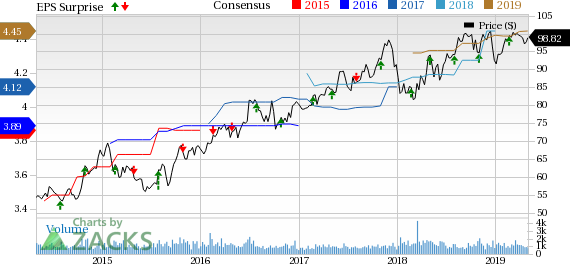

IDACORP, Inc. (NYSE:IDA) reported first-quarter 2019 operating earnings of 84 cents per share, which beat the Zacks Consensus Estimate of 71 cents by 18.3%. The reported earnings also improved 16.7% from the year-ago figure of 72 cents.

The improvement in earnings was due to colder-than-normal weather that boosted demand, new rates and customer growth in its service areas.

Highlights of the release

The company continues to enjoy increase in customer volumes, primarily due to low rates and high-quality service.

Customer growth led to a year-over-year increase in IDACORP’s operating income by $4.1 million, as the number of Idaho Power customers grew 2.4% during the 12 months ended Mar 31.

Net income in the quarter under review was $42.7 million, reflecting an increase from $36.1 million recorded in the year-ago period.

Guidance

IDACORP reiterated its 2019 earnings guidance in the range of $4.30-$4.45, whose mid-point of $4.38 is lower than the current Zacks Consensus Estimate of $4.45.

The company expects 2019 operating and maintenance expenses associated with Idaho Power in the range of $350-$360 million.

Zacks Rank

Currently, IDACORP has a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Utility Releases

NextEra Energy, Inc. (NYSE:NEE) reported first-quarter 2019 adjusted earnings of $2.20 per share, beating the Zacks Consensus Estimate of $2.01 by 9.4%.

FirstEnergy Corporation (NYSE:FE) reported first-quarter 2019 operating earnings of 67 cents per share, which beat the Zacks Consensus Estimate of 66 cents by 1.52%.

American Electric Power Co., Inc. (NYSE:AEP) reported first-quarter 2019 adjusted earnings per share of $1.19, surpassing the Zacks Consensus Estimate of $1.10 by 8.2%.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

IDACORP, Inc. (IDA): Free Stock Analysis Report

FirstEnergy Corporation (FE): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

American Electric Power Company, Inc. (AEP): Free Stock Analysis Report

Original post

Zacks Investment Research