the trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the EA stock price at expiration is below the strike price of the long call (or $140 in our example).

To calculate the maximum potential gain by subtracting the premium paid from the spread between the two strikes, and multiplying the result by 100. In other words:

($10 – $3.90) x 100 = $610.

The trader will realize this maximum profit if the EA stock price is at or above the strike price of the short call (higher strike) at expiration, or $150 in our example.

Bottom Line

Due to regulatory concerns, Activation Blizzard stock is trading at a significant discount to Microsoft’s offer of $95. Investors who expect the transaction to complete could consider investing either in ATVI stock or an ETF that gives exposure to Activation Blizzard.

Alternatively, they could also set up an options trade to benefit from a potential run-up in the price of Electronic Arts, an important ATVI competitor.