Did you know inflation is too low?

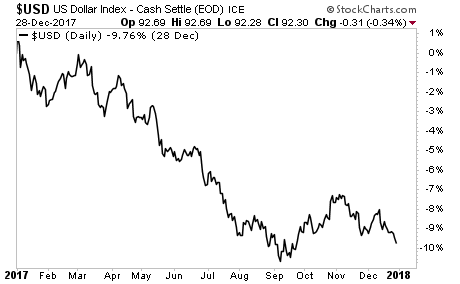

I didn’t. And neither does the $USD.

The greenback is down almost 10% this year and is about to end 2017 with its largest loss in over a decade.

Bear in mind, the $USD is collapsing at this pace DESPITE the Fed raising rates three times in 2017.

THAT’s how bad inflation is.

Why does this matter?

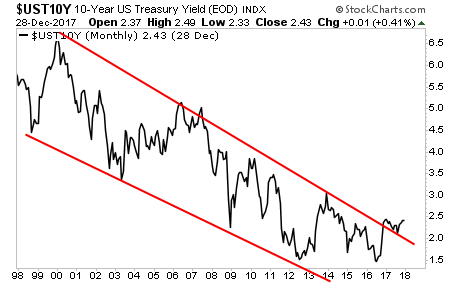

As I explain in my bestselling book The Everything Bubble: the Endgame For Central Bank Policy, US sovereign bonds (also called Treasuries) trade based on inflation expectations.

Put simply, when inflation spikes higher, so do Treasury bond yields.

When bond yields rise, bond prices fall.

When bond prices fall, the Bond Bubble bursts.

When the Bond Bubble bursts, the EVERYTHING bubble follows.

Well, guess what? The yield on 10-Year US Treasuries is spiking, having broken above its 20-year trendline.

What’s coming will take time for this to unfold, but as I recently told clients, we’re currently in “late 2007” for the coming crisis. The time to prepare for this is NOW before the carnage hits.

The time to prepare for this is NOW before the carnage hits.

issues as well as what’s to come when The Everything Bubble bursts.