World liquids demand will be huge in 2015 because of low oil prices. That’s the good news.

The bad news is that the demand surge hasn’t really begun yet and over-supply will dominate the market through 2016.

This is what I predicted Monday in my post “When Will Oil Prices Turn Around?” and what I reported yesterday based on the EIA STEO report.

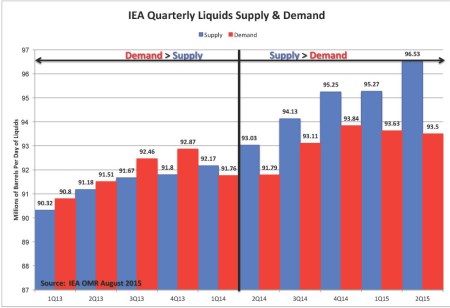

In its August Oil Market Report (OMR), the IEA revised 2nd quarter 2015 demand upward 370,000 bpd from its July estimate but also revised supply upward by 140,000 bpd. Total liquids supply is 96.53 million bpd and demand is 93.5 million bpd (Figure 1).

Related: Japan’s Nuclear Restart Could Spell Disaster For Commodities Markets

Figure 1. IEA quarterly liquids supply and demand. Source: IEA August 2015 OMR & Labyrinth Consulting Services, Inc.

Related: Some Light At The End Of The Tunnel For Oil?

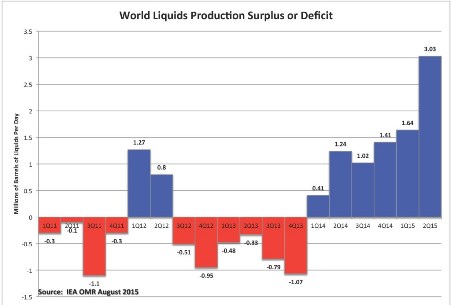

The production surplus for the 2nd quarter of 2015 was 3.03 million bpd, 230,000 bpd lower than the agency’s July estimate (Figure 2).

Figure 2. World liquids production surplus or deficit. IEA August 2015 OMR & Labyrinth Consulting Services, Inc.

IEA stated that demand for the rest of 2015 will be “the biggest growth spurt in five years and a dramatic uptick on a demand increase of just 0.7 mb/d in 2014.” Consumption will likely increase 1.6 million bpd. The agency went on to say that supply continues to grow at 2.7 million bpd.

Related: Saudi Oil Strategy: Brilliant Or Suicide?

IEA further suggests that the long-anticipated decline in world production will probably be most pronounced in the second half of 2015 and into 2016 “with the US hardest hit. “

The message is clear. The world continues to have an over-supply problem that is slowly improving but it will take another year before the market comes into balance.

OPEC continues to hold the cards and could change the balance if it chooses.