Growth investors generally have high risk tolerance and are continuously on the lookout for above-average growth stocks that are expected to outperform the broader industry with respect to revenues, earnings or cash flow.

However, this apparently simple growth investment technique has some drawbacks and lack of proper understanding of the strategy may often lead to short listing of growth stocks that are a misfit to the portfolio. Since growth investors seek capital gains, they tend to remain exposed to high risks.

In a bull market, it has been popularly said that a stock keeps scaling new highs until some event works against it. However, the timing of the pullback is hard to gauge.

Insight into Zacks Methodology

Our latest style score system has made the task quite simple. It helps us choose stocks that have a solid performance record and might therefore prove to be a great choice for investors.

Our Growth Style Score highlights all evaluation metrics and represents them as one score that cautions investors regarding “growth traps” and helps them find stocks that have high growth potential.

Meanwhile, stocks with a Zacks Rank #1 (Strong Buy) or 2 (Buy) reflects an upward trend in the stock’s earnings estimates. Our research shows that stocks with a Growth Style Score of A or B when combined with a Zacks Rank #1 or 2 offer the best upside potential.

Based on this, we have identified a candidate IDEXX Laboratories (NASDAQ:IDXX) , with a Zacks Rank #2 and a Growth Score of A, which may prove to be a solid growth pick.

What’s Working in Favor of IDEXX Laboratories?

IDEXX Laboratories has a favorable VGM Score of B. Under the Zack Style Score system, V stands for Value, G for Growth and M for Momentum. The VGM Score is simply a weighted combination of these parameters and is a comprehensive tool that allows investors to filter through the standard scoring system and pick the winning stocks.

The company also has a favorable historical earnings per share (EPS) growth rate of 33.92% when compared to the broader industry’s 14.69. Historical EPS growth rate considers the average annual (trailing 12 months) EPS growth rate over the last 3-5 years of actual earnings.

The stock has an attractive projected EPS growth rate when compared to the broader industry. Projected earnings growth rate is an important informative tool that assesses the company’s growth potential by gauging the estimated growth rate for a year. Technically, it considers the consensus estimate for the current fiscal year (F1) divided by the EPS for the last completed fiscal year (F0) (actual if reported, the consensus if not). Thus, IDEXX Laboratories has an estimated earnings growth rate of 26.9%, beating the industry’s 18.5%.

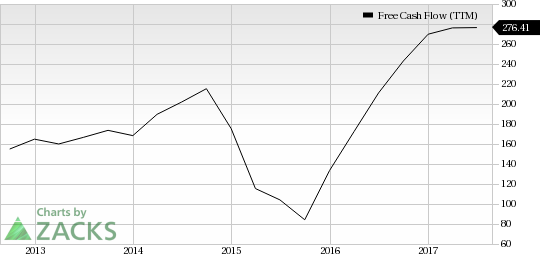

Our next parameter is the cash flow growth of the company. Cash flow can be described as the net cash moving in and out of the company. IDEXX Laboratories proves to be a great growth pick as its current cash flow growth rate stands at 14.5% as compared to 5.2% of the industry. Thus, the company’s strong cash balance bolsters our confidence in the stock.

IDEXX Laboratories, Inc. Free Cash Flow (TTM)

IDEXX Laboratories also stands strong when it comes to sales in relation to assets, profits and projected growth. The company has a favorable Net Margin (Net Income/ Sales) of 14.1%, far better than the broader industry’s decline of 25.1%. The Sales to Assets ratio of 1.14 supports the company as a solid growth stock in comparison to the industry’s 0.57. Moreover, the projected sales growth rate of 10.1% surpasses the broader industry’s 7.6%

In this regard, we take note that IDEXX Laboratories’ companion animal market fundamentals are solid with tremendous global runway for growth. Management’s unique innovation-based, multi-modality global strategy, enabled by enhanced commercial capability, accelerated recurring CAG Diagnostics revenue growth.

This apart, IDEXX continues to display solid growth with respect to international expansion. The company has been significantly benefitting from the companion animal market of emerging nations, demonstrating the bountiful opportunities.

Other Growth Stocks to Consider

Other growth picks in the medical sector that are worth mentioning are Lantheus Holdings, Inc. (NASDAQ:LNTH) , Amedisys, Inc. (NASDAQ:AMED) and Masimo Corp. (NASDAQ:MASI) .

Lantheus carries a Zacks Rank #2 and a Growth Score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

Amedisys carries a Zacks Rank #2 and a Growth Score of A.

Masimo carries a Zacks Rank #2 and a Growth Score of B.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without.

More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really take off.

See Stocks Now>>

Masimo Corporation (MASI): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH): Free Stock Analysis Report

Amedisys Inc (AMED): Free Stock Analysis Report

Original post

Zacks Investment Research