IEA THEORY - DEMAND GROWTH AND HIGHER PRICES

The IEA's latest Oil Market Report for 12 September 2013 was highly predictable. Only able to report world oil demand growth at 0.9% for 2012-2013 to date, it pushed forward its estimate for renewed demand growth to 2014, with a 1.1% or 0.9 million barrels-a-day (Mbd) growth forecast. This would raise aggregate world demand to around or about 92.6 Mbd by late 2014.

On prices, the IEA's September report merely said that “rising geopolitical tensions over Syria’s suspected use of chemical weapons and the near total shut-in of Libyan production” raised prices despite record Saudi and Iraqi production inside OPEC, and record US and Russian production outside the cartel. It also noted that prices turned down from mid-September “as a Russian proposal for Syria to surrender its chemical weapons gained traction”. Since the report's release and to date, October 7, Brent and WTI have lost about $5-$6 per barrel.

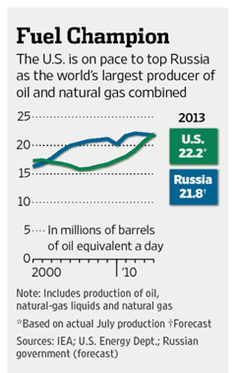

A Wall Street Journal analysis of global energy, published October 7 shows that the U.S. is on track to pass Russia as the world's largest producer of oil and gas combined this year—if it hasn't already. One reason is that Russian output growth is slowing due to multiple reasons including aging oilfield infrastructures and the slow pace of Russia adopting “fracking” technology, but the main reason is surging US output growth of both oil and so-called natural gas liquids (NGLs) or oil condensates from mixed oil-and-gas output streams. Combined with the reality of weak global oil and gas demand growth, surging supply means that high prices have to turn down – sooner rather than later. On a strict fuel price equivalent base, current US natural gas prices are about $21 per barrel of oil equivalent.

RISING SUPPLY AND STAGNANT DEMAND

The IEA avoids the demand-side reasons for “bearish” price outlooks for world oil in particular, and for global natural gas within 3 – 5 years. The key surrogate for global oil energy demand, excluding non-energy end uses, is world refinery runs. Here, the latest IEA report was able to say that global refinery crude runs reached a seasonal peak in July at about 78.2 Mbd, about 1.8 Mbd more than a year earlier, but rapidly shrinking margins due to weakening demand will soon shift this to an IEA forecast average run of 76.8 Mbd in 3Q 2013.

Compared with one year previous this is a growth of 0.4 Mbd or 0.5%.

Global oil demand for combined fuel + nonfuel utilisation is likely growing at rates much lower than IEA forecasters' estimates and forecasts, for the present year set by the “oil watchdog” agency at 0.9%, followed by 1.1% for 2014. The IEA, mostly for political-correct reasons, but also through its forecasting methods has a long track record of over-estimating world oil demand growth. Its “Refinery margins Methodology notes” publication provides ample details on typical refinery output profiles in major world regions, for example much higher diesel fuel yields and therefore operating costs in Europe than USA, due to very different car fleet compositions. The previous economic policy rationale for “dieselization” of car fleets in Europe – to use lower cost high sulfur crudes – ignoring the cancer threat and health costs of diesel fuel and its residues, has been overturned by increasing world NGL and condensate supply and also by the closing of high sulfur-low sulfur crude price spreads. As a result, fuel prices are high in Europe and set to stay that way – further depressing demand growth potentials.

Conversely, refinery operating costs are very low in Asia, as low as $1.50 per barrel compared with extremes up to $7.50 a barrel in Europe, making it rational to forecast continuing Asian demand growth on a pure fuel price basis. This however ignores the global macroeconomic context, as well as national energy, economic and environment policy factors and pressures. At the global macro scale the energy revolution focused by 'Wall St Journal', October 7, includes a vastly faster rate of growth of light crudes, NGLs and condensates than heavier and 'conventional' crude supply. Shifting back to Asia and despite its liquid fuel price advantage due to lower cost refining structures with high yields of gasoline, cooking fuel kerosene, and naptha the region is far ahead on a global basis in the transition to natural gas fuelled and LPG-fuelled road transport.

While US shale oil production is expanding fast from a low-or-zero base even 3 years ago, its shale gas production, despite extreme low domestic natural gas prices remains very strong and growing – and certain to spread overseas. Russia, for example, is estimated by many as holding the world's largest undeveloped shale oil + shale gas reserves. As in the US, international shale gas output will precede shale oil, making it a near-certain bet that global natural gas prices have to decline. When they do, the shift away from oil energy in its last major role – for transport – will accelerate and can only do so.

Back to back, in a context where global oil output rose by 2.7% in 2012 but demand increased 0.9% and 2014 looks set to do this again, and the outlook for world and regional oil demand growth is weak, prices have to tank. For sure, they can “surf” a little while longer on Syrian atrocities and geopolitical musings about breakdown in the Middle East, but world economic trends and global energy resource development run right against those comforting theories – for oil brokers and traders, only.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

IEA Oil Market Report: Politically Correct, Again

Published 10/08/2013, 01:32 AM

Updated 07/09/2023, 06:31 AM

IEA Oil Market Report: Politically Correct, Again

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.