LUKAS Hydraulik GmbH, a subsidiary of IDEX Corporation (NYSE:IEX) , recently completed the acquisition of AWG Fittings GmbH (“AWG”) in a €46.0 million cash-free, debt-free transaction. IDEX had initiated the deal on May 16, 2016.

About AWG

AWG is one of the leading manufacturers of mobile and stationary fire protection systems in the world. The company’s expertise and extensive experience, gained over many decades, have helped it achieve greater efficiency and augment its rescue and fire-fighting operations.

Based in Ballendorf, Germany, AWG’s revenues for the year ended Dec 31, 2015, was approximately €36 million. The company will now operate within the IDEX Fire and Safety/Diversified Products segment.

Synergies from the Deal

Per Andy Silvernail, IDEX Chairman and Chief Executive Officer, the acquisition of AWG will boost the company’s Fire Suppression platform with its highly integrated firefighting technology and equipment. With this, IDEX has two successfully completed acquisitions so far this year, the other being that of Akron Brass. The company is looking forward to the global expansion opportunities these acquisitions are likely to provide.

Impact of Brexit

Germany, Europe’s largest economy, is expected to be gravely affected by Brexit. The country has much to lose and almost nothing to gain from U.K.’s exit from the 28-nation bloc. This is because Brexit would change the way multinationals make investment decisions and would favor U.K. with liberalized trade policies. Germany is likely to become a less attractive destination for foreign investors post Brexit.

Given the present scenario, the acquisition may not live up to IDEX’s expectation, as Brexit could result in higher tariff and non-tariff barriers to trade between the U.K. and the EU, lowering the productivity of the company. This would undermine the long-term growth potential of the company to some extent as German exporters are likely to suffer.

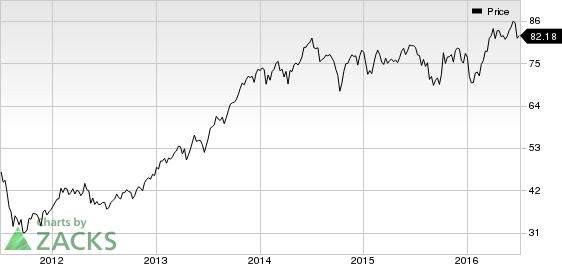

IDEX carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same space include Altra Industrial Motion Corp. (NASDAQ:AIMC) , Ingersoll-Rand Plc (NYSE:IR) and Middleby Corp. (NASDAQ:MIDD) . All three stocks carry a Zacks Rank #2 (Buy).

INGERSOLL RAND (IR): Free Stock Analysis Report

MIDDLEBY CORP (MIDD): Free Stock Analysis Report

ALTRA INDUS MOT (AIMC): Free Stock Analysis Report

IDEX CORP (IEX): Free Stock Analysis Report

Original post

Zacks Investment Research