IDEXX Laboratories, Inc. (NASDAQ:IDXX) reported fourth-quarter 2017 adjusted earnings per share (EPS) of 77 cents, excluding the negative impact of 34 cents per share due to U.S tax reform. The adjusted EPS figure surpassed the Zacks Consensus Estimate of 73 cents. Reported EPS came in at 43 cents.

Full-year 2017 reported EPS came in at $2.94 per share. Moreover, reported earnings figure was up 21% on a comparable constant currency basis.

Revenues in Detail

Revenues rose 14.2% year over year (up 11.7% on organic basis) to $506.1 million, surpassing the Zacks Consensus Estimate of $491 million by 3.1%.

Worldwide sales in the year came in at $1.97 billion, up 10.9% year over year on a reported basis. The figure also surpassed the Zacks Consensus Estimate of $1.95 billion.

The year-over-year upside was driven by strong global gains in Companion Animal Group (“CAG”) Diagnostics recurring revenues, including double-digit organic revenue gains across consumable and reference lab as well as strong acceptance of rapid assays and veterinary software, services and diagnostic imaging systems.

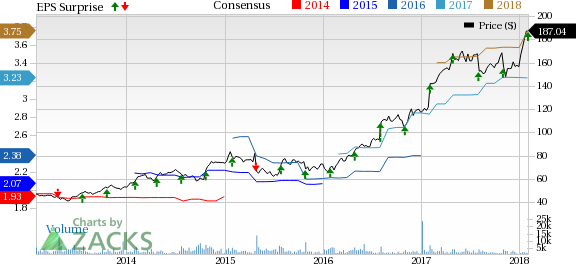

IDEXX Laboratories, Inc. Price, Consensus and EPS Surprise

Segmental Analysis

IDEXX derives revenues from four operating segments: CAG; Water; Livestock, Poultry and Dairy (“LPD”); and Other.

In the fourth quarter, CAG revenues rose 14.2% (up 11.8% organically) year over year to $433.5 million. Water segment’s revenues were up 18.6% from the prior-year quarter (up 16.1% organically) to $28.9 million. LPD revenues grew 12.8% (up 8.4% organically) to $37.2 million. Revenues at the Other segment rose 6.3% (up 5.8% organically) to $6.5 million.

Margins

Gross profit increased 13.3% to $272.5 million in the reported quarter. However, gross margin contracted 50 basis points (bps) to 53.8% on a 15.4% rise in cost of revenues to $233.6 million.

Sales and marketing expenses rose 12.3% to $90.5 million, while general and administrative expenses increased 8.9% to $55.3 million. Research and development expenses rose 13.4% to $28.8 million. Operating margin in the quarter improved 40 bps to 19.3%.

Financial Position

IDEXX exited fiscal 2017 with cash and cash equivalents of $472 million, up from $391.8 million at the end of 2016. Net cash provided by operating activities in 2017 was $373.3 million, compared with $338.9 million in the year-ago period.

2018 Guidance

IDEXX raised its 2018 revenue outlook to $2,205-$2,245 million from the previous $2,140-$2,180 million, reflecting organic revenue growth expectations of 9.5% to 11.5% compared with 9-11% stated previously. The Zacks Consensus Estimate for 2018 revenues is pegged at $2.17 billion, below the guided range.

Management also raised its EPS guidance to $4.04-$4.18 from the earlier $3.50-$3.62, supported by continued operating margin expansion aligned with its long-term goals. The updated outlook represents EPS growth of 37-42% on a reported basis compared with 8-12% stated previously. The Zacks Consensus Estimate for 2017 EPS is pegged at $3.75, below the guided range.

Our Take

IDEXX exited the fourth quarter on a solid note. Moreover, solid year-over year growth in organic revenues and a raised EPS guidance for 2018 are encouraging.

The stellar performance was driven by strong sales at the CAG business. The companion animal market fundamentals remain solid with tremendous global runway for growth. Management’s innovation-based, multi-modality global strategy, enabled by enhanced commercial capability, accelerated recurring CAG Diagnostics revenue growth. Moreover, the strong top-line growth in the quarter was driven by considerable contributions from the rest of the business segments.

Zacks Rank & Other Key Picks

IDEXX has a Zacks Rank #2 (Buy). A few other top-ranked stocks that reported solid results this earnings season are PetMed Express (NASDAQ:PETS) , PerkinElmer (NYSE:PKI) and Accuray (NASDAQ:ARAY) . While PetMed sports a Zacks Rank #1 (Strong Buy), PerkinElmer and Accuray carry a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed reported third-quarter fiscal 2018 results with adjusted EPS of 44 cents, improving 88.3% from the prior-year quarter. Revenues rose 13.7% on a year-over-year basis to $60.1 million.

PerkinElmer reported fourth-quarter 2017 adjusted EPS of 97 cents. Adjusted revenues were approximately $641.6 million, up from $567 million in the year-ago quarter.

Accuray reported a loss of 6 cents per share in second-quarter fiscal 2018, 5 cents narrower than the year-ago figure. Total revenues improved 15% year over year to $100.3 million.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

PetMed Express, Inc. (PETS): Free Stock Analysis Report

PerkinElmer, Inc. (PKI): Free Stock Analysis Report

Accuray Incorporated (ARAY): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Original post

Zacks Investment Research