As Bitcoin approaches the $6,000 psychological support level again, the question in the minds of most investors is whether the support will break this time around or hold. Bitcoin has been dropping from its all-time-high level of nearly $20,000 since December 2017.

During its choppy ride down, it’s been forming lower highs at levels that have now turned into resistance. To get a better idea of Bitcoin’s price action, let’s do a classic Invest Diva Diamond Analysis, aka, IDDA.

Fundamentals

From a fundamental point, there are no specific positive developments to help Bitcoin regain its lost energy. Keep in mind that cryptocurrencies surged so much, so fast, mainly because of the media and how they created a cyclonic buzz around the industry.

Sentiment

In addition to lack of positive coverage, Bitcoin has also been suffering from a lack of liquidity. Because of this, it is more vulnerable to significant price swings caused by big market players. So if a large hedge fund decides to push the prices higher tomorrow, they could arguably do so by buying a large number of Bitcoins at the $6,000 price level. Although, any such player would be risking a lot because CFTC is currently investigating price manipulation in Bitcoin, according to Forbes.

BTC/USD Technical Analysis

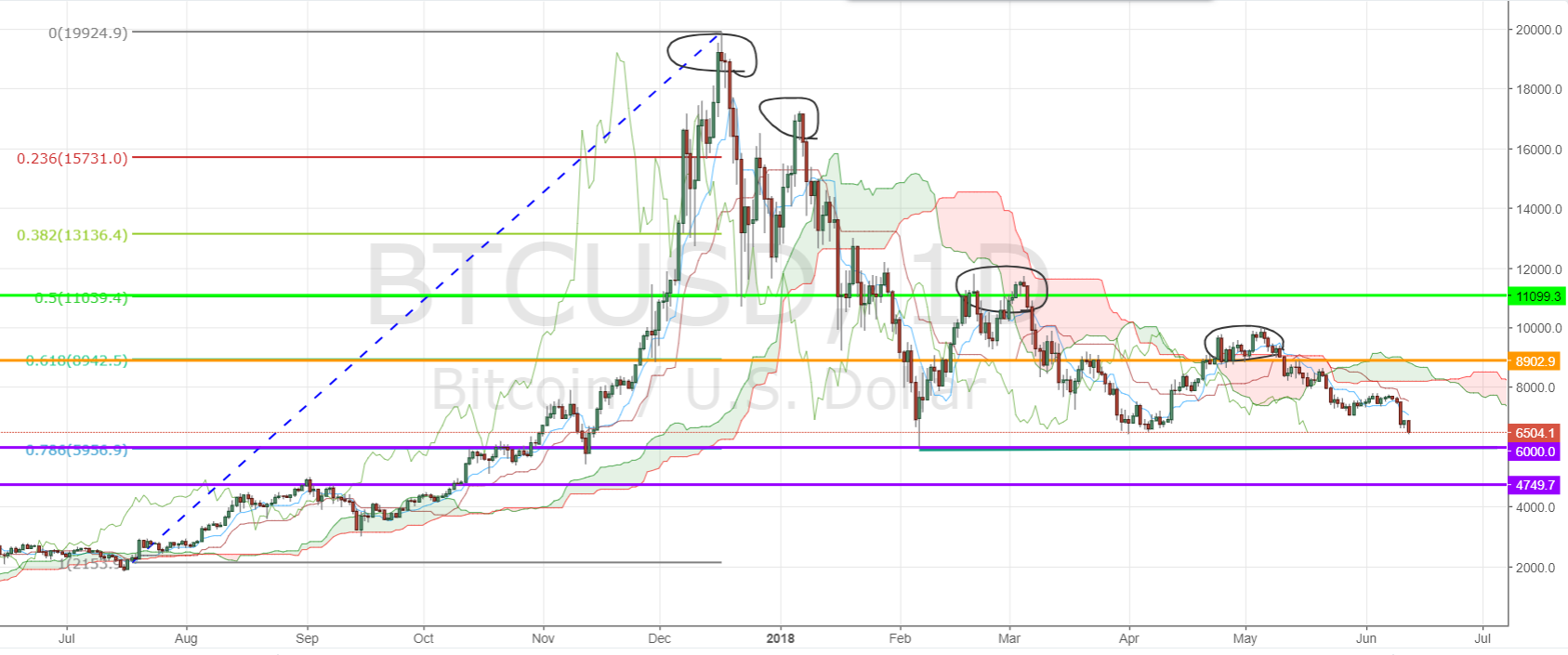

Taking a look at the BTC/USD daily chart, you’d notice that the price has broken below the daily Ichimoku cloud with the future cloud turning bearish. The $6,000 level falls on the 78% Fibonacci retracement level which is the final level tracing the strong uptrend from July to December 2017. A

A

There is a possibility that the market as a whole contributes to change the sentiment temporarily at the $6,000 level and push the level to the $8,000 resistance again. However, we could very well see the support breaking and prices falling to the next support level of $4,700 before the real uptrend starts again, somewhere towards the end of 2018.

As the 4th point of the IDDA technique, you must calculate your risk tolerance before deciding on the investment strategy that is suitable for your portfolio.

Don't forget to complete your risk management due-diligence before developing your investment strategy.

*This article was originally published here.