Today’s topic du jour isn’t even a word but an abbreviated name. Whereas yesterday markets were somewhat spooked by a relatively obscure British firm, Provident, today they are again by still another. This time it’s WPP (NASDAQ:WPPGY), an advertising aggregation firm that owns a sizable portfolio of ad agencies located all around the world.

Given that position, the company’s fortunes, or misfortunes, can provide a proxy for macro conditions. Their guidance today was worse than expected, suggesting that quite against “reflation” hopes there might still be the opposite tendencies in the global economy. Worse, if WPP is right, these negative factors are bleeding out from North America, meaning primarily US firms.

As a company tied to the advertising business, the cutbacks they have seen (including losing some banner clients) makes one wonder what is really going on here. But like so many others in similar positions, the nature of the problem is tangled up in other issues.

“The digital disruption is a fundamental one,” Sir Martin Sorrell, WPP’s chief executive, said in an interview. “If you’re a manufacturer and you have to reach people directly through, for example, Alibaba (NYSE:BABA) then it’s going to change things.”

The business itself is undergoing a radical change, hand in hand in some ways to what’s taking place in the retail industry. Mass marketing by its very nature is inefficient and has become quite costly. The upside, its effectiveness, has been questionable from the very beginning of mass media.

The rise more recently of social networking through American giants Facebook (NASDAQ:FB) and Google (NASDAQ:GOOGL) has threatened to alter the status quo. These firms are at their very core data collection tools, and their products have always been you. They claim to know everything (or close to it) necessary to more effectively promote especially company brands to people who voluntarily identify their own core selling characteristics (as well as other information, whether they know it or not).

It hasn’t yet been established that is the case, just as there remain reservations about shopping online versus going into the physical store and paying more for a similar product. Without a clear cut advantage of the “new” way over the “old” way, it is left perhaps to other factors to break the tie.

In the retail space, I believe that is being done by stagnant wages and an “unexpected” but serious economic downturn that last year pushed the price angle far more than might have happened under more neutral economic circumstances.

The worry over WPP is that something similar may be going on inside Corporate America (and in other key places around the world). They may be ditching traditional advertising as just too costly, willing finally to experiment with this new way of doing things simply because they have no (topline) choice.

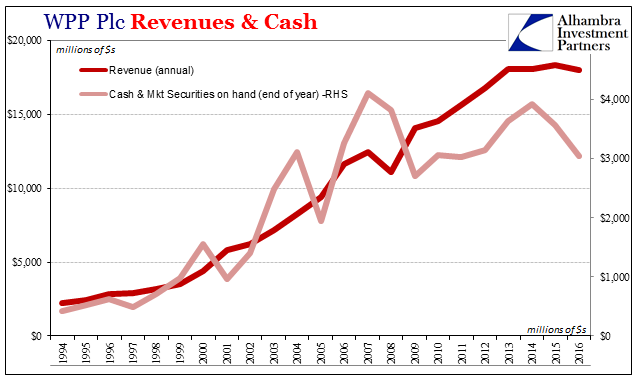

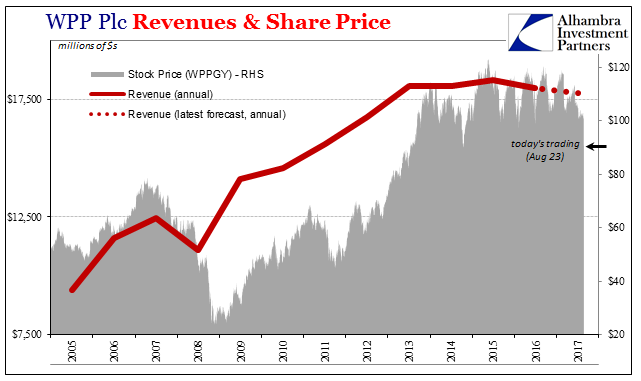

The chart immediately above brings up yet another complication, particularly from the view of Americans trying to view and understand the global setting. In American dollar terms, revenues and thus profits have stagnated since the middle of 2014. That is, of course, coincident to the “rising dollar”, which in this dimension has the effect of reducing foreign results (again, WPP is a London-based company).

But the “rising dollar” was not purely an accounting issue of currency translations. It was more so an economic issue, or, more accurately, became an economic issue through monetary effects that are poorly understood by a misinformed public on the topic of all this currency stuff.

The company in local terms reported in 2016 record revenues and earnings. And yet, right at the start of last year’s shareholder letter accompanying WPP’s annual report, Mr. Sorrell felt it necessary to qualify them:

2016, our thirty-first year, was another record year, our sixth record year in a row, despite a generally low growth, or tepid, global environment…

This was primarily due to the Company’s reduced revenue and net sales guidance for 2017 from 3% to 2% due to an increasingly challenging economic environment.

They did not mention Google, Facebook, or Alibaba, likely because the “challenging economic environment” especially in the US and Europe was at the time supposed to give way to at least reflation if not better. In the middle of 2017, however, now all of a sudden we get “the digital disruption is a fundamental one.”

Again, that is true but in all likelihood it is being accelerated by macro terms that aren’t changing favorably. Companies especially in America are being pressed by revenues that won’t grow no matter how many times Janet Yellen says the word “transitory” or one similar. Because companies can’t get topline growth, the only way to try to maintain profit growth is to over-manage their cost structure. That means a lid on labor growth, but also a lot of other big ticket expenses.

WPP now expects revenue in constant currency terms to be negative.

This year, 2017, is already one of huge disappointment in many ways. Though it is often eerily similar to 2014, there are a number of capacities in which it has been different. For a great number of things, 2017 doesn’t even come close to the ersatz improvement in 2014 (including, importantly, retail sales here and elsewhere).

WPP adds to the fears that this is actually true. The year 2014 was itself a huge letdown, so what might that make 2017? It’s not a perfectly clear issue like it might be in looming recession, but that just underscores the true nature of stagnation (dare I write depression?). A recession is easy to see and figure; a lost decade is a tangled web or gray haze of questions and seemingly intractable problems.